Ever notice how the most exciting financial stories are the ones nobody wants to copy? I sure have. Growing up, I assumed rich people had wild secrets, fast cars, and scandalous adventures. But here’s my confession: true wealth actually starts with what most folks find incredibly boring—steady habits, awkward conversations about money, and the nerve to risk public embarrassment once in a while. Let me take you through the less glamorous, but far more reliable path to economic freedom, with a few unexpected twists along the way.

Section 1: The Rebellion Against Excitement—Why Boring Wins Wealth

Let’s be honest: it’s the boring that makes you rich (0:00–0:02). If you’re searching for the secret to wealth building, you might be surprised to learn that it’s not about chasing the next big thing or making flashy moves. Instead, financial literacy and steady saving techniques are your real allies. The most unbelievable way to generate wealth and long-term economic security is through habits so unglamorous, most people overlook them (0:04–0:09).

Why Consistency Beats Excitement

You might hear stories of overnight millionaires or viral investment wins, but these are the exception, not the rule. Research shows that consistent investment and discipline—rather than luck—are the primary drivers of lasting wealth. Scott Galloway, a leading voice in business and finance, puts it simply:

"It's the boring that makes you rich." – Scott Galloway

He learned this lesson the hard way, losing fortunes twice before embracing the power of routine and discipline.

Boring Habits That Build Wealth

- Investing regularly: Setting aside a fixed amount each month, no matter what the market is doing, leverages the power of compound interest—where your money earns interest on both the principal and the accumulated interest over time.

- Controlling spending: The uncomfortable truth? 98% of people spend everything they get their hands on (0:47–0:50). Developing the discipline to save instead of spend is rare, but it’s a powerful advantage.

- Tracking finances: Keeping a close eye on your income, expenses, and investments ensures you stay on course, even when it feels tedious.

The Power of Inertia and Small Wins

It’s easy to underestimate the impact of small, regular actions. The power of inertia means that once you set up automatic investments or savings, you’re more likely to stick with them. Over time, these small wins add up in ways that are almost invisible at first—but become explosive as the years go by.

Risk-Taking vs. Routine: When to Lean In

In your 20s, your biggest advantages are flexibility and time (0:29–0:32). This is the stage to take calculated risks, explore your talents, and even pursue ownership opportunities. But as you age, the scales tip. Routine, discipline, and consistent saving techniques become the real drivers of wealth building. As Galloway advises, if you’re not young, focus on what you can control—especially your spending (0:44–0:47).

Flash-in-the-Pan Riches vs. Lifelong Accumulation

There’s no shortage of stories about people who struck it rich overnight. But research indicates that these stories are rare and often unsustainable. The vast majority of wealthy individuals built their fortunes through decades of steady, disciplined investing. Starting with small, manageable investments leads to long-term results—thanks to the exponential growth of compound interest.

How Compound Interest Changes the Game

Let’s look at the numbers. Imagine you start investing $1,000 every month at age 25 and continue for 40 years, until you’re 65. By the time you retire, the steady growth from compound interest will have outperformed waiting for a larger sum to invest later. The earlier you start, the more time your investments have to compound, creating a snowball effect that’s hard to match with sporadic, high-risk bets.

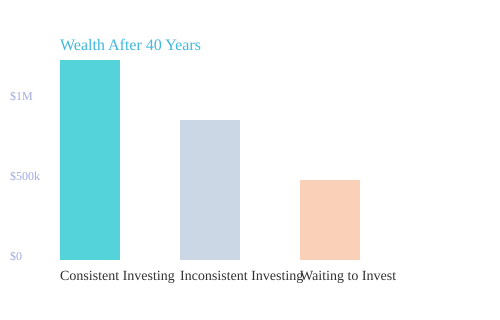

The chart above highlights how 40 years of consistent investing outpaces both inconsistent investing and waiting to invest. The difference isn’t just a few thousand dollars—it can mean hundreds of thousands, or even millions, more in your retirement account.

Ultimately, the rebellion against excitement is about embracing the unglamorous routines that drive real wealth. If you can develop the patience and discipline most people lack, you’ll find yourself far ahead in the wealth-building race.

