Let me tell you about the time I almost bought a local print shop because the owner wanted more time with her grandkids. Mergers and acquisitions always sounded like cold, corporate jargon, but that day, it felt decidedly human—awkward handshake, half-empty coffee cup, and all. If you think M&A is reserved for Wall Street titans, it’s time for a plot twist. The juicy secret? Economic downturns aren’t just survival games—they’re riddled with hidden deals. Today, I’ll walk you through the not-so-glamorous, shockingly practical strategies the top entrepreneurs use to snatch up businesses in the most unexpected places. Buckle up, there’s poetic justice (and maybe a snowball fight) ahead.

Section 1: Why Economic Winter is M&A Hunting Season

Every entrepreneur knows that economies move in cycles—there’s the high-energy “summertime” of growth, and then there’s the “wintertime” of downturns. While most people dread economic winter, savvy entrepreneurs see it as the perfect season for uncovering business acquisition opportunities. In fact, economic downturns can be the most lucrative time to pursue mergers and acquisitions (M&A), especially in the small business sector.

Why Economic Downturns Favor Bold Acquirers

During periods of economic slowdown, the rules of the game change. Business valuations drop, sellers become more motivated, and there’s less competition from other buyers. As one top entrepreneur put it:

“In the wintertime of the economy, it’s a really good thing to be doing mergers and acquisitions...”

Think of it like a snow day. My neighbor once told me that some games are just more fun in winter—sledding, snowball fights, and building forts. The same is true for M&A. When the economic weather turns cold, the field clears out, and the real opportunities become visible to those willing to play.

Motivated Sellers: The Baby Boomer Wave

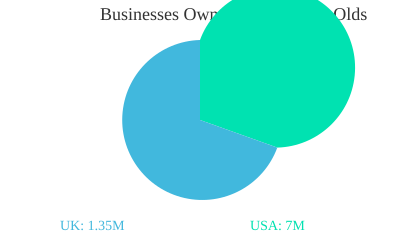

One of the most significant drivers of small business M&A right now is the massive wave of baby boomer business owners heading for retirement. The numbers are staggering:

- 1.35 million UK businesses are owned by individuals aged 65 and over.

- Nearly 7 million US businesses are owned by people in the same age group.

Many of these owners are ready to exit, but they’re facing a market with fewer buyers and more uncertainty. This creates a unique window for entrepreneurs with experience, networks, and a bit of courage to step in and make deals that simply aren’t possible during boom times.

Chance Meetings and Hidden Doors

Some of the best deals I’ve seen came from unexpected conversations—sitting next to someone at a conference, or a casual chat at a local coffee shop. During economic winter, these chance meetings can open doors to businesses that aren’t even officially for sale. Owners who might have held on during better times are now ready to talk, and you can be the solution they need.

Strategic Advantages of Buying in Winter

- Lower Valuations: Prices are more reasonable, giving you greater upside.

- Motivated Sellers: Retirement, burnout, or shifting priorities drive more owners to sell.

- Less Competition: Many buyers sit on the sidelines, so you have more negotiating power.

- Post-Acquisition Growth: Businesses that seem “unloved” often thrive with fresh leadership and new energy.

Think of economic downturns as your own “entrepreneurial winter sport.” Deals are everywhere if you know where to look and have the courage to act when others are holding back. Leaning into these cycles isn’t just smart—it’s how top entrepreneurs build real wealth through mergers and acquisitions.

Section 2: Not All That Glitters is Gold—Spotting Boring Business Gems

When you think about Business Acquisition Opportunities, it’s tempting to chase after flashy tech startups or trendy new brands. But the truth is, most sale-ready small businesses are what many would call “boring.” Think print shops, landscaping companies, HVAC contractors, IT services, engineering firms, or local publishers. These businesses may not make headlines, but they often have something far more valuable: stability and consistent profits.

Why Exciting Isn’t Always Profitable: Stability Beats Flash

It’s easy to overlook a business that doesn’t seem exciting on the surface. However, in Small Business M&A, the real gems are often hiding in plain sight. These “boring” businesses usually have:

- Steady, recurring customers

- Reliable cash flow

- Six-figure profits—even with outdated practices

- Owners who are ready to retire or move on

As one seasoned entrepreneur put it:

“There are so many little businesses that fit this description... littered all over the map.”

