A few years ago, I met an angel investor at a dingy coffee shop who swore that the next big bubble would be in AI. I laughed him off—after all, there were hardly any headlines about AI companies raising billions overnight. Fast forward to 2025, and I'm wondering if I should have paid his tab. In this post, we'll break down the whirlwind numbers, the hype vs. reality debates, and the surprising human stories that are shaping what some are calling the 'Wild West' of AI investing.

Hype, Hope, and Hysteria: Tracing the Trajectory of AI Startup Valuations 2025

If you’ve been following AI startup valuations 2025, you’ve probably asked yourself:

“Are we in the midst of an AI bubble that's about to burst?”The numbers are staggering—valuations doubling, even tripling, in a matter of months. It’s a trend that’s raising eyebrows and sparking intense debate across the tech and investment worlds.

Think back to the first time you heard about a $10 billion startup. For many, it felt almost unreal—a milestone reserved for the rarest unicorns. Fast forward to 2025, and $10B headlines are now routine, almost expected. The fizz of excitement has become a weekly occurrence as another AI company announces a massive new funding round. It’s reminiscent of the dot-com era, but with a distinctly AI twist.

AI Investment Trends 2025: The Numbers Behind the Frenzy

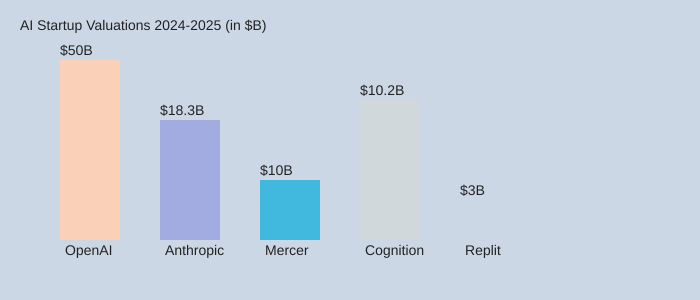

Let’s look at the data fueling this conversation. The most prominent example is OpenAI, the company that ignited the current AI boom with ChatGPT. In just twelve months, OpenAI’s valuation soared from $17.5 billion (October 2024) to $30 billion (March 2025), and then to an eye-popping $50 billion by the end of the year. That’s an average jump of nearly $2.9 billion per month—almost $1 billion every single day.

OpenAI isn’t alone. Anthropic, another leader in the space, leaped from a $6.5 billion valuation in March 2025 to $18.3 billion by September. Meanwhile, mid-tier players like Mercer have rewritten the rules entirely: Mercer raised a $100 million Series B at a $2 billion valuation in February, then secured another $350 million by October, catapulting its valuation to $10 billion. That’s a 5X jump in just eight months.

| Company | Valuation (Early 2025) | Valuation (Late 2025) | Increase |

|---|---|---|---|

| OpenAI | $17.5B (Oct 2024) | $50B (2025) | ~3X |

| Anthropic | $6.5B (Mar 2025) | $18.3B (Sep 2025) | ~3X |

| Mercer | $2B (Feb 2025) | $10B (Oct 2025) | 5X |

Emerging AI Companies 2025: The Middle Tier Goes Mainstream

It’s not just the giants. Across the board, emerging AI companies 2025 like Cursor, Reflection AI, Lyla Sciences, Harmonic, Fael, Abridge, and Dopple have each raised two or more rounds this year, with valuations climbing higher each time. Some, like Harvey and Data Bricks, are reportedly on their third funding round in 2025 alone. The pace is dizzying, and the scale is unprecedented.

Genuine Innovation or Investor Mania?

Here’s where the debate heats up. Is this rapid growth a sign of genuine innovation and real market demand, or is it simply the result of investor frenzy and easy capital? The echoes of the dot-com bubble are unmistakable, but the AI sector’s underlying technological advances and real-world adoption add a new twist.

- Are these AI startup valuation jumps sustainable?

- Is the market rewarding true breakthroughs, or just chasing the next big thing?

- Will the “AI gold rush” end in a pop, a fizz, or a lasting fire?

As you watch the headlines and the numbers, one thing is clear: the trajectory of AI startup valuations in 2025 is rewriting the playbook for tech investment—and challenging everyone to separate the hype from the hope.

