If you’ve ever rolled your eyes at another YouTube video preaching 'work harder' as the only way to get rich, you’re not alone. As someone who’s spent years juggling multiple businesses—with wins, losses, and a few embarrassing faceplants—I’m here to tell you: getting wealthy isn’t about grinding yourself into dust. Instead, it’s about asking bolder, even 'lazy' questions: What’s the smartest route with the best payoff for your effort? In 2025, with crazy market shifts and tech at our fingertips, it’s time to ditch the outdated hustle mindset and put some real strategy behind your wealth-building dreams. Let’s get a little unconventional…

1. The Problem with Hustle: Is Working Harder Really the Golden Ticket?

If you’ve ever felt like you’re not doing enough because you’re not working 60 or 70 hours a week, you’re not alone. The world loves to glorify “grind culture.” We see it everywhere: social media posts about 4 a.m. wake-ups, endless side hustles, and the idea that if you just work harder, you’ll eventually strike gold. But is this really the best Wealth Building Strategy for 2025? Let’s break down why working harder isn’t always the answer—and how you can build smarter financial habits for real wealth.

Why Grind Culture Isn’t All It’s Cracked Up to Be

Let’s be honest: hustle culture can be toxic. It pushes you to believe that if you’re not exhausted, you’re not trying hard enough. But research shows that burning out rarely leads to financial freedom. In fact, many people who work the hardest—think nurses, teachers, and service workers—aren’t necessarily the ones who end up wealthy. Their dedication is admirable, but the hours they put in don’t always translate into financial security or freedom.

I’ve been there myself. Years ago, I juggled multiple side hustles, convinced that sheer effort would pay off. What I got instead was burnout, stress, and a bank account that didn’t reflect the hours I’d sacrificed. If you’re nodding along, you know the feeling: working late nights, sacrificing weekends, and still feeling stuck. It’s a trap that’s easy to fall into, especially when everyone around you seems to be hustling even harder.

Let’s Talk About “Lazy” Solutions (and Why They’re Actually Smart)

There’s a stigma around seeking easier, more efficient ways to build wealth. We’re taught to feel guilty if we’re not grinding 24/7. But here’s the truth: being smart about your financial strategy is not lazy—it’s essential. In fact, many millionaires and successful entrepreneurs look for scalable, less effort-intensive models. They focus on maximizing their return on investment (ROI), not just the number of hours they work.

Think about it: if you’re putting in 60–70 hours a week and still not seeing results, maybe it’s not your work ethic that’s the problem. Maybe it’s your strategy. That’s why Building Financial Habits that prioritize efficiency and scalability is so important in 2025. Automating your savings, tracking your spending, and investing in assets that grow over time are all smarter moves than simply working more hours.

Why ROI Matters More Than Hours Logged

Let’s put it simply: you can work yourself to the bone and still not get ahead if you’re in the wrong “boat.” Warren Buffett put it best when he said:

“It’s not about how hard you row, it’s about what boat that you’re in.”

This analogy is powerful. You could be the hardest worker in the world, but if you’re in a leaky boat—or a business model that doesn’t scale—your efforts won’t translate into wealth. On the other hand, choosing the right vehicle for your efforts can make all the difference. That’s why Maximizing Wealth in 2025 is about more than just effort; it’s about direction and strategy.

Comparing Hard Work and Wealth Outcomes

Take a look at professions known for their hard work—nurses, teachers, first responders. These are some of the most dedicated people you’ll ever meet. Yet, statistically, they aren’t the ones building fortunes. Why? Because the path to wealth isn’t just paved with sweat; it’s paved with smart decisions, scalable opportunities, and financial habits that stick.

- Choosing scalable business models (like digital products or software) over purely service-based work can multiply your efforts.

- Automating savings and investments ensures you’re building wealth even when you’re not actively working.

- Prioritizing tax efficiency and low-cost investments helps your money grow faster, with less effort on your part.

So, if you’re ready to rethink your Wealth Building Strategy for 2025, start by questioning the grind. It’s not about working harder—it’s about working smarter, building habits that last, and picking the right boat to row in.