What to Look For: The Boring Business Checklist

When searching for Business Acquisition Deals, focus on businesses with:

- Declining revenues (not failing, just lacking energy or innovation)

- Stable customer base (loyal, long-term clients)

- Outdated systems (think paper invoices or websites stuck in the 90s)

- Motivated but not desperate sellers (owners who want to retire, not fire-sale)

Invented Story: The Landscaping Business I Almost Missed

Let me share a quick story. I once came across a landscaping business whose website still used Comic Sans. At first glance, I dismissed it—how could a business with such an outdated look be worth my time? But after a closer look, I discovered it had over $1 million in annual revenue and $200,000 in profit. The owner was simply ready to retire, and his kids had no interest in taking over. That “boring” business turned out to be a hidden gem—one I almost missed because I judged the book by its cover.

The Importance of Casting a Wide Net

In Small Business M&A, you can’t expect golden opportunities to fall into your lap. You’ll need to review 20 to 30 businesses before finding a true fit. Why? Because most leads won’t meet your criteria for Valuing Small Businesses, or the seller’s motivations won’t align with your goals. The more businesses you evaluate, the better your chances of finding a diamond in the rough.

| Typical “Boring” Business | Annual Revenue | Annual Profit | Deals Reviewed for One Fit |

|---|---|---|---|

| Print Shop | $1,200,000 | $180,000 | 20-30 |

| Landscaping | $1,000,000 | $200,000 | 20-30 |

| HVAC Service | $1,500,000 | $250,000 | 20-30 |

No Easy Leads: The Grit Behind Golden Finds

Lead generation for Business Acquisition Deals is just as gritty as any other field. You’ll need to use outbound marketing, cold calls, and content marketing to connect with owners. Most of these businesses are run by baby boomers who want to retire, lack a succession plan, and value leisure over more money. Their children rarely want to inherit the business, opening the door for you.

Remember, the best Business Acquisition Opportunities are often steady, sleepy businesses overlooked by others. If you’re willing to do the “boring” work, you’ll find truly golden deals hiding in plain sight.

Section 3: Art of the Pitch—When You’re Not the Highest Bidder (But Still Win)

Pitching Acquisition Deals: Value, Vision, and Team Over Cash

In the world of business acquisition, the highest offer doesn’t always win. When you approach a retiring owner—especially one who is already financially secure—the pitch that stands out is the one that focuses on value, vision, and your team. Sellers often care deeply about their business’s legacy, employees, and reputation in the community. If you can articulate a clear plan for growth and continuity, you’re already ahead of many cash-rich competitors.

- Value: Show how your expertise and network will revitalize the business.

- Vision: Paint a compelling picture of where the company will go under your leadership.

- Team: Introduce a credible team with relevant experience and energy.

Understanding Seller Motivations: Beyond the Money

Many “bored baby boomer” owners have paid-off homes and healthy investments. Their motivation isn’t just about cashing out—it’s about peace of mind, ongoing income, and a smooth transition. As one seller put it,

“They want to be able to negotiate terms that work for them.”This is where seller finance arrangements shine. By offering a five-year payout structure with interest, you provide steady income and security, making your offer more attractive—even if it’s not the highest upfront bid.

Building Trust: What Sellers (and Their Families) Google About You

Trust is the foundation of any business growth strategy involving acquisition. Sellers and their families will research your online presence. A strong personal brand, positive press, and clear evidence of business success can tip the scales in your favor. Make sure your LinkedIn, website, and testimonials reflect your credibility. Remember, you’re not just pitching the seller—you’re pitching their spouse, children, and advisors too.

Wild Card: When the Pitch Meeting Goes Sideways

Imagine you’re in a pitch meeting. The seller seems hesitant, worried about handing over their life’s work. Your initial offer is met with silence. This is your cue to pivot: lay out a detailed five-year plan, explain how seller finance works, and show how their ongoing involvement (if desired) ensures a smooth transition. Suddenly, the mood shifts. The seller sees a path to retirement that protects their legacy and income.