The Funding Frenzy: How (and Why) AI Companies Are Raising at Warp Speed

If you’ve been following the AI startup funding rounds of 2025, you’ve probably noticed a new kind of arms race. Startups are raising capital at a pace that feels almost unreal—sometimes closing three rounds in a single year. The question is: why are they moving so fast, and what does this mean for the future of the industry?

Insider Strategies: ‘Salting the Earth’ for Competitors

One of the most talked-about venture capital strategies in AI right now is using rapid-fire fundraising to “salt the earth” for competitors. As Max Altman puts it:

“By raising vast amounts of capital, these companies can essentially salt the earth for their competitors, making it more difficult for them to compete.”

This tactic isn’t just about grabbing headlines or chasing hype. It’s about building a war chest so large that new entrants can’t keep up. Stripe is a classic example—by securing massive early funding, they created an empire that was nearly impossible to challenge. In the AI world, companies like Harvey and Data Bricks reportedly raised three rounds in 2025 alone, using their capital to expand infrastructure, improve models, and meet surging demand.

FOMO in VC Slack Channels: The Pressure to Move Fast

Imagine the FOMO (fear of missing out) in venture capital Slack channels. Every day, investors see another AI startup announce a new round, each at a higher valuation. The pressure to get in early and not miss the next big thing is intense. This high-velocity AI market dynamic is leading to a cycle where speed is everything—and hesitation can mean losing out on the next unicorn.

Three Rounds in a Year: Chasing Opportunity or Hype?

Some startups are raising capital at a breakneck pace. Harvey and Data Bricks are just two examples of companies that closed three funding rounds in 2025. Is this a sign of their inherent strength and potential, or is it simply a unique business opportunity driven by the AI revolution? In reality, it’s often a mix of both. The market is moving so quickly that startups feel compelled to raise now, while investor appetite is at its peak.

Cap Table Gymnastics: The Hidden Cost of Rapid Fundraising

But there’s a catch. Raising multiple rounds in quick succession can lead to serious dilution for founders and early investors. This “cap table gymnastics” can complicate ownership structures and make it harder to manage the company in the long term. As Jennifer Lee, general partner at Andreessen Horowitz, warns, “These back-to-back fundraisings can either go right or wrong.” They work when the capital directly fuels product-market fit and execution, but can become a dangerous liability if not managed carefully.

Comparing Cycles: ZIRP Era vs. Today’s AI Boom

It’s tempting to compare today’s frenzy to the zero interest rate policy (ZIRP) era of 2021, when startups like cybersecurity firm Wiz saw valuations jump from $1.7 billion to $6 billion in just five months. But the dynamics are different now. Back then, the AI landscape was still emerging—ChatGPT hadn’t launched, and the market wasn’t as mature. Now, the stakes are higher, the competition fiercer, and the capital pools even deeper.

Risks and Sustainability: When the Music Stops

Perhaps the biggest risk in this environment is that some startups will end up with unsustainable burn rates. When capital is easy, it’s tempting to spend fast. But if the market shifts and funding dries up, these companies may find themselves in trouble. Early investors stand to gain the most if things go well—but they also risk losing the most if the bubble bursts.

Beneath the Hype: The Search for Real AI Startup Success Factors in 2025

In 2025, the AI startup world is buzzing with stories of rapid growth and eye-popping numbers. But as you look beneath the surface, it’s clear that not all that glitters is unicorn dust. The surge in annual recurring revenue in AI startups is impressive, but the sustainability of these numbers is under growing scrutiny. As you navigate this landscape, it’s crucial to separate genuine AI startup success factors 2025 from the hype-driven growth traps that can threaten even the brightest ventures.

ARR Surges: Impressive, but Are They Sustainable?

Let’s look at some headline-grabbing examples:

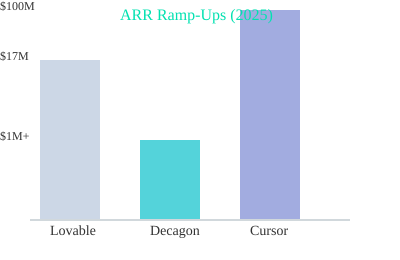

- Lovable: This vibe coding startup went from $0 to $17 million in ARR in just three months.

- Decagon: A conversational AI startup, Decagon reached seven figures in ARR within its first six months.

- Cursor: Perhaps the most dramatic, Cursor—a developer-focused AI coding tool—rocketed from zero to $100 million in ARR in only one year.