2. Smarter Not Harder: Choosing the Best Wealth Building Vehicle

If you’ve ever wondered, “How can I make the most money with the least amount of effort?”—you’re not alone. In 2025, asking this question is almost taboo. The grind culture tells you that wanting to build wealth without burning out is lazy, but let’s be real: the laziest people I know are often the smartest with their money. They don’t cut corners—they just find the highest return on investment (ROI) for their time and energy. That’s the core of modern Wealth Building Strategies: working smarter, not harder.

Let’s break down what this means for you. Building long-term wealth isn’t about hustling 24/7 or sacrificing your health. It’s about making strategic choices—choosing the right “boat,” as Warren Buffett puts it, not just rowing harder. The business model you pick matters more than the hours you put in. Some models are simply more efficient, and that’s a fact. So, let’s do a Financial Health Check on the smartest wealth vehicles out there.

What Makes a ‘Lazy’ Business Model?

First, let’s clear the air. “Lazy” here isn’t about being careless or cutting corners. It’s about maximizing smarts and minimizing unnecessary effort. The best “lazy” business models deliver high ROI with low input. You want a system where your money and time work for you, not the other way around.

Five Key Criteria for Wealth Building Vehicles

To compare business models, you need a framework. Here are the five crucial criteria:

- Upfront Capital: How much do you need to start?

- Scalability: Can your income grow without your effort growing, too?

- Fulfillment Difficulty: How hard is it to deliver your product or service?

- Risk: What’s the chance of losing money or failing?

- Overall Difficulty: How steep is the learning curve?

Research shows that comparing multiple business models using these clear, real-life metrics helps identify the most efficient path to wealth. This isn’t just theory—I’ve built successful companies in each of these models, so you’re getting the real scoop.

Evaluating the Top Wealth Building Models

Let’s look at five of the most popular business models for 2025:

- Agency/Services

- Physical Products (e-commerce brand)

- Dropshipping

- Software/SaaS

- Digital Products

Each has its own pros and cons. For example, digital products can be launched with almost zero upfront capital, while a physical product brand might require $125,000 just to order your first 1,000 units. Dropshipping can take 6–12 months to become profitable, but you avoid inventory headaches. Software/SaaS can scale fast but often needs a technical co-founder or developer. Agencies and service businesses can start with just your skills, but fulfillment is time-intensive and hard to automate.

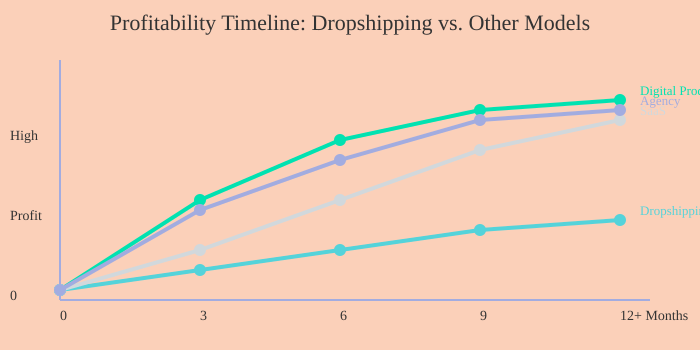

Chart: Upfront Capital vs. Scalability of Business Models

To help you visualize the trade-offs, here’s a chart showing how each business model stacks up in terms of upfront capital and scalability:

As you can see, digital products and software/SaaS offer the highest scalability with the lowest upfront costs. Physical products require a heavy investment but can scale, while agencies and dropshipping sit somewhere in the middle. This is why automating savings and investing in scalable models is a core part of Financial Habits That Stick and Long-Term Wealth Strategies.

The Wild Card: The Lazy Millionaire Scenario

Imagine this: You’re building wealth in your pajamas, automating your savings, and watching your income grow while you sleep. It sounds like a dream, but it’s possible if you pick the right vehicle. In 2025, market conditions and government policies reward those who adapt—so choose a model that fits your lifestyle and goals. Remember, the smartest path isn’t always the hardest one. Sometimes, it’s the one that lets you enjoy your mornings and still hit your Investment Strategies and Income and Expenses targets.

3. Drop Shipping (and Other Models): The Not-So-Lazy Truth

If you’ve ever scrolled through social media and seen ads promising easy riches through dropshipping, you might think it’s the ultimate “lazy” way to build wealth. Just pick a product, find a supplier, and let the sales roll in—right? Well, not so fast. Let’s break down the real Income and Expenses, investment strategies, and wealth building strategies behind dropshipping, and why the investment costs aren’t always as low as they seem.