Negotiating Seller Finance: The Game-Changer

Seller finance means the seller acts as the bank. You pay over time—often with little or no down payment. This opens the field to entrepreneurs without large capital reserves and appeals to retiring owners who want ongoing income. Here’s a sample structure:

| Valuation | Down Payment | Interest Rate | Balloon Payment | Monthly Payment | Term |

|---|---|---|---|---|---|

| $1,000,000 | $0 | 5% | $200,000 | $15,000 | 5 years |

This structure gives sellers peace of mind and gives you, the buyer, a path to ownership without massive upfront risk.

The Three Deal-Breakers: Valuation, Terms, and Transition Plan

- Valuation: Be transparent and fair. Explain your reasoning and show your math.

- Terms: Offer creative solutions—interest rates, balloon payments, and flexible timelines.

- Transition Plan: Detail how you’ll care for the business, staff, and customers post-acquisition.

In business acquisition, a strong narrative and a well-structured seller finance arrangement can unseat even the highest cash offer. Focus on what matters most to the seller, and you’ll win deals others never see coming.

Section 4: The Seller Finance Playbook—Structuring Creative Win-Wins

Breaking Down a Typical Seller Finance Arrangement

Seller Finance Arrangements are a powerful M&A strategy that can unlock business acquisition deals with little to no upfront cash. Here’s how a classic structure works:

- Deposit: Often $0 or a nominal amount, especially when trust is high.

- Principal: The agreed purchase price, say $1,000,000.

- Interest Rate: Typically negotiable, but 5% is common.

- Monthly Payments: Calculated to cover interest and, sometimes, principal.

- Balloon Payment: A larger sum due at the end of the term (e.g., $200,000 after five years).

This financial structuring dramatically lowers the barrier to acquiring established businesses, especially in today’s “winter” economy.

Comparative Scenarios: Interest-Only, Full Amortization, and Balloon Payments

- Interest-Only: You pay only the interest each month (e.g., $4,000 on $1M at 5%), then the full $1M principal as a balloon payment at the end.

- Full Amortization: Each payment covers both interest and principal, so the loan is paid off entirely over the term (e.g., $18,870/month for five years at 5%).

- Balloon Payment: A hybrid—smaller monthly payments (e.g., $15,000), with a $200,000 lump sum at the end.

Each scenario can be tailored to fit the business’s cash flow and the seller’s comfort level.

Invented Dialogue: Negotiating with Mrs. Thomas, the Ex-Print Shop Owner

“Mrs. Thomas, would you prefer a big lump sum now, or steady monthly checks over the next five years?”

She smiles, ‘Honestly, I’d rather have the monthly income. My husband and I already have our house and savings. If you take over, I get peace of mind and a steady check—plus, if you grow the business, everyone wins.’

Many sellers, especially those already financially secure, value ongoing income and the legacy of their business over a single payout.

Charting the Cash Flows: Impact on Buyers and Sellers

| Scenario | Buyer’s Monthly Payment | Seller’s Income | Balloon Payment |

|---|---|---|---|

| Interest-Only | $4,000 | $4,000/month | $1,000,000 |

| Amortized | $18,870 | $18,870/month | $0 |

| Balloon | $15,000 | $15,000/month | $200,000 |

For buyers, this means you can acquire a business without draining your capital. For sellers, it’s a reliable income stream—“If they agree to be the bank...they’ll also earn interest on top of that.”

Why Sellers Say ‘Yes’ to 0% Down Deals

Trust and motivation matter more than upfront cash. Sellers often agree to zero-down deals when they believe in your credibility, personal brand, and plan for the business. Their priority is often legacy and steady income, not just the headline price.

Potential Pitfalls and How to Avoid Them

- Growth Lags: If profits dip, you may struggle with payments. Always ensure the business’s cash flow covers your obligations.

- Negotiation Gaps: Be transparent about your plan and team to build trust.

- Legal Protections: Use clear contracts and seek legal advice to protect both parties.

Seller finance arrangements, when structured thoughtfully, create win-win M&A strategies that are rare but highly effective in small business acquisition deals.