Section 2: Compound Interest—the Quiet Juggernaut

When it comes to building real wealth, nothing works quite like compound interest. It’s the quiet juggernaut of investment growth—steady, relentless, and surprisingly powerful over time. If you’ve ever heard the phrase “money makes money,” that’s compounding in action. But what does it really mean for your long-term investments, and why does it matter whether you start at 25 or 40? Let’s break it down in simple terms and see why patience and consistency can lead to explosive, higher returns.

Compounding: Money Earning More Money, Snowball Style

Imagine you’re rolling a small snowball down a hill. At first, it grows slowly. But as it picks up more snow, it gets bigger—and the bigger it gets, the faster it grows. Compound interest works the same way. You earn interest not just on your original investment, but also on the interest that money has already earned. Over time, this creates a snowball effect, leading to exponential growth instead of just linear gains.

Visualizing Compound Growth: The Bucket of Sand Analogy

To help visualize this, think of a bucket of sand (0.58-1.02). Each grain represents a small deposit or a bit of interest earned. If you add a handful every month, the bucket fills slowly at first. But as the pile grows, each new handful lands on top of more sand, and the bucket fills faster and faster. This is what happens when you invest consistently and let your returns compound. The magic doesn’t happen overnight, but it becomes undeniable over decades.

Time Is Your Greatest Ally—Start as Early as Possible

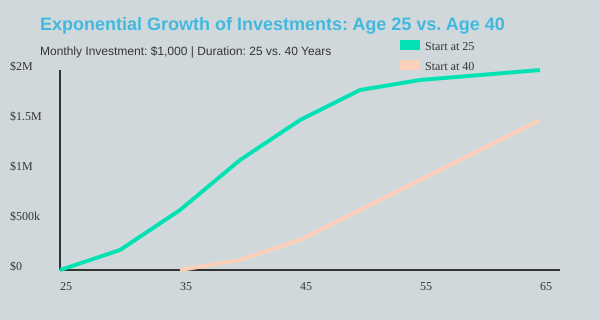

Here’s where the real power of compound interest comes in: time. Research shows that starting early gives your investments more time to grow, leading to much higher returns in the long run. For example, if you start investing $1,000 a month at age 25 and keep it up for 40 years, by age 65 the growth is massive (1.04-1.13). The longer your money has to compound, the more dramatic the results.

Late Starters: It’s Never Too Late to Turn the Tide

But what if you’re not 25? Maybe you’re in your 40s and just starting to think about long-term investments. It’s easy to feel like you’ve missed the boat, but studies indicate that even late starters can benefit from compound interest. The key is to start now, no matter your age. Consistent investing—even if you begin later—still leads to meaningful growth over time. The exponential nature of compounding means that patience pays off, and the magic happens slowly, then suddenly.

Myth-Busting: “I Don’t Have Enough to Start” and “It’s Too Late”

One of the most common myths about investing is that you need a huge sum to get started. In reality, waiting until you have £1 million before investing is far less effective than starting with just £500 (1.16-1.23). As Scott Galloway puts it:

“The way you get a million pounds is by investing that 500.”

Even small, regular contributions can snowball into significant wealth, thanks to the power of compounding. Don’t let the idea that “it’s too late” or “I don’t have enough” hold you back. The most important step is to begin, no matter how modest the amount.

Exponential Growth: The Patience Payoff

Compound interest doesn’t deliver overnight riches. The early years can feel slow, but stick with it. Over decades, the growth curve steepens—what once seemed like small gains suddenly accelerates, leading to much higher returns than you’d expect from simple interest. This exponential growth is why long-term investments are so effective at building wealth and why financial literacy around compounding is crucial for anyone planning for retirement or future financial security.

Chart: Exponential Investment Growth—Starting at 25 vs. 40

This chart shows how starting early with compound interest leads to much higher returns, but even a later start can still yield impressive results. The earlier you begin, the more dramatic the exponential growth of your long-term investments.

Section 3: The Honesty Deficit—Why We Don’t Talk About Money (and Why You Should)

When it comes to financial literacy and wealth building, the biggest obstacle might not be your income or your spending habits—it’s the silence surrounding money. If you’ve ever felt awkward talking about your salary, your debts, or even your financial goals, you’re not alone. There’s a powerful cultural taboo at play, and it’s holding many people back from true financial empowerment (2.39-2.44).