How Dropshipping Really Works: The Upfront Investment

At first glance, dropshipping appears to offer low investment costs. You don’t need to buy inventory upfront, and you don’t have to worry about shipping. But here’s the catch: finding a product that actually sells is a costly process. You’ll spend weeks, sometimes months, running paid ads just to test if your chosen product is a winner. These ad costs add up quickly, and there’s no guarantee you’ll land on a profitable item.

Research shows that a solid wealth building strategy starts with a clear understanding of your income and expenses. With dropshipping, those expenses can balloon before you see any return. If you’re not careful, you might burn through your budget long before you find a winning product.

Fulfillment: The Hidden Stress

One of the main selling points of dropshipping is that fulfillment is “done for you.” In reality, you have very little control over the supply chain. Shipping delays, out-of-stock suppliers, and refund requests are common headaches. Even when you think you’ve got everything set up, something can go wrong. For example, “Even just yesterday, listen, it wasn’t a massive order. It was only about a thousand units. So, those thousand units of one of our SKUs at the eyewear company, whatever, that’s 125 grand worth of sales or stock.”

Imagine putting months of work into your store, only to have a $125,000 order delayed or ruined by a production error. That’s not just a minor setback—it can wipe out months of progress and cash flow. This kind of fulfillment anxiety is unique to dropshipping and can make the business far more stressful than it appears from the outside.

External Risks: Market Trends, Tariffs, and Refunds

Another thing to consider in your investment strategy: dropshipping is highly vulnerable to external risks. Market trends shift quickly, and what’s hot today might be dead tomorrow. Government tariffs can also hit without warning, slashing your margins overnight. For example, new tariffs or supply shocks can introduce sudden risk, making it even harder to predict your income and expenses.

Studies indicate that effective wealth building strategies in 2025 require you to adapt to changing market conditions and government policies. Dropshipping, unfortunately, leaves you exposed to forces you can’t control. If you’re looking for investment costs low and stable, dropshipping might not be the best fit.

Brand Building vs. Pure Dropshipping

There’s a big difference between running a dropshipping store and building a true e-commerce brand. Real brands invest in quality, reputation, and customer experience. This takes more time, more capital, and a higher tolerance for risk. But it also gives you more control over your business and your wealth building strategy. Dropshipping, on the other hand, is often about chasing the next trend—opening new stores, closing old ones, and hoping to catch lightning in a bottle.

Brand-building isn’t a shortcut. It’s a commitment. If you want to build sustainable wealth, you’ll need to focus on habits and systems, not just quick wins.

The Steep Learning Curve

Let’s be honest: dropshipping in 2025 is harder than ever. The competition is fierce, the learning curve is steep, and the margin for error is razor-thin. It can take six months, a year, or even longer to see real profitability. Many beginners burn through their savings without ever turning a profit. If you’re serious about wealth building, you need to be prepared for a marathon, not a sprint.

4. The Five Factors of a Truly Lazy (and Lucrative) Business Model

If you’re serious about building wealth the “smart lazy” way in 2025, you need more than just hustle. You need a framework—a Financial Health Check for business models. Forget the hype. Let’s break down the five core factors that separate a business that quietly prints money from one that drains your time, energy, and bank account. Here’s how to assess your options using real numbers, real risks, and a clear-eyed look at what makes a business model both lucrative and low-maintenance.

1. Upfront Capital: How Much Do You Need to Start?

First up: upfront capital. This is the minimum amount of money you need to spend just to get your business off the ground. If you’re new to entrepreneurship, keeping investment costs low is crucial. Why? Because your risk tolerance is probably lower, and you want to avoid a situation where a single misstep wipes out your savings. For example, I’ve wired $500,000 for an eyewear brand and nearly $1 million for a consumables launch. That’s not where you want to start unless you’re already established. For most, a low upfront investment means less stress and more flexibility as you learn the ropes.