Section 5: Fact vs. Fantasy—Multiplying Value After the Deal

Reality Check: Not Every Acquisition Soars from Day One

It’s easy to fantasize about acquiring a business and watching profits skyrocket overnight. The reality? Most deals demand hands-on leadership and a clear plan for improving acquired businesses. While the deal structure is important, the real value comes from what you do after the ink dries. Operational changes and focused business growth strategies are what deliver real ROI from acquisitions—not wishful thinking.

Common Improvements: Revitalized Marketing, Modernized Systems, Energized Teams

Once you take the reins, the fastest wins often come from:

- Revitalizing marketing: Update branding, launch new campaigns, and reconnect with lapsed customers.

- Modernizing systems: Replace outdated tech, streamline workflows, and automate repetitive tasks.

- Energizing teams: Bring in fresh leadership, set new goals, and reward initiative.

These improvements are the foundation for market expansion and synergy realization—the real engines of post-acquisition growth.

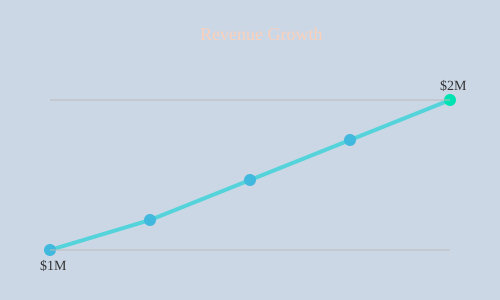

Anecdote: Doubling Revenue with a Rebrand (and More Coffee Stains)

Consider the case of a sleepy local print shop acquired by an energetic entrepreneur. The shop had flatlined at $1M in annual revenue for years. Within six months, the new owner rebranded the business, launched targeted digital ads, and introduced a subscription service for local businesses. The result? Revenue doubled to $2M, and the break room coffee machine worked overtime to keep up with the new pace. As one observer put it:

“With your energy behind it, why couldn’t they even double from there?”

Quick Wins vs. Long-Haul Transformations

Not every improvement delivers instant results. Identify quick wins—like renegotiating supplier contracts or updating the website—that boost cash flow fast. But don’t ignore long-haul transformations such as culture change, new service lines, or expanding into new markets. Both are essential for sustainable growth and synergy realization.

Avoiding the Sunk-Cost Trap

It’s tempting to keep pouring resources into a struggling acquisition, hoping for a turnaround. But sometimes, the best move is to walk away or pivot. Regularly assess whether your efforts are delivering results. If key metrics aren’t improving, don’t let pride or sunk costs cloud your judgment.

Tracking Results: The Importance of Metrics and KPIs

Active management means measuring everything. Track:

- Revenue growth (aim for $1M to $2M+ post-acquisition)

- Profit margins (move from six-figure profit to double-digit margins)

- Customer churn (reduce lost clients)

- Monthly payouts (ensure operational growth covers obligations, e.g., $15,000/month)

Set clear post-acquisition KPIs and review them monthly. This discipline separates fantasy from fact—and ensures your business growth strategies are paying off.

SVG Chart: Revenue Growth Pre- and Post-Acquisition

Chart: Example revenue growth from $1M to $2M after operational improvements and market expansion.

Section 6: Building Your Influence—Why Deals Hinge on Your Reputation

In the world of small business M&A strategy, your reputation is not just an asset—it’s the key that unlocks the best business acquisition opportunities. Every party involved in a deal will research your credibility. The question is: when they Google you, do you show up as a Key Person of Influence or just another name in the crowd?

Google: The World’s Biggest Private Detective

“Every single deal you do—somebody’s going to Google you.”

Think of Google as the world’s most thorough private detective. Sellers, their spouses, and even future buyers will type your name into the search bar before moving forward. What they find can clinch—or kill—the deal. Data shows that Google search traffic spikes around participants during deal closing windows, and up to 50% of sellers say the buyer’s perceived credibility was a deciding factor.

| Statistic | Insight |

|---|---|

| Google search traffic spikes | Occurs during deal closing windows |

| 50% of sellers | Say buyer’s credibility was a deciding factor |

Why Your Digital Footprint Matters in M&A Strategy

Your digital presence is your handshake, your pitch, and your reference letter—all rolled into one. In today’s market, being a visible Key Person of Influence is not just a buzzword; it’s a real deal-closing asset. Sellers want to know their business is in capable hands. Buyers want to trust the person on the other side of the table. If your online footprint is weak, you risk being passed over for more credible competitors, regardless of your offer.