Cultural Taboos: Why Money Talk Feels Off-Limits

From a young age, most of us are taught that discussing money is impolite, even vulgar. It’s right up there with politics and religion—topics you’re supposed to avoid at the dinner table. But why? The truth is, this silence serves those in power. As Scott Galloway points out,

'Rich people talk about money and it’s considered taboo for employees, middle class, and women.'(3.27-3.37). The wealthy and powerful benefit from open financial conversations, while the rest are told to keep quiet.

How Financial Ignorance Helps Bosses—And Hurts You

In most organizations, there’s a clear asymmetry of information. Your boss knows what everyone earns, but employees are discouraged from sharing salary details. Why? Because if you found out that a colleague is making 30% more for the same work, you’d probably demand change (3.42-3.56). This lack of transparency keeps wages down and power concentrated at the top. Research shows that transparency unlocks collective bargaining power and helps individuals make smarter moves in their careers and finances.

| Scenario | Impact |

|---|---|

| One employee making 30% more than another for same work | Hidden without transparency; leads to wage inequality |

| Employees discouraged from talking about salary/compensation | Keeps workers in the dark, limits negotiation power |

Honest Conversations: The Secret Weapon for Financial Literacy

Think about it: Roger Federer talks about tennis to get better. If you want to be good at money, you need to talk about it too (4.11-4.19). Honest conversations about finances—whether it’s sharing your salary, discussing investment strategies, or admitting to financial missteps—are crucial for building financial literacy. When you break the silence, you open yourself up to learning, support, and smarter decision-making. Studies indicate that breaking the money silence can foster smarter decisions and stronger community support.

Breaking Barriers: Sharing Money Stories with Friends and Family

It’s not just about the workplace. Many people avoid talking about mortgages, debts, or financial failures with friends and family. But sharing these stories can break down barriers and help everyone make better choices. When you talk openly about money, you normalize the conversation, reduce shame, and create opportunities for collective problem-solving. This is especially important in relationships and finance, where hidden financial stress can erode trust and stability.

Gender Dynamics: Who Gets to Talk About Money?

There’s also a gendered aspect to the money taboo. Men are often taught to be secretive about their earnings, while women are excluded from financial conversations altogether. This dynamic perpetuates inequality, both at home and in the workplace. Financial transparency isn’t just about numbers—it’s about empowerment and inclusion.

Financial Transparency as Radical Self-Care

Ultimately, breaking the silence around money is a form of radical self-care. When you’re honest about your finances, you take control of your own narrative. You give yourself—and others—the tools to build real wealth and security. The culture around discussing money needs to shift for true financial empowerment. Start small: ask a friend about their budgeting tips, or share your own financial wins and losses. Every honest conversation chips away at the honesty deficit and brings you closer to financial freedom.

Section 4: Accidental Lessons—The Role of Luck, Privilege, and Serendipity

When it comes to wealth building and financial literacy, it’s tempting to believe that hard work and smart decisions are all you need. But if you look closer, you’ll see that luck, privilege, and serendipity play a much bigger role than most people want to admit. Sometimes, who gets the first money lesson—or even the chance to start investing early—comes down to being in the right place, at the right time, with the right people.

Luck: The Unseen Force in Financial Journeys

Let’s be honest: luck often decides who gets the head start. As Scott Galloway bluntly put it,

"The smartest thing I ever did was being born a white heterosexual male in California in the 60s."

(5.36-5.41)

This wasn’t just a throwaway line. Back then, being born into that demographic meant access to opportunities that were out of reach for most. For example, the University of California had a 76% admissions rate in the 1960s and 70s. Today, it’s just 9%. That’s a dramatic shift, and it shows how timing and background can quietly shape your financial path before you even realize it (5.47-5.53).

| Year/Period | UCLA Admissions Rate | Financial Milestone |

|---|---|---|

| 1960s/70s | 76% | Access to affordable higher education |

| Recent Years | 9% | Much more competitive, limited access |

| Age 13 | - | First stock purchased with $200 from a family mentor |

Privilege: The Quiet Advantage

Privilege isn’t always obvious, especially when you’re young. If you grew up surrounded by people who looked like you, had similar backgrounds, and were already “in the room” where financial decisions happened, you might not notice the doors that were quietly opened for you (5.57-6.08). Galloway admits he didn’t realize his unfair advantage until much later. This kind of privilege—race, gender, timing—can create a foundation for long-term investments and wealth building that others may never get.