These numbers are breathtaking, and they’ve fueled a valuation frenzy. But you have to ask: is this rapid AI startup revenue run-rate truly sustainable, or is it a product of the current AI hype cycle?

Velocity and Volatility: The Double-Edged Sword

According to Aidan Sanket, founder and managing partner at Felice’s Ventures, the current market is moving at breakneck speed. “The costs of being wrong are higher than ever,” he notes. This high-velocity environment means that startups can raise back-to-back funding rounds in record time. But as Jennifer Lee, general partner at Andreessen Horowitz, points out, this can go either way:

“They go right when the capital directly fuels product market fit and execution.”

When new funding is used to expand infrastructure, improve AI models, or meet outsized demand, it can accelerate genuine growth. But when the focus shifts from building to constant fundraising, the foundation of the business can become dangerously shaky.

Foundations Matter: Building vs. Just Fundraising

One of the most overlooked AI startup success factors 2025 is the strength of your foundation. If you prioritize fundraising over building, you risk repeating the mistakes of 2021’s fallen darlings like Joker, OpenSea, and Cerebral. These companies soared on hype and high valuations, only to see their fortunes reverse when public markets recalibrated expectations. Chime and Klarna, for example, both saw their valuations slashed after their IPOs.

Unconventional Risks: Talent Retention and Burn Rates

Another hidden risk in this environment is talent retention. Wild valuation swings can threaten employee equity, making it harder to keep top talent on board. When valuations drop, employee options can lose their value overnight, undermining morale and stability. At the same time, excessive fundraising can lead to unsustainable burn rates. If capital dries up, these startups may find themselves unable to cut costs fast enough to survive—a classic AI startup growth trap.

Comparing ARR Ramp-Ups: Lovable, Decagon, Cursor

As you can see, the ARR ramp-ups of Lovable, Decagon, and Cursor are remarkable. But remember, real success in AI startups comes from strong foundations, not just fast numbers. The true AI startup option value lies in building something that lasts beyond the hype.

Table 1: Comparing AI Startup Funding Rounds and Valuations 2024-2025

If you want to understand the current landscape of AI startup funding rounds and the wild ride of valuations, there’s no better way than a side-by-side look at the numbers. The comparative analysis of AI startups in 2021 vs 2025 reveals a market where momentum often matters more than fundamentals, and where some companies leapfrog from one funding round to the next in a matter of months. In 2025, the kitchen table moment—when founders toast a new nine-figure round—has become almost routine for the industry’s pace-setters.

Concrete Numbers: Multi-Round Valuation Jumps

Let’s start with the headline-makers. Anthropic closed a $3.5 billion Series A in March 2025, which valued the company at $6.5 billion. Fast forward just six months to September, and they announced a staggering $13 billion Series F round, pushing their valuation to $18.3 billion. That’s a massive increase in a short period, and it’s not unique.

OpenAI, the company that ignited the current AI boom with ChatGPT, continues to set the pace. In October 2024, OpenAI’s valuation stood at $17.5 billion. By March 2025, it had jumped to $30 billion, and later in 2025, a tender offer valued the company at an unprecedented $50 billion.

Further down the AI food chain, but still commanding attention, Mercer—a recruitment startup—raised a $100 million Series B in February 2025 at a $2 billion valuation. By October, they had secured another $350 million, catapulting their valuation to $10 billion. That’s a 5X increase in just eight months.

Table: Contrasting Growth Trajectories Across Leading Companies

| Company | Funding Rounds (2024-2025) | Valuation (2024-2025) |

|---|---|---|

| OpenAI |

Oct 2024: – Mar 2025: – 2025: Tender Offer |

$17.5B (Oct 2024) $30B (Mar 2025) $50B (2025) |

| Anthropic |

Mar 2025: Series A ($3.5B) Sep 2025: Series F ($13B) |

$6.5B (Mar 2025) $18.3B (Sep 2025) |

| Mercer |

Feb 2025: Series B ($100M) Oct 2025: Series C ($350M) |

$2B (Feb 2025) $10B (Oct 2025) |

| Cognition | 2025: – | $10.2B (2025) |

| Replit | 2025: – | $3B (2025) |

‘Kitchen Table’ Moments and the Reality Behind the Numbers

It’s not just the mega-rounds that define the emerging AI companies of 2025. The perception of momentum is often enough to attract multiple rounds of funding within a single year. As one industry observer put it:

“Startups raised two or more funding rounds this year, each with escalating valuations.”

