Have you ever thought your brain might need a firmware update? Stick with me here: Just as your smartphone must be upgraded now and then, your financial mindset also runs on outdated code—often installed by school, parents, or even pop culture. My own wake-up call came on a rainy Tuesday in my cramped London flat, eyes glued to the page as a single book completely rewired my understanding of money. Suddenly, I realized the rules I played by weren’t even up to date! This post is my attempt to share that spark—four books that aren’t just information but transformation, peppered with stories (some awkwardly personal), a couple wild left turns, and more data than you’d expect from a book list. Welcome to the ultimate financial firmware upgrade.

When Society Installs Outdated Financial Code: The Slow Lane Trap

Have you ever wondered why, even after following all the “right” steps—good grades, good job, steady promotions—you still feel like true financial freedom is always just out of reach? If so, you’re not alone. Society has handed most of us a set of financial instructions that worked for our grandparents, but in today’s world, this outdated code is more likely to keep you in the slow lane than to help you build real wealth.

The ‘Slow Lane’ Mindset: Why School and Parents Taught You the Wrong Financial Story

From a young age, you were probably told a familiar story: work hard in school, get into a good university, land a stable job, and climb the corporate ladder. Save diligently, invest in your 401(k), and—if all goes well—you’ll retire comfortably at 65. This is the slow lane approach to wealth building, and it’s the default setting for millions of people. But here’s the problem: the world has changed, and this formula is now broken for most people.

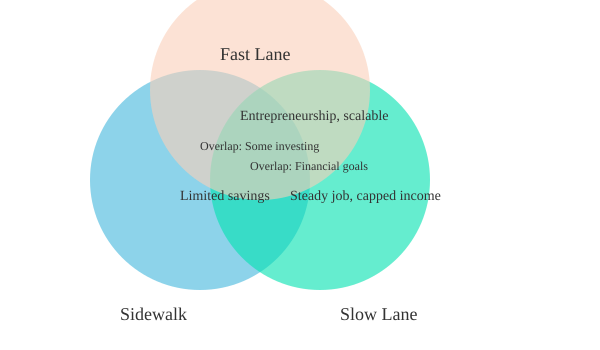

MJ DeMarco’s The Millionaire Fastlane—one of the best personal finance books for challenging your financial mindset—breaks down three archetypal money paths:

- Sidewalk: Living paycheck to paycheck, with little to no savings or plan for the future.

- Slow Lane: The “safe” route—steady job, slow savings, gradual investing, and hoping time does the rest.

- Fast Lane: Entrepreneurial thinking, building scalable income streams, and aiming for financial independence within a decade.

Why Most High-Achievers End Up Stuck in the Slow Lane

Here’s the twist: if you’re reading this, you’re probably not on the sidewalk. You’re likely a high-achiever—educated, employed, maybe even admired by peers. Society sees you as successful. But that’s exactly why the slow lane trap is so dangerous. You’re doing everything “right,” but you’re still working for someone else, trading your time for money, and your earning potential is capped by your job title, not your ability.

“When you are in the slow lane, you are working for someone else.”

Data shows that most employees—even those who save and invest responsibly—face a hard ceiling on wealth accumulation. According to the U.S. Bureau of Labor Statistics, the median annual wage for full-time workers is around $60,000. Even with aggressive saving and smart investing, reaching true financial freedom before 65 is a long shot unless you’re in the top 1% of earners.

Real-Life Anecdote: The $1.3M Pivot

Let’s make this real. A friend of mine, Sahil, was once in the slow lane. He had a good job, a stable income, and a promising career path. Then he read The Millionaire Fastlane. The book’s message hit home: the slow lane would keep him working for someone else, with limited upside. Inspired, Sahil quit his job and started a business. Within two years, his company was generating $1.3 million in annual recurring revenue. His secret? He built a software tool that solved a real problem for video editors—scaling his income far beyond what any salary could offer.

“I can never get a job ever again, because now I see how money works.”