Environmental Factors: The Other Side of the Coin

Of course, not everyone starts with the same hand. Galloway was also raised by a single immigrant mother, living with economic insecurity (6.15-6.21). If you’ve ever felt like financial stability was a distant dream, you know how that “ghost” of insecurity can follow you around, whispering that you’re not worthy or that you’ll never catch up (6.30-6.36). This environment can shape your drive for economic security, sometimes making it your sole focus for decades (6.39-7.01).

Serendipity: Chance Encounters That Change Everything

Sometimes, a single unexpected moment can change your entire financial life. For Galloway, it was his mother’s boyfriend, Terry—a man with a complicated personal life, but a generous spirit. At age 13, Terry handed him $200 and a challenge: buy a stock, or give the money back (7.04-7.54). That push led to Galloway’s first investment: 14 shares of Columbia Pictures, bought after a young broker took the time to explain the basics (8.03-8.13). For years, Galloway would call the broker from a payphone, learning about the market one conversation at a time (8.18-8.28).

Maximizing Your Luck: Exposure and Openness

Research shows you can’t control luck, but you can maximize your exposure to it. The more rooms you enter, the more people you meet, the more mentors you seek out—the greater your odds of stumbling into the right opportunity. Financial literacy isn’t just about reading books or crunching numbers; it’s about being open to new experiences, asking questions, and letting serendipity work in your favor.

- Seek out diverse rooms and conversations.

- Find mentors who challenge your perspective.

- Be willing to act when opportunity knocks—even if it feels intimidating.

Ultimately, while you can’t choose your starting point, you can choose to stay open, curious, and ready for the next accidental lesson that might propel your wealth journey forward.

Section 5: Embrace the Discomfort—Why Risk and Rejection Belong in Your Wealth Toolbox

If you’re serious about wealth building, there’s one uncomfortable truth you can’t ignore: risk taking and rejection are not just part of the journey—they are the journey. As Scott Galloway puts it,

“Unless you’re willing to take an uncomfortable risk, nothing wonderful is ever going to happen to you.”(9.31-9.34). This isn’t just motivational fluff. It’s a hard-won insight from years of personal setbacks and public failures that, paradoxically, become the launchpad for future success.

Why Wonderful Things Rarely Happen Without Uncomfortable Risks

Think about the biggest leaps in your life. Maybe it was applying for a dream job, starting a business, or even approaching someone you admired. Each of these moments required stepping into discomfort—risking embarrassment, rejection, or outright failure. Most people, research shows, avoid these situations at all costs. In fact, 99% of people let the fear of embarrassment and rejection stop them in their tracks (10.00-11.00). This is where the gap between entrepreneurship vs corporate life becomes obvious: entrepreneurs are rewarded not for playing it safe, but for their willingness to fail in public.

The Power of Public Failure

Public failure is what stops most aspirants. It’s not the risk itself, but the visibility of that risk—the idea that others will see you stumble. Yet, embracing public failure is a superpower. When you’re willing to risk being seen, judged, or even laughed at, you unlock opportunities that others never even attempt. Galloway shares that his own “enormous unlock” came from understanding the finite nature of life (9.51-10.11). Realizing that the opinions of others fade with time, he found the courage to express himself and take uncomfortable risks—whether that meant calling a potential investor, approaching a stranger, or pitching a bold idea.

Salespeople: Masters of Risk and Rejection

If you want a real-world example of risk taking in action, look at salespeople. In any organization, they’re often the most overcompensated because they’re willing to “eat rejection for breakfast” (11.26-11.47). They hear “no” more times in a day than most people do in a year. But that’s exactly why they’re so valuable. Their willingness to endure repeated rejection is directly tied to their outsized rewards—financial, social, and personal. This is a lesson every aspiring entrepreneur should internalize: the bigger your appetite for risk and rejection, the greater your potential upside.