2. Scalability: Can You Grow Without Working More?

Scalability measures your ability to increase income and profits without a matching increase in effort. The dream? Automating savings and income streams so your business grows while you sleep. Digital product companies, for instance, can process $100 million a month for users with minimal incremental work. That’s the gold standard. If your business model requires you to work harder for every extra dollar, it’s not truly scalable—and it’s definitely not lazy.

3. Fulfillment: How Hard Is It to Deliver?

Fulfillment is all about how challenging it is to deliver your product or service. Can you automate delivery? If so, you’re on the right track. The easier it is to fulfill orders or provide services, the more time you free up for strategy, automating savings, or even launching new ventures. If fulfillment is complex, you’ll be stuck in the weeds, and your business won’t scale efficiently.

4. Risk: What’s on the Line?

Risk is where most people trip up. It’s not just about losing money—it’s about time, reputation, and opportunity cost. Early on, you want to keep risk low. As you gain experience and financial cushion, you can afford to take bigger bets. Personally, I’ve taken major risks—wiring hundreds of thousands, investing in multiple companies, and sometimes losing out. But that’s only after years of building up my risk tolerance. For you, a Financial Health Check means being honest about how much you can afford to lose, and not letting Debt Management Tips fall by the wayside.

5. Difficulty: How Easy Is It to Understand and Execute?

Finally, difficulty. Some business models are just plain hard to figure out. They require endless trial and error, steep learning curves, and constant adaptation. If you’re looking for the “lazy” path, you want something simple, clear, and easy to execute. The easier it is to understand, the faster you can get started—and the sooner you can see results.

Wild Card: Does the Perfect Business Model Exist?

Imagine a business that’s easy on all five factors: low upfront capital, high scalability, simple fulfillment, low risk, and minimal difficulty. Does it exist? Maybe. But don’t fall for gurus who claim their way is the only way. Most are biased—they succeeded with one model and assume it’s best for everyone. I’ve built, invested in, and run businesses across all these models, so I can tell you: use rigorous criteria, not hype. That’s how you reduce financial stress and make smarter choices.

How to Use This Framework for Smarter Choices

Conduct a Financial Health Check on any business idea. Look at your Income and Expenses, keep Investment Costs Low, automate wherever possible, and always manage risk. Research shows that building wealth in 2025 is about forming strong financial habits—automating savings, managing spending, and reducing debt. Use this five-factor framework to evaluate opportunities, and you’ll be on the path to a business that works for you, not the other way around.

| Business Model | Upfront Capital | Scalability | Fulfillment Complexity | Risk | Difficulty |

|---|---|---|---|---|---|

| Eyewear Brand | $500,000 | Medium | High | High | Medium |

| Consumables Brand | $1,000,000 | Medium | High | High | Medium |

| Digital Product Company | Low | Very High ($100M/month processed) | Low | Low | Low |

5. Building Financial Habits That Stick (Without the Burnout)

Let’s get real for a second: if you want to build wealth in 2025, you don’t need to grind yourself into exhaustion. The secret? Financial habits that stick—the kind that don’t rely on willpower or endless spreadsheets. As someone who’s taught thousands of aspiring entrepreneurs how to make money online, I’ve seen what works (and what fizzles out fast). Here’s how you can build habits that last, without burning out.

The Lazy Millionaire’s Secret: Automate Everything

Ever notice how the laziest millionaires seem to have it all handled? It’s not magic. They automate everything—from savings to debt payments, even follow-ups with clients. Why? Because automation removes the need to make decisions over and over. You set it once, and it runs in the background, quietly building your fortune.

Think about it: automated platforms now process up to $100 million a month in digital products. That’s not just big business; it’s a lesson in efficiency. If you set up automatic transfers to your savings account, or schedule debt payments as soon as your paycheck lands, you’re making wealth-building effortless. Automating savings and debt management isn’t just a convenience—it’s a proven path to consistent progress.

Micro-Routines: Why Small Wins Beat Big Changes

Here’s the thing: drastic changes rarely stick. Maybe you’ve tried a no-spend month or a super strict budget, only to bounce back to old habits. Research shows that sustainable wealth comes from small, repeatable actions—not grand gestures. In fact, a University College London study found it takes an average of 66 days to form a habit. That’s not overnight, but it’s doable if you keep your changes bite-sized.