This table shows that there’s no single template for success in the AI space. Some companies skyrocket, others fizzle, and a few—like Shine, recently acquired by Cegid—find their exit through acquisition rather than continued fundraising. The comparative analysis of AI startups from 2021 to 2025 makes one thing clear: valuations don’t always track with market fundamentals, and different companies scale at wildly different speeds.

Chart 1: From Startup to Titan – The OpenAI and Anthropic Valuation Race

If you want to understand the AI startup valuation jumps of 2025, look no further than the meteoric rise of OpenAI and Anthropic. This chart doesn’t just show numbers—it tells the story of how two companies are racing up the valuation ladder, sometimes leapfrogging each other in ways that would have seemed impossible just a year ago.

Visual Race: How Fast Can a Startup Become a Titan?

Picture the chart: On one axis, you have time—just a handful of months. On the other, you have valuation—soaring from millions to billions. The lines for OpenAI and Anthropic don’t just climb; they rocket upward, sometimes doubling in a matter of months. This is the essence of OpenAI valuation growth analysis and Anthropic funding rounds 2024 2025—a visual race where both companies are sprinting at record speeds.

- Anthropic: $6.5 billion (March 2025) → $18.3 billion (September 2025)

- OpenAI: $17.5 billion (October 2024) → $30 billion (March 2025) → $50 billion (2025)

In just six months, Anthropic’s valuation nearly tripled. OpenAI, meanwhile, added $32.5 billion to its valuation in a single year. The chart makes sense of the headlines: “valuations doubled in months” is not an exaggeration—it’s the reality of the current AI startup landscape.

Surprise Element: Anthropic’s Dramatic, Under-the-Radar Gains

OpenAI gets the headlines, but Anthropic’s growth is the real surprise. While OpenAI’s $50 billion valuation made waves, Anthropic quietly pulled off one of the fastest valuation jumps in startup history. From $6.5 billion in March 2025 to $18.3 billion by September, Anthropic’s month-over-month growth outpaced even OpenAI’s.

This is the kind of AI startup valuation jump that makes investors and founders alike sit up and take notice. Anthropic’s Series A round in March 2025 brought in $3.5 billion and set the stage for a $13 billion Series F just six months later. The company’s valuation nearly tripled in half a year—a pace that’s almost unheard of, even in the frothy world of AI.

OpenAI: The Headline Titan

OpenAI, of course, remains the biggest name in the game. The launch of ChatGPT kicked off the current AI boom, and OpenAI’s valuation reflects its status as the market leader. In October 2024, OpenAI was valued at $17.5 billion. By March 2025, that number had jumped to $30 billion. And in a recent tender offer, OpenAI’s valuation soared to an unprecedented $50 billion.

This kind of OpenAI valuation growth analysis shows just how quickly expectations, hype, and real business traction can translate into jaw-dropping numbers. OpenAI’s climb is steady, headline-grabbing, and relentless.

Tangential Note: What If the Tortoise Is Sprinting, Too?

The classic story says the tortoise wins by slow and steady progress. But in this race, both the tortoise and the hare are sprinting. Anthropic, often seen as the quieter competitor, is actually moving at a breakneck pace. The chart shows that in the world of AI, even the “slow” movers are breaking records.

In summary, this chart is your front-row seat to the wildest valuation race in tech today. OpenAI and Anthropic are not just growing—they’re redefining what’s possible for AI startups.

Table 2: Annual Recurring Revenue (ARR) Rockets – Who’s Really Winning?

If you’ve been tracking the annual recurring revenue in AI startups, you know the numbers are getting wild. In the past, reaching $10 million in ARR was a milestone that took years. Now, some AI companies are blasting past that in mere months. But what do these headline-grabbing numbers really mean for the future of mission-critical AI work? Let’s break down the most talked-about ARR rockets and ask: is this runaway growth a sign of real business success, or just a mirage?

ARR Rockets: The Fastest Climbers in AI Startup Revenue Run-Rate

| Startup | ARR Growth | Time to ARR |

|---|---|---|

| Lovable | $0 → $17M | 3 months |

| Decagon | 7 figures (>$1M) | 6 months |

| Cursor | $0 → $100M | 1 year |

Let’s look at these numbers side by side. Lovable, a vibe coding startup, shot from zero to $17 million in ARR in just three months. Decagon, focused on conversational AI, crossed the seven-figure ARR mark within six months of launch. Then there’s Cursor, the developer-focused AI coding assistant, which is perhaps the most jaw-dropping example: zero to $100 million in ARR in a single year.