Sahil’s story isn’t an outlier—it’s a blueprint for what’s possible when you upgrade your financial mindset and embrace a new wealth building strategy.

Does Saving and Investing Work for Everyone? When It Fails in Today’s Economy

Let’s be honest: if you’re earning $900,000 or more a year, the slow lane might work for you. You can save and invest your way to financial freedom because your income is so high. But for most people, that’s not reality. The average professional simply doesn’t have enough surplus income to save their way to wealth. Rising living costs, stagnant wages, and unpredictable markets mean that the old “save and invest” formula is no longer a universal ticket to financial independence.

In fact, research from the Federal Reserve shows that nearly 40% of Americans would struggle to cover a $400 emergency expense. Clearly, the slow lane isn’t working for everyone.

What The Millionaire Fastlane Reveals About Capping Potential Income as a Salaried Employee

Here’s the core lesson from The Millionaire Fastlane: your job title is often the true ceiling on your income, not your skills or ambition. When you work for someone else, your earning potential is limited by what your employer is willing to pay. But when you build a business or create scalable income streams, there’s no cap. You control your destiny—and your income.

Think of it like this: what if Apple still ran on its 2007 firmware? It would be slow, buggy, and unable to keep up with today’s demands. That’s exactly what happens when you stick with society’s outdated financial code. By upgrading your thinking, you open the door to smarter investing, entrepreneurial opportunities, and true financial freedom.

Venn Diagram: Comparing the Three Paths to Wealth Building

Ask yourself: which lane are you really in—and what would it take to upgrade your financial firmware?

Breaking the Income Ceiling: Entrepreneurship and Limitless Possibility

Have you ever felt like your salary is stuck on a treadmill, moving forward just enough to keep up with the rising cost of living? If you’re like most people, you’ve probably noticed that no matter how hard you work, there’s a limit to how much you can earn at your job. This is the “income ceiling”—an invisible barrier that keeps your wealth-building strategy in check. But what if you could smash through that ceiling? That’s where entrepreneurial success comes in, and why some of the best personal finance books quietly nudge you toward thinking like a business owner.

How Starting a Business Removes the Cap on Your Earnings

Let’s get straight to the point:

There is no cap on how much money you can earn when you have a business.Unlike a traditional job, where your salary is set by pay bands, HR policies, and annual reviews, entrepreneurship puts you in the driver’s seat. Your income is no longer determined by what your boss thinks you’re worth or what the market pays for your title. Instead,

The only ceiling is your own skills, which is super nice.Your earning power becomes a direct reflection of your abilities, your willingness to learn, and the market you choose to serve.

The Numbers Game: Realistic Business Income Ranges

Let’s talk real numbers, not just motivational hype. If you build a business, your income potential is limited only by your skills and the market’s appetite for what you offer. Here’s what that can look like:

| Scenario | Potential Annual Income | Ceiling |

|---|---|---|

| Employee (typical raise) | Inflation + 2% per year | Determined by job market, salary bands |

| Business Owner | $100K, $200K, $500K, $1M, $2M, $5M+ | Skills & market demand |

These aren’t just fantasy numbers. Many entrepreneurs—sometimes with no more formal education than you—have built businesses that generate six, seven, or even eight figures a year. The difference? They’re not limited by someone else’s pay scale. They’ve chosen a wealth building strategy that’s based on growth, not restriction.

Contrast: Salary Raises vs. Business Growth—How Slow is “Slow”?

If you’ve ever waited for your annual review, you know the drill. Maybe you get a 3% raise. Maybe it’s just enough to keep up with inflation. But that’s the system:

We’ve got all these bands and you have to stay within this particular band and we can only raise your salary by inflation plus 2% every year.Over a decade, that’s a slow crawl toward financial freedom—if you get there at all.

Now compare that to business growth. If you acquire new skills, improve your offer, or reach a bigger market, your income can jump dramatically—sometimes overnight. There’s no manager telling you to wait three years for a promotion. There’s no HR policy capping your ambition. The only real limit is your ability to learn, adapt, and serve your customers.