Want to make your spending plan stick? Start by tweaking one thing at a time. Maybe you automate $25 a week into savings. Or you set a calendar reminder to check your spending every Friday. These micro-routines add up, and over time, they become second nature.

Spotting ‘Lazy’ Leaks in Your Spending

Let’s talk about the money that slips through the cracks—the subscriptions you forgot about, the daily coffee runs, the apps you never use. These are your ‘lazy’ leaks. They’re easy to ignore, but over months (or years), they drain your wealth.

How do you find them? Run through your bank statements with a highlighter. Look for recurring charges or impulse buys. Cancel what you don’t use. Redirect those dollars into your automated savings or debt payments. This isn’t about deprivation—it’s about reclaiming money you didn’t even realize you were losing.

Debt Management Tips: Automate, Don’t Agonize

If debt is weighing you down, automation is your best friend. Set up automatic payments for at least the minimum due. If you can, add a little extra each month. This keeps you on track, avoids late fees, and chips away at your balance without constant stress. Remember, success comes from automating good habits—not just making big, one-off payments when you feel motivated.

Why Incremental Tweaks Outlast Big Proclamations

It’s tempting to declare, “This is the year I get rich!” But in reality, it’s the tiny, consistent actions that build real wealth. Maybe you round up every purchase and save the difference. Or you review your spending plan once a month. These aren’t headline-grabbing moves, but they’re the foundation of financial habits that stick.

Long-term wealth isn’t about working harder—it’s about working smarter. Automate what you can. Make small tweaks, not sweeping changes. And remember: every little win counts. Over time, those micro-improvements add up to something big.

6. Adapting in 2025: Navigating Shifting Markets and Tax Strategies

Let’s face it—2025 is not the year for playing it safe with your money. If you’re watching the headlines, you’ve seen the chaos: new trade tariffs, wild market swings, and online business rules that seem to change overnight. If you want to build wealth this year, you have to get comfortable with change. Think of it like playing chess, not checkers. Every move counts, and you need to be several steps ahead, especially when it comes to Tax Efficient Planning and Market Downturn Strategies.

Why 2025 Is a Wild Ride for Investors and Entrepreneurs

Here’s the reality: new tariffs and regulations are making business models like dropshipping much trickier. As someone who runs an e-commerce brand, I’ve felt the sting of these changes firsthand. One day, your supply chain is humming along. The next, a new policy hits, and suddenly your costs spike or your margins vanish. I’ve watched beginners burn through cash because they didn’t see the risks coming. Even established stores can collapse if they don’t adapt quickly enough to market trends. In 2025, sticking to a fixed strategy is dangerous. Flexibility isn’t just helpful—it’s essential.

Tax-Efficient Planning: The Smart Lazy Path

Now, let’s talk about Tax Efficient Planning. If you’re a high earner, this is your secret weapon. Research shows that maximizing your retirement accounts, like 401(k)s and IRAs, is more important than ever. Not only do you lower your taxable income, but you also set yourself up for long-term growth. And don’t overlook tax-loss harvesting. This strategy lets you offset gains with losses, reducing your tax bill in volatile years. It’s not glamorous, but it works—especially when markets are unpredictable.

- Maximize retirement contributions: Hit those annual limits on your 401(k) or IRA.

- Harvest losses: Sell investments that are down to offset gains elsewhere.

- Keep costs low: Choose low-fee funds and avoid unnecessary expenses.

Studies indicate that keeping your investment costs low is one of the easiest ways to boost your returns over time. Every dollar you save on fees is a dollar that stays in your pocket—and compounds for your future.

Retirement Savings Priorities: Build Habits, Not Hype

It’s tempting to chase the latest trend or try to time the market, but the real winners in 2025 are those who stick to solid Retirement Savings Priorities. Automate your savings. Set up recurring transfers to your retirement accounts. Make it boring, make it automatic. That’s how you build habits that last, even when the world feels upside down. Research shows that forming strong financial habits—like automating savings and managing spending—lays the foundation for long-term wealth.

Personal Angle: Learning to Adapt (Even When It Hurts)

I’ve had to pivot my own business more times than I can count. When a new regulation hits, it’s rarely convenient. Sometimes it’s downright painful. But every time, adaptation has been necessary. I’ve seen digital product businesses process $100M a month—proof that scale and efficiency are possible, even in tough times. I’ve also invested in companies that returned 15x, but only because they were quick to adjust when the market shifted. If you want to thrive, you have to be willing to change course—fast.