Quick Fixes for a Lackluster Online Presence

- Testimonials: Collect and display testimonials from clients, partners, or industry peers. Third-party validation is powerful.

- Leadership Articles: Publish articles or blog posts that showcase your expertise in your field. This positions you as a thought leader.

- Speaking Appearances: Share videos or photos from industry events, podcasts, or panels. Public speaking signals authority and trustworthiness.

These quick wins can rapidly enhance your digital credibility and help you stand out as a Key Person of Influence in your niche.

Business Networking: The Hidden Engine Behind M&A Opportunities

Business networking is the secret sauce behind many successful M&A deals. Mastermind groups, workshops, and accelerator programs put you in rooms with other high-level operators. These environments are where real business acquisition opportunities are shared—often before they hit the open market. Peer validation and referrals from these groups can swing negotiations in your favor, as sellers and buyers alike trust recommendations from within their network.

Accelerator Programs: Your Shortcut to M&A Credibility

Accelerator programs focused on building your personal brand as a Key Person of Influence can fast-track your credibility. These programs offer structured support, peer accountability, and direct access to deal flow. By participating, you not only enhance your reputation but also gain insider knowledge and connections that can make or break your next M&A strategy.

In summary, your reputation is a fundamental lever in unlocking more and better M&A opportunities. Cultivating visible expertise and a strong digital presence paves the road for smoother, higher-quality business deals. Make sure you are the person everyone wants to do business with—online and offline.

Section 7: David vs. Goliath—Small Businesses Punching Above Their Weight

When you think of mergers and acquisitions (M&A), you might picture only large corporations making headline-grabbing deals. But the reality is, you don’t need to be a corporate giant to play the M&A game. In fact, some of the most strategic and rewarding business acquisition stories come from smaller, nimble entrepreneurs who spot opportunities that bigger players overlook. These “David versus Goliath” deals are where a small business goes and buys a much bigger business—often with transformative results.

How Small Businesses Win Big: The David Versus Goliath Approach

Imagine this: you’re running a business that generates $300,000 a year in revenue. With the right M&A strategy, you identify a $3 million business—ten times your size—that’s owned by a retiring baby boomer. Through smart negotiation and seller finance, you acquire this business, instantly multiplying your scale, market reach, and reputation. This is not just a fantasy; it’s a scenario that’s playing out more often as experienced entrepreneurs leverage advanced acquisition frameworks.

“David and Goliath deals are where a small business goes and buys a much bigger business.”

Benefits: Why Punching Above Your Weight Pays Off

- Instant 10X Scale: Acquiring a larger business can multiply your revenues overnight, giving you a much bigger footprint in your industry.

- Market Expansion: You gain access to new customers, contracts, and markets that would take years to reach through organic growth.

- Enhanced Credibility: Owning a larger, established business boosts your status and opens doors to bigger opportunities and partnerships.

- Strategic Advantage: Well-structured deals allow you to take market share from slower, less agile competitors.

Risks: What to Watch Out For

- Biting Off More Than You Can Chew: Managing a business much larger than your current operation can stretch your resources and skills.

- Culture Clash: Integrating teams and processes from different backgrounds requires humility, careful planning, and strong leadership.

- Financing Challenges: Even with seller finance, you must ensure the acquired business’s cash flow can support repayment and growth.

How to Spot When You’re Ready to ‘Fight Goliath’

David versus Goliath M&A deals are not for beginners. Here’s how to know if you’re ready:

- Experience: You have at least 10-15 years in business, a solid network, and a strong personal brand.

- Vision: You see the potential in “boring” but profitable businesses that others overlook.

- Deal-Making Skills: You understand seller finance, negotiation, and integration planning.

- Grit and Humility: You’re willing to do the hard work—reviewing dozens of deals, building rapport, and learning from setbacks.

Spotting the Right Opportunity

Look for businesses owned by retiring baby boomers—often in sectors like IT services, blue-collar trades, or local agencies. These businesses usually have strong cash flow and are overlooked by larger buyers. Your energy and vision can revitalize them, allowing you to leapfrog competitors and accelerate your market expansion.