Personal Tales: Losing, Learning, and Leveraging Failure

Galloway’s own story drives this point home. He ran for sophomore, junior, and senior class president—and lost every single time. Most would have given up, but he decided to run for student body president anyway (11.58-12.10). The outcome? Another loss. But the real win was in the confidence and resilience he gained. Each public setback became a springboard, not a stumbling block. This pattern is echoed in countless stories of wealth building: those who succeed are rarely the ones who never fail, but the ones who refuse to let failure define them.

Risk Taking: The Exponential Advantage

Here’s the animating theme: the willingness to endure rejection is directly tied to outsized rewards. When you risk rejection—whether in business, relationships, or personal growth—you open the door to exponential outcomes. Just as compound interest grows wealth by building on itself, so too does risk taking create a snowball effect of opportunities. Each leap, each “no,” each awkward moment is a deposit in your wealth toolbox, compounding over time into something far greater than the sum of its parts.

So, if you’re weighing entrepreneurship vs corporate life, or simply wondering how to accelerate your own wealth building, remember: the discomfort you feel is not a sign to stop. It’s a signal you’re on the right path. Embrace it. Seek it out. And watch as the world opens up in ways you never imagined.

Section 6: Big Lessons and Unexpected Truths—What Sticks for a Lifetime

When you think about wealth building, it’s easy to picture big wins or sudden windfalls. But if you look closer, the real story is much quieter. Financial security is as much about your mindset as it is about your bank balance (6.59-7.01). The habits you build, the risks you’re willing to take, and the lessons you learn from failure—these are the things that stick with you for a lifetime.

Connecting the Dots Backward: Habits Over Goals

It’s tempting to focus on goals—saving a certain amount, reaching a specific net worth, or buying a dream home. But when you look back, you’ll notice that it’s the persistent, boring habits that matter more than any single goal (7.01-7.04). Research shows that the true differentiator in long-term investments is the willingness to commit to these unglamorous routines, year after year. That means setting aside money every month, even when it feels insignificant. It means checking in on your budget, reviewing your portfolio, and resisting the urge to chase the latest trend.

Stories of Relentless Pursuit—and Repeated Failure

Sometimes, the most valuable lessons come from unexpected places. At 13, a simple act of generosity—a $200 gift and a push to buy his first stock—set Scott Galloway on a path to understanding the markets (7.37-8.16). Every weekday, he’d call his broker from a payphone, learning about stocks and the power of compounding. These early experiences weren’t glamorous, but they built a foundation for a lifetime of financial literacy and discipline.

But it wasn’t all smooth sailing. Galloway ran for class president three times and lost every time (12.00-12.13). He tried, failed, and tried again. This humility—this willingness to endure public failure—became a superpower. As he puts it:

"The majority of people aren’t willing to take uncomfortable risks." - Scott Galloway

Reframing Success: Economic Security, Not Just Dollars

Success isn’t just about accumulating money. It’s about building economic security—the kind that lets you weather storms, take risks, and live life on your own terms (6.59-7.01). That security comes from the small, repeated actions that compound over decades. Studies indicate that starting early with saving techniques and harnessing the power of compound interest can lead to exponential growth, even if your initial investments are small. The earlier you start, the more time your money has to grow, and the more you benefit from that snowball effect.

Invent Your Own Wealth Definition

It’s easy to get caught up chasing someone else’s script—comparing your journey to others, or measuring success by someone else’s standards. But real wealth is personal. It’s about defining what matters most to you and building habits that support that vision. Maybe your version of wealth is about freedom, security, or the ability to help others. Whatever it is, don’t be afraid to make it your own.

The Wild Card: Embracing the Boring

Here’s a truth that doesn’t get enough attention: sometimes, the biggest challenge in wealth building is being willing to do the boring stuff. Most people regret not starting earlier or not making bigger, bolder moves. But the reality is, wealth is often about repeated, boring actions done consistently. It’s about being okay with routines that aren’t flashy, but that work. As research shows, those who stick to their plan—who invest for 40 years, who save a little every month—end up with the greatest rewards.