Playing Chess, Not Checkers: Outmaneuvering Uncertainty

Think of your financial strategy as a chess game. You can’t just react to what’s in front of you. You need to anticipate, plan, and sometimes sacrifice a piece to win in the long run. That means reviewing your financial health regularly—checking your income, expenses, savings, debt, and investments. Refine your goals with measurable targets. Stay invested, but be ready to rebalance when needed. And above all, keep your eye on the big picture.

“Market conditions and government policies in 2025 require adaptive financial strategies, especially regarding tax planning and investment management.”

Adaptability, tax-smart investing, and a long-term vision aren’t just buzzwords—they’re your best tools for building wealth in 2025’s unpredictable landscape.

7. Conclusion: Your Laziest Wealth-Building Move Yet – Take Action... Wisely!

Let’s be honest: the world of wealth building in 2025 is more complex, competitive, and—if you let it—overwhelming than ever. But here’s the twist: the smartest move you can make is often the laziest, as long as you’re strategic about it. If you’ve ever wondered, “What’s the easiest, most sustainable way to build long-term wealth?”—you’re already thinking like a pro. Don’t be afraid to ask, “What’s the laziest way?” because, as research shows, the most effective long-term wealth strategies are often the ones that automate, simplify, and fit your real life.

There’s absolutely no shame in making your money work for you instead of you working for your money. In fact, that’s the goal. You want your investments, habits, and systems to quietly build your fortune in the background, freeing you up to live more and stress less. As one wise entrepreneur put it:

“Your business can work for you and you can build a lazy business that works for you rather than you being a slave to business.”

That’s not just a catchy quote; it’s a mindset shift. Wealth building should be conscious, not reactionary. You don’t have to hustle endlessly or chase every new trend. Instead, focus on Financial Goals Refinement. Set clear, measurable targets that actually matter to you. Studies indicate that refining your financial goals and tracking your progress is the backbone of any successful long-term wealth strategy. When you know what you’re aiming for, every decision becomes easier—and smarter.

But how do you know if you’re on the right track? Start with a Financial Health Check. Take a close look at your income, expenses, savings, debt, and investments. Are you automating your savings? Are you keeping investment costs low? Are you maximizing tax efficiency? These are the questions that matter. Research shows that high-income earners, in particular, can maximize their financial potential by combining goal refinement, tax planning, and disciplined spending plans. And for everyone, automating good habits—like regular investing and debt reduction—removes the friction that causes most people to stumble.

Now, let’s circle back to the five evaluation factors we’ve discussed for every business model: risk, difficulty, time commitment, scalability, and sustainability. The truth is, every wealth-building path has its trade-offs. Take dropshipping, for example. Market shifts, like new tariffs or increased competition, can make an already tricky model even harder. As you’ve seen, beginners can burn through money without the right training, and even established stores can falter when trends change. That’s why individualized evaluation is so crucial. What works for someone else might not work for you—and that’s okay.

Here’s your wild card: visualize your “lazy empire.” What does it look like? Which habits and models actually fit your lifestyle, your risk tolerance, and your long-term vision? Maybe you’re drawn to automated index investing. Maybe you want to build a business that runs itself. Or maybe you’re focused on tax-advantaged retirement accounts. The point is, you get to choose. The secret sauce is habit automation and honest self-evaluation. That’s how real, lasting wealth is built.

So, what’s your next move? Conduct your own financial health check. Reframe your wealth-building map for 2025. Ask yourself the bold, even “lazy,” questions that lead to smart, sustainable strategies. Don’t just react to market noise or the latest trends. Instead, structure your wealth plan to work for you—quietly, efficiently, and with as little friction as possible.

Remember, building long-term wealth isn’t about working harder. It’s about working smarter, automating what you can, and refining your goals as you grow. Take action—wisely. Your future self will thank you.

TL;DR: Smart beats hard: Wealth in 2025 comes down to choosing the right model, automating your habits, and prioritizing sustainable growth over hustle. Evaluate, optimize, and build the kind of wealth that lasts—with less stress attached.

Post a Comment