The Artificial Cap: Why Annual 2% Salary Increases Won’t Make You Wealthy

Let’s be honest: a 2% annual raise is not a wealth building strategy. It’s a survival strategy. It keeps you from falling behind, but it rarely moves you ahead. If you want financial freedom before retirement, you need a way to break out of the slow lane. Entrepreneurship does exactly that by removing the artificial caps imposed by traditional employment.

Personal Sidebar: The Awkward Moment I Realized I Could Never Ask for Another Raise

I’ll never forget the day I realized I’d hit my salary ceiling. I’d worked hard, delivered results, and was ready for the next step. But when I asked about a raise, my manager shrugged and pointed to the pay band. “Sorry, that’s the max for your role.” That moment stung, but it was also a wake-up call. I realized that as long as I relied on someone else to decide my worth, I’d always be limited. That’s when I started looking at entrepreneurship—not as a risky leap, but as the only way to truly control my income.

If It’s All Down to You, Is Risk as Scary as You Think?

Yes, starting a business involves risk. But so does staying in a job with capped growth. The difference is, as an entrepreneur, you can spot and manage your risks. You can learn new skills, pivot your strategy, and choose your market. In real life, calculated risk is about making informed decisions—not gambling your future. And remember:

The only ceiling is your own skills.If you’re willing to learn and adapt, the possibilities are truly limitless.

Entrepreneurship isn’t for everyone. But if you want to break the income ceiling, build real wealth, and achieve financial freedom, it’s the only path where your earning power is truly unlimited. The best personal finance books don’t just teach you how to save—they teach you how to think bigger, and that’s the real secret to entrepreneurial success.

The Power of Learning Funnels: Dotcom Secrets and the Art of Selling Without Sleaze

Dotcom Secrets: Why Sales Funnels Are Like McDonald's (Hint: They Profit from Fries, Not Burgers)

If you want to grow your wealth and master smart money personal finance, you need to understand not just how to make money, but how businesses actually keep it flowing in. Russell Brunson’s Dotcom Secrets is one of the best personal finance books for this reason—it unlocks the hidden mechanics behind how companies, big and small, really make their profits.

Let’s take McDonald’s as the perfect example. You might think they make money selling burgers. But the truth is, the burger is just the entry ticket. The real profit comes when they ask, “Would you like fries with that?” That simple upsell—fries and a drink—turns a break-even sale into a gold mine. As Brunson puts it:

“If they didn’t say, ‘Would you like fries with that?’ McDonald’s would have gone out of business long ago.”

This is the heart of a sales funnel: guiding a customer from a small purchase to bigger, more profitable ones. It’s not about being pushy or sleazy. It’s about serving people at different levels, giving them more value if they want it, and building a business that lasts.

What’s a Funnel, Really? From Potato Gun Kits to Million-Dollar Journeys

So, what exactly is a sales funnel? In the simplest terms, it’s a step-by-step path that takes someone from not knowing you exist to becoming a loyal customer who buys your biggest offer. Brunson’s own story is legendary: he started by selling a guide on how to build a potato gun. But the real breakthrough came when he realized he could offer more—like selling the actual materials needed to build the gun, right after someone bought the guide. That extra offer, right after the first sale, multiplied his profits.

Here’s how a typical sales funnel works:

- Awareness: Someone discovers your product or service.

- Interest: They learn more and get curious.

- Entry Offer: You sell them something small and valuable.

- Upsell: You offer a related product or service that makes their experience even better.

- High Ticket Item: For those who want the best, you have a premium offer.

This isn’t just for online courses or e-commerce. It’s everywhere—gyms, clinics, coaching, even your local dentist.

Wild Card: Imagine Your Dentist Using an Upsell Funnel

Think about your last dental visit. You go in for a cleaning—that’s the “burger.” But then, the hygienist asks, “Would you like whitening with your cleaning?” That’s the “fries.” Maybe there’s a special on electric toothbrushes at checkout. Suddenly, your simple visit has become a mini sales funnel, and you don’t feel pressured—you feel like you’re getting more value.