So, what really drives long-range wealth? Mindset and consistency, above all. It’s not about genius or luck. It’s about showing up, day after day, and letting the power of time and discipline do the heavy lifting.

FAQs: Turning Confusion into Clarity

Building wealth can feel mysterious, intimidating, or even out of reach—especially if you’re just starting out or feel behind. But as Scott Galloway’s approach shows, the path to financial security is far more straightforward than most realize. Let’s tackle some of the most common questions that hold people back, using clear, actionable insights grounded in financial literacy and the proven power of compound interest.

Is it Ever Too Late to Start Investing for Wealth?

Absolutely not. One of the biggest myths in personal finance is that if you haven’t started investing by your twenties, you’ve missed your chance. In reality, you can begin building wealth at any age. Scott Galloway emphasizes that even if you’re in your forties or fifties, you likely have decades ahead to benefit from investment growth. The key is to start now, automate your savings, and let compound interest work its magic over time. Research shows that even small, consistent investments can snowball into significant wealth, especially when you give them time to grow.

How Does Compound Interest Actually Work Day-to-Day?

Compound interest is the silent engine behind most wealth accumulation. It means you earn interest not just on your original investment, but also on the interest that investment has already earned. Day-to-day, this looks like your savings or investments growing a little more each month—not just from what you put in, but from what’s already there. Over years, this creates a snowball effect. For example, investing £1,000 a month in a broad index fund can, over decades, multiply into a life-changing sum. The earlier you start, the more dramatic the results, but the principle works at any age.

What if I Don’t Have Much Money to Invest?

This is a common concern, but it’s not a barrier. Scott Galloway is clear: you don’t need a fortune to start. Even £500 invested early can grow exponentially thanks to compound interest. The most important step is to begin—no matter how small the amount. Use “force savings” tactics like automatic transfers to investment accounts or employer pension plans. Over time, as your income grows, increase your contributions. Consistency and discipline matter far more than the starting sum.

Why Do People Avoid Talking About Their Finances?

Money remains a taboo subject for many, especially outside wealthy circles. This silence breeds confusion and keeps financial literacy low. Galloway points out that open conversations about money—whether with friends, partners, or a trusted “kitchen cabinet” of advisors—are crucial for breaking down barriers and learning the real steps to wealth. The more you talk about finances, the more comfortable and informed you become.

How Do I Find Reliable Financial Mentors or Information?

Mentorship doesn’t have to be formal. Start by asking specific, targeted questions to people you admire or trust. Look for those who have achieved what you hope to achieve, and be persistent but respectful in seeking advice. Reliable information is also widely available through books, podcasts, and reputable financial websites. The key is to filter out noise and focus on proven, boring strategies—like index fund investing and disciplined saving—that have stood the test of time.

What’s More Important: Luck or Discipline?

Luck plays a role in every success story, but discipline is what you control. Galloway’s own journey includes moments of luck, but his wealth came from consistent, sometimes “boring” habits: saving, investing, diversifying, and living below his means. Research indicates that while you can’t manufacture luck, you can absolutely build discipline—and that’s what drives long-term investment growth.

How Do I Get Over the Fear of Failure in Investments or Business?

Fear is natural, especially when money is on the line. The antidote is education and small, calculated risks. Start with manageable investments, diversify your assets, and set clear boundaries for how much you’re willing to risk. Remember, even the most successful investors and entrepreneurs have faced setbacks. The difference is that they learned, adapted, and kept going. Financial literacy empowers you to make informed decisions and bounce back from mistakes.

In the end, the path to wealth isn’t glamorous or mysterious—it’s about mastering simple habits, embracing transparency, and letting compound interest do the heavy lifting. Start small, stay consistent, and keep learning. That’s how confusion turns into clarity—and clarity into wealth.

TL;DR: Dull habits, honest conversations, and a willingness to risk rejection are the real engines of wealth. Compound interest is magic, starting early is gold, and luck might play a role—but habits are what keep wealth around. Don’t let fear of boredom or embarrassment stop you from getting rich on your own terms.

Hats off to The Diary Of A CEO for their incredibly insightful content! Be sure to check it out here: https://youtu.be/rKOx5qlLyaA?si=ypEFOGdotXo6acpc.

Post a Comment