With the right M&A strategy, even a small business can punch far above its weight, turning the classic David versus Goliath story into a blueprint for rapid growth and industry influence.

FAQ: Real Questions About Small Business Acquisitions

What qualifies as a ‘boring’ but profitable business for acquisition?

When we talk about “boring” businesses in the context of Business Acquisition Deals, we’re referring to companies that aren’t flashy or trendy, but have steady cash flow and a long history of serving their community. Think local print shops, landscaping companies, HVAC services, engineering firms, or IT support agencies. These businesses often have loyal customers, consistent revenues, and are overlooked by younger buyers—even though they’re usually profitable and ripe for growth with new energy and ideas.

How do you find business owners who are ready to sell?

Finding motivated sellers is all about targeted outreach. Many owners over 65 are looking to retire, especially in today’s economic “winter.” Use outbound marketing, cold calls, LinkedIn, and content marketing to connect with these owners. Networking events, local business associations, and even direct mail can also help you reach those who might not have considered selling until you approach them. Remember, you may need to review 20 to 30 opportunities before finding the right fit for your Small Business M&A strategy.

Do I need upfront capital to buy a business?

Not always. One of the most powerful aspects of advanced Business Acquisition Deals is the use of Seller Finance Arrangements. Many retiring owners are willing to accept a structured payout over several years, especially if they are financially secure and want to see their legacy continue. In some cases, you can negotiate little or even zero upfront payment, provided you have a strong plan and personal credibility.

What’s seller finance and how common is it?

Seller finance means the seller acts as the bank, allowing you to pay for the business over time. This is more common than you might think in the small business space, especially with owners who are independently wealthy and want a smooth transition. Typical terms include a fixed interest rate (like 5%), monthly payments, and sometimes a final “balloon” payment. This approach can make deals possible even if you don’t have large amounts of cash on hand.

How long does a small business acquisition typically take?

The process can range from a few months to a year, depending on the complexity of the deal and how quickly both sides move. Due diligence, negotiations, and legal paperwork all take time, but having a clear six-step framework can speed things up and reduce surprises.

How do you value a small business for M&A?

Valuation usually starts with the business’s annual profits and revenue history. Common methods include multiples of EBITDA (earnings before interest, taxes, depreciation, and amortization) or seller’s discretionary earnings. You’ll also consider the business’s assets, customer base, and market position. It’s smart to work with an accountant or M&A advisor to ensure you’re not overpaying.

What risks should I be aware of when acquiring a business?

Risks include overestimating profits, underestimating costs, cultural mismatches, and hidden liabilities. Always conduct thorough due diligence—review financials, contracts, staff agreements, and customer relationships. A careful approach helps you avoid costly surprises and sets you up for a successful transition.

How do I handle staff and cultural shifts after purchasing a business?

Communication is key. Meet with staff early, share your vision, and listen to their concerns. Retaining key employees and respecting the existing culture while introducing gradual improvements will help ensure a smooth transition and maintain morale.

Can a small business really acquire a much larger business?

Yes, it’s possible. With the right Seller Finance Arrangements and a compelling plan, smaller companies can acquire larger ones—especially if the seller is motivated and trusts your ability to lead. These “David versus Goliath” deals are rare but can be transformational.

Why is my reputation so critical to closing deals?

In Small Business M&A, your personal brand and online reputation are everything. Sellers, their families, and future buyers will research you. Being seen as a “key person of influence” builds trust and credibility, making it far more likely that you’ll close the deal on favorable terms.

In conclusion, small business acquisitions are not just for Wall Street insiders—they’re accessible to experienced entrepreneurs who know where to look and how to structure the right deal. By mastering these advanced strategies, leveraging Seller Finance Arrangements, and building a strong personal brand, you can unlock opportunities hidden in plain sight—even in the economic winter. Now is the time to act boldly, apply what you’ve learned, and become a winner in the world of small business M&A.

TL;DR: Seasoned entrepreneurs know winter is prime time for M&A. With millions of boomer-owned businesses up for grabs, creative deal structures like seller financing make acquisitions possible for those ready to spot, pitch, and close. It’s less about spreadsheets and more about seeing opportunity when the market looks cold.

Post a Comment