Spotlight: Ultra-Fast ARR Creation (Months vs. Years)

Traditional SaaS companies often take several years to reach these revenue milestones. In contrast, these AI startups are achieving similar numbers in a fraction of the time. This AI coding assistant growth is unprecedented, and it’s raising eyebrows across the tech and investment landscape.

- Speed: Months, not years, to reach multi-million ARR.

- Visibility: Investors and the media are watching these numbers closely.

- Pressure: Founders are under intense scrutiny to maintain momentum.

Runaway ARR: Real Success or a Mirage?

Here’s the big question: does a record-fast ARR run-rate mean a company is truly winning? Or could these numbers be hiding deeper problems? Rapid revenue growth can sometimes disguise underlying financial sustainability issues. For example, if a startup is burning through cash to acquire customers at any cost, that ARR might not be sustainable.

“Record-fast revenue booms may disguise underlying financial sustainability issues.”

Let’s test this with a hypothetical scenario. Imagine a startup spends $50 million on viral marketing, rockets to $10 million in ARR, but is losing $40 million per year. Is that a win? On paper, the ARR looks impressive. But if the company can’t control its burn rate, it could be heading for trouble.

What’s Worth Celebrating?

The debate is on: should we celebrate ARR built at lightning speed if it isn’t sustainable? Founders chasing rapid growth may face tough challenges if their expenses outpace their revenue. For mission-critical AI work, long-term viability matters as much as short-term wins.

- Is ultra-fast ARR growth a sign of product-market fit, or just aggressive spending?

- How can you tell if an AI startup’s revenue run-rate is built to last?

- What happens when the hype fades and investors demand profitability?

As you watch these ARR rockets, keep asking: who’s really winning—and how long can it last?

Bubble, Boom, or Both? Risks and Reality Checks in 2025’s AI Market

The AI startup landscape in 2025 is moving at breakneck speed. Deals are closing rapidly, and venture capital is pouring in. But as you navigate this high-stakes environment, it’s crucial to ask: Are we in the midst of a genuine boom, a speculative bubble, or a confusing mix of both? Let’s unpack the risks of the AI funding boom and the reality checks investors and founders need right now.

Speculative Bubble? Dissenting Voices and the Lure of 'Option Value'

Even the most bullish investors admit that not every AI startup will become the next OpenAI or Anthropic. As Bay-Egel of Bison Ventures warns, there’s a dangerous tendency to believe every new AI model company is destined for greatness. This mindset leads to sky-high valuations based on “option value”—the hope that a tiny chance of massive success justifies big bets. But history shows that most companies won’t grow into these valuations, resulting in significant AI startup losses for investors.

Talent Crunch: The Employee Equity Dilemma

One of the overlooked risks of the AI funding boom is the impact on talent. Employees are often granted equity at peak valuations. If public markets turn south or a startup’s value drops, workers can be left with underwater options or worthless shares. This not only hurts morale but also makes it harder to attract and retain top talent. The lesson from recent cycles: when valuations fall, it’s often employees who feel the pain first.

Risk Wild Card: Unsustainable Burn Rates

Many AI startups are spending aggressively to capture market share, but this comes with a hidden cost. Unsustainable burn rates can force companies into layoffs, down rounds, and even shutdowns. If revenue growth doesn’t keep pace with spending, the fallout can be swift and severe. This is a key concern for anyone tracking sustainability of AI startup growth and the speculative bubble in AI investments.

Lessons from 2021: Chime, Klarna, and OpenSea

If you’re wondering how this cycle might end, look back to 2021. Fintech and crypto darlings like Chime, Klarna, and OpenSea soared to eye-watering valuations, only to see them slashed in later funding rounds or post-IPO. These cautionary tales remind us that AI venture capital trends can turn quickly—and that today’s unicorn can become tomorrow’s lesson in over-optimism.

Capital Concentration: The VC Focus on a Few Darlings

Venture capital’s “flight to quality” is more pronounced than ever. Investors are concentrating their bets on a handful of perceived winners, driving their valuations even higher. As Ben Braverman puts it,

'Venture capital has always been about the power law, that big winners keep winning big...'But this dynamic leaves most startups fighting for scraps, and many are unlikely to ever justify their lofty price tags.