The truth is, most businesses already do this brilliantly. The best part? You can use these same principles to grow your wealth and make smart investing decisions, whether you’re running a side hustle, a clinic, or an online store.

Practical Takeaway: Funnels Apply to Clinics, Coaches, Side Hustles—Anywhere People Buy Things

You don’t have to be a tech wizard or a marketing guru. If you sell anything—fitness classes, consulting, handmade crafts, even your time—understanding funnels gives you a roadmap for smarter business and, by extension, smarter personal spending. When you see how upsells and cross-sells work, you’ll start to notice them everywhere. And you’ll realize how you can use them ethically to serve your customers better and build a business that supports your lifestyle.

This is why Dotcom Secrets is so transformative. It’s not just about online business. It’s about seeing the hidden systems that power every successful company, from McDonald’s to your local gym.

Business Models That Scale: Small Product Upfront, Big Offer Behind

The secret sauce of the world’s most successful businesses is this: they often sell something small and affordable upfront, then offer bigger, more valuable products or services to those who want more. This is how you scale. The first sale builds trust; the next sale builds your business. Whether you’re selling digital products, coaching, or even physical goods, the funnel model lets you serve everyone—those who just want a taste, and those who want the full experience.

This approach is at the heart of smart money personal finance for entrepreneurs. You’re not just chasing one-off sales—you’re building a system that grows your wealth over time.

The Learning Curve: Why You Might Want to Leave Sticky Notes in Your Next Book

Here’s a practical tip: as you read Dotcom Secrets (and you really should read the physical or Kindle version for all the diagrams), keep a stack of sticky notes handy. Jot down every funnel idea, every upsell you notice in your daily life, and every “aha!” moment. You’ll start to see patterns—how your gym offers a free class, then a membership, then personal training. How your favorite app has a free tier, then a paid upgrade, then a premium mastermind group.

This kind of active reading is a financial firmware update for your brain. You’ll start to see opportunities everywhere, and you’ll understand why the best companies make their real money on the back end—not from the first sale, but from the journey they take their customers on.

If you want to master smart investing and build a business that supports your dream life, learning the art of the funnel is non-negotiable. Dotcom Secrets is your playbook.

From Theory to Action: Million Dollar Weekend and Making Progress Real

Let’s be honest: most of us treat the best personal finance books like a binge-worthy Netflix series. We read, we highlight, we nod along, and then… we move on to the next book. We get the dopamine hit of feeling productive, but nothing in our bank account or business life actually changes. This is the great trap of financial self-help—learning without doing. It feels like progress, but it’s just comfort in disguise.

Million Dollar Weekend: The Hands-On Playbook for Entrepreneurial Success

Noah Kagan’s Million Dollar Weekend is the antidote to this illusion. It’s not just another book about money mindset or business theory. It’s a direct challenge to your comfort zone, a call to action that flips the script from thinking to doing. The premise is as bold as it is simple: you can start a real business in a single weekend. Not someday. Not after you read ten more books. This weekend. The first chapter doesn’t ease you in—it’s literally called “Just f*cking start.”

Kagan knows exactly where most people get stuck. He writes, “That is where the rubber meets the road, that's where you have to face your imposter syndrome and analysis paralysis.” All the emotional hurdles—fear, self-doubt, perfectionism—come roaring to the surface the moment you try to move from theory to action. And the truth is, most people will never get past this point. The industry average is sobering: less than 10% of readers actually take action on what they learn from business books.

The Illusion of Progress: Why Reading Feels Safer Than Doing

There’s a dangerous comfort in reading about money and business. It feels like you’re upgrading your brain’s “financial firmware”—and in a way, you are. But unless you actually run that new code in real life, nothing changes. You can read every book on entrepreneurial success, but your financial confidence only grows when you take real steps, make real offers, and risk real embarrassment.

“For the minority of people that read this book and actually do what Noah Kagan says, and you take action, this is how you can build a business.”