Key Question: Cautionary Tales or the Next OpenAI?

With OpenAI’s valuation reportedly rising by nearly $2.9 billion per month from October 2024 to October 2025, the stakes have never been higher. But the key question remains: Are most AI entrants destined to become cautionary tales, or could one of them truly become the next breakout success? In this environment, rigorous due diligence and a clear-eyed view of AI startup losses and sustainability are more important than ever.

FAQ: Your Burning Questions About AI Startup Valuations in 2025, Answered

What’s driving the AI startup valuation boom in 2025?

You’re seeing AI startup valuations in 2025 reach record highs, and the reasons are both simple and complex. At the core, there’s a real technological revolution underway—AI models are rapidly improving, and their commercial applications are expanding across nearly every industry. This has created genuine demand for AI solutions, drawing in customers and driving revenue growth at a pace rarely seen before. At the same time, the venture capital landscape has shifted. Investors, eager not to miss the next OpenAI or Anthropic, are pouring money into promising startups, often at higher and higher valuations. The result is a feedback loop: as more capital flows in, valuations rise, which in turn attracts even more capital. This dynamic is further fueled by the “winner-takes-most” mentality, where a few standout companies capture the lion’s share of funding and attention.

Is this a bubble—will it pop?

Many are asking if the current surge in AI startup valuations is sustainable or if we’re witnessing a bubble that’s bound to burst. The answer isn’t simple. Unlike the 2021 ZIRP era, where hype often outpaced substance, many of today’s AI startups are showing real revenue growth and product traction. However, the pace and scale of investment are so intense that risks are building. If the market cools or if AI startups can’t maintain their growth, valuations could fall sharply. While some companies are likely to become enduring giants, others may struggle to justify their sky-high valuations, leading to corrections or failures. The sustainability of AI startup growth will depend on whether these companies can turn early momentum into lasting business models.

Which AI companies have the fastest revenue growth?

Several AI startups are posting astonishing revenue numbers. For example, Lovable, a “vibe coding” startup, hit $17 million in annual recurring revenue (ARR) within just three months of launch. Decagon, focused on conversational AI, reached seven-figure ARR in six months. Cursor, which builds developer tools, went from zero to $100 million in ARR in a single year. These numbers are not just impressive—they’re nearly unprecedented, even compared to the fastest-growing tech companies of the past decade. This rapid growth is a key reason why investors are willing to pay such high prices for equity in these startups.

Can you give examples of valuation jumps in a year?

Absolutely. The most striking example is Anthropic, which soared from a $6.5 billion valuation in March 2025 to $18.3 billion by September—just six months later. Mercer, an AI recruitment startup, jumped from $2 billion to $10 billion in eight months. Even smaller players like Cursor, Reflection AI, and Lyla Sciences have seen their valuations multiply several times within a single year. These leaps are driven by both rapid revenue gains and the intense competition among investors to back the next big AI winner.

How do rapid funding rounds impact founders and employees?

While big funding rounds can provide resources for growth, they also bring challenges. Founders may face pressure to scale faster than is sustainable, and employees might see their equity diluted with each new round. If a company’s valuation later drops, employee stock options could become worthless, hurting morale and retention. Rapid fundraising can also distract from building strong products and teams, increasing the risk of future setbacks.

What’s the biggest risk no one is talking about?

One subtle but serious risk is the temptation for startups to burn cash too quickly. With so much capital available, some companies ramp up spending on hiring, marketing, and infrastructure before their business models are proven. If the funding environment tightens or growth slows, these startups could face layoffs or even collapse. The concentration of capital in a few “AI darlings” also means that many promising companies may be overlooked, stifling broader innovation. As you watch the AI venture capital trends unfold, it’s clear that while the opportunities are enormous, so are the risks—and the story of AI startup valuations in 2025 is still being written.

TL;DR: AI startup valuations are skyrocketing in 2025, with huge funding rounds and rapid-fire growth driving both opportunity and risk. While some companies, like Anthropic and OpenAI, show signs of real traction, the speed and scale of investment may be setting the stage for a dramatic shake-up. Buckle up—this market could pop, fizz, or ignite the next tech revolution.

Post a Comment