Most people will read, nod, and move on. That’s okay. But if you want to be financially free, you have to do more than just think about it. You have to act.

Begin Before You Are Ready: The Power of Imperfect Action

The most powerful lesson from Million Dollar Weekend is this: Begin before you are ready. If you wait for permission, for the perfect idea, for the stars to align, you’ll be waiting forever. The first steps are always awkward. You’ll feel exposed. You’ll worry about what people think. But that’s exactly where growth happens.

Let me share my own struggle. One weekend, fueled by two cups of coffee and a mix of excitement and dread, I sat down to build a website for a business idea I’d been sitting on for months. The site was half-baked. My offer was rough. I was embarrassed to share it. But I hit “publish” anyway. I sent the link to a few friends, posted in a small online group, and waited. Within hours, I got my first sale. The embarrassment melted away, replaced by a rush of financial confidence I’d never felt from reading alone. That single, imperfect action changed everything.

Action Trumps Knowledge: Only Implementation Sets You Free

- Reading is not enough. You have to do the work.

- Most people won’t act. But those who do see real results—fast.

- First steps are messy. But they’re the only way to move forward.

Think of your brain like a computer. Reading books is like downloading a firmware update. But unless you reboot and actually run the new code, nothing changes. Million Dollar Weekend is the reboot button. It’s the push to stop learning and start earning.

Why the Minority Wins

Statistics don’t lie: less than 10% of readers ever take action on what they learn. But for that minority, the rewards are real and lasting. They build businesses, create new income streams, and unlock true financial freedom. As Kagan says, “You’ll never be financially free if you don’t take action.”

So, if you’re tired of the illusion of progress and ready to make your entrepreneurial success real, take the challenge. Start before you’re ready. Embrace the awkwardness. Let action—not just knowledge—be your guide. That’s the real firmware update your financial life needs.

Comparative Table: Four Transformative Books at a Glance

When it comes to Personal Finance Books Success, it’s not just about what you read—it’s about reading the right book at the right time for your journey. Whether you’re seeking a mindset shift, practical tactics, or a push to finally launch, these four Best Personal Finance Books each offer a unique “firmware update” for your financial brain. Here’s your at-a-glance guide to choosing the book that fits your current stage, goals, and appetite for action. Remember:

“It’s the power of learning from those who came before us—standing on the shoulders of giants.”

Quick Reference: Which Book for Which Stage?

- Just starting out? Begin with The Millionaire Fastlane for a total mindset overhaul.

- Ready to build online? Dotcom Secrets gives you the tactical playbook.

- Want to charge more and sell better? $100M Offers is your pricing and product bible.

- Need to take action—fast? Million Dollar Weekend is your launchpad.

Comparative Matrix: 2025-Ready Financial Independence

This table breaks down the focus, core concept, best audience, and actionability of each book. Use it to pick your next move wisely—each book is a stepping stone on your path to Financial Independence.

Side-by-Side Features: Theoretical vs. Practical, Audience Fit, and Implementation Difficulty

- The Millionaire Fastlane is your go-to for a total mindset reset. It’s more theoretical, giving you the roadmap to escape the “slow lane” and build real wealth. Perfect if you’re just starting or feel stuck in old patterns.

- Dotcom Secrets is practical and tactical. If you want to build an online business in 2025, this book gives you the exact funnel strategies and digital sales systems that work now—not in the dot-com era of the past.

- $100M Offers is for those ready to package, price, and sell at a higher level. It’s practical, with frameworks that help you create offers people can’t refuse—ideal for freelancers, creators, and business owners who want to level up.

- Million Dollar Weekend is the most action-oriented of all. If you’re ready to break through fear and launch something fast, this book is your step-by-step guide. It’s about implementation, not just inspiration.

How to Use This Table for Your Financial Independence Journey

Think of this matrix as your personal GPS for Best Personal Finance Books

Yearly Growth Path: Charting the Road from Learning to Action

Imagine your mind as a computer, quietly running on outdated software. You read, you learn, but nothing really changes—until you hit “update.” By reading these books, you’ll have a massive firmware update in your mind. But what happens after that? How do you move from learning about Financial Freedom to actually living it? The answer lies in the path you choose and the actions you take, year by year.

Slow Lane vs. Fast Lane: The Typical Timeline to Financial Freedom

Most people are taught to follow the “slow lane.” You work hard, save diligently, and invest a portion of your paycheck. Over decades, your wealth grows, but true Financial Independence remains a distant dream—often not arriving until you’re 65 or older. This approach is safe, but as the world changes faster than ever, it’s also increasingly outdated. If you want to Grow Your Wealth and become financially free before retirement age, the slow lane just isn’t enough.

Contrast this with the “fast lane,” a concept championed in The Millionaire Fastlane. Here, you use entrepreneurial thinking, leverage, and action to accelerate your journey. You’re not just saving—you’re building, creating, and multiplying your wealth. The difference in outcomes is dramatic, as seen in the real-life story of Sahil, who went from $0 to a $1.3 million/year business in just two years after embracing this mindset.

| Path | Time to Financial Freedom | Example |

|---|---|---|

| Slow Lane | Retire at 65+ | Traditional saver/investor |

| Fast Lane | <10 years | Sahil: $0 to $1.3M/year in 2 years |

What Happens After a ‘Firmware Update’? Tracking Milestones Year by Year

Once your mindset shifts, the real journey begins. Year one is about awkward starts—launching a side hustle, making your first investment, or simply tracking your spending. It’s messy and uncomfortable, but it’s movement. By year two, you’re refining your approach, learning from mistakes, and seeing your first real wins. Each year compounds, not just financially, but in confidence and skill. By year five, you might have a thriving business or investment portfolio. By year ten, Financial Independence could be your reality—not just a dream for retirement.

Visualization: Perpetual Learner, Slow Saver, and Action-Taker

Let’s visualize three paths:

- The Perpetual Learner: Reads every book, takes every course, but never acts. In 2030, their knowledge has grown, but their bank account hasn’t.

- The Slow Saver: Follows the traditional advice. By 2030, their wealth has grown modestly, but true freedom is still decades away.

- The Action-Taker: Embraces the fast lane, starts awkwardly, and learns by doing. By 2030, they could be living life on their own terms, enjoying the fruits of Financial Freedom.

The difference isn’t just in the numbers—it’s in the lifestyle, the choices, and the sense of control over your future. When you visualize your growth path, it becomes clear: reading plus action equals rapid results, while slow lane methods seldom deliver on freedom before retirement.

Where Will You Be in 2030 If You Start Now?

Close your eyes and picture yourself in 2030. Are you still waiting for the right moment, or are you living with Financial Independence? The next six years will pass whether you act or not. The only question is: will you use this time to Grow Your Wealth, or will you let another decade slip by?

Tangent: Why Starting Awkwardly Is Better Than Staying Stuck

It’s easy to wait for the perfect plan, the perfect moment, or the perfect amount of knowledge. But the truth is, everyone starts awkwardly. Sahil didn’t have all the answers when he began, but he took action—and that made all the difference. Starting awkwardly is infinitely better than staying stuck. Every small step compounds, and every awkward beginning is the first chapter of a success story.

Conclusion: Your Roadmap to Financial Freedom

By updating your brain’s financial firmware with these four books, you’re not just learning—you’re preparing to act. The path you choose from here will define your future. Will you stick to the slow lane, hoping for freedom at 65? Or will you take the fast lane, embrace action, and chart your own course to Financial Independence in less than a decade?

The choice is yours. Start now, start awkwardly, but most importantly—start. By 2030, you’ll be glad you did.

TL;DR: If you read just these four (surprisingly fun) books, you’ll radically rewrite your money beliefs, learn how real wealth is built, and, with a little action, leave the slow lane behind—no finance degree or Wall Street pedigree required.

Post a Comment