Let’s be real: you’re tired of hearing you have to burn your bridges, quit your job, and hustle ‘til you break. So am I. Back in my early 20s, fresh out of college, I almost fell for that noise—until I watched a friend lunge at one of those ‘just leap’ schemes and land flat on their face, savings fried and confidence shattered. Today, I’m here to show you the offbeat, slightly unglamorous, but genuinely effective path out of the rat race. You’ll get real talk, concrete moves, and maybe a story or two that feels a little too familiar.

1. Why “Quit & Hustle” Advice Is a Trap (and What Actually Works)

If you’ve spent any time online searching for ways to achieve financial freedom, you’ve probably seen the same advice over and over: quit your job, burn all your bridges, and go all-in on your business. It sounds bold. It sounds inspiring. But let’s be honest—this “quit & hustle” narrative is a trap for most people. The reality is far less glamorous, and if you want to build wealth without quitting, you need to see through the hype.

The Hidden Dangers of the “Quit Your Job” Cult

Let me share a quick story. A close friend of mine bought into the dream. He quit his stable job, convinced that going all-in on his new venture was the only way to achieve financial freedom. Within six months, his savings were gone. The pressure to make money fast led him to take on nightmare clients and rush out half-baked products. The result? Burnout, stress, and a business that never got off the ground.

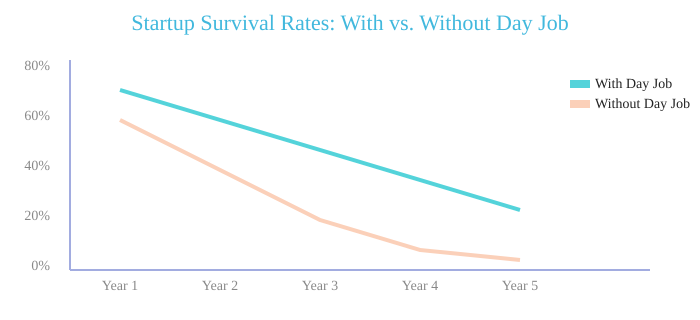

This isn’t just one story. Research shows that over 60% of new businesses fail within the first three years (US Bureau of Labor Statistics). The odds are even worse if you’re operating from a place of desperation, with no safety net or backup plan.

Self-Serving Gurus vs. Real-Life Financial Freedom Strategies

Why does this advice persist? Frankly, it’s self-serving. Many online “gurus” profit from selling the dream, not from living it. Their advice gets applause, but it rarely leads to real, lasting success. In contrast, if you look at icons like Jeff Bezos, Phil Knight, or Sara Blakely, you’ll see a different story. They built their empires while holding onto jobs or other sources of income. They understood that building wealth without quitting your job is not only possible—it’s often the smartest move.

“The whole quit your job and follow your dreams narrative, it sounds inspiring in YouTube videos, but it’s just simply not practical for most people.”

Emotional Pressure and Desperation: The Real Cost

Let’s break down what happens when you quit without a plan. First, your savings start to disappear. Most people only have a 3-6 month window before their emergency fund runs dry. That ticking clock creates anxiety and a scarcity mindset, which can repel opportunities instead of attracting them. You start making desperate choices—taking on bad clients, undercharging, or rushing products to market. These decisions rarely end well.

And then there’s the mental toll. The stress of having no safety net can be overwhelming. It’s hard to think clearly or make smart moves when you’re constantly worried about money. This is where burnout creeps in, and it’s a major reason so many would-be entrepreneurs give up entirely.

Why Keeping Your Job Might Be Your Smartest First Move

Here’s the truth: Financial freedom strategies that actually work are grounded in realism, not hype. Keeping your job while you build your side business gives you stability, reduces stress, and allows you to make better decisions. It’s not flashy, but it works. Most successful entrepreneurs start this way, using their steady income to fund their ventures, test ideas, and avoid desperate mistakes.

The Power of Realism Over YouTube Hype

It’s easy to get swept up by motivational quotes and viral videos. But if you want to achieve financial freedom and avoid burnout, you need to focus on strategies that are proven, practical, and sustainable. Building wealth is a marathon, not a sprint. Don’t let the “quit & hustle” trap derail your journey.

2. Your Job: Secret Superpower, Not Your Enemy

It’s time to flip your mindset about your 9-to-5. If you’re dreaming of financial stability starting a business, your job isn’t a shackle—it’s your launchpad. Too often, people see their salary as something to escape from as quickly as possible. But if you look at the stories of legendary entrepreneurs, you’ll see a different pattern. They used their day jobs as a secret superpower, not an obstacle.

How Your 9-to-5 Funds Your Future: Lessons from Amazon, Nike, and Spanx

Let’s take Jeff Bezos. Before Amazon became a household name, Bezos worked at DE Shaw, a prestigious investment firm. He didn’t quit the moment he had an idea. Instead, he developed his business plan while still employed, using his salary to fund early experiments and buy himself time. Only after he had a clear strategy and initial funding did he take the leap. The result? Amazon now touches billions of lives, from Prime Video to AWS.

Phil Knight, the founder of Nike, is another classic example. He worked as an accountant while selling Japanese running shoes out of his car trunk. Knight didn’t walk away from his job until Nike had real traction. Similarly, Sarah Blakely, founder of Spanx, sold fax machines door-to-door for two years while building her brand at night. She waited until she landed her first major order before quitting. These stories show that side business strategies work best when you leverage your salary as seed money and breathing room.

Turning Salary Into Side-Hustle Seed Money

Research shows that wages provide the essential initial capital for your side hustle. More importantly, a steady paycheck helps reduce “scarcity thinking”—the fear and stress that come from not knowing how you’ll pay your bills. This mental space is invaluable. It lets you experiment, learn, and grow your business without the pressure of needing instant results. In fact, many successful entrepreneurs set a milestone before quitting, such as earning $10,000/month in side income or reaching a profit target. Studies indicate the average time to reach your first business profit milestone is 6 to 24 months, depending on your industry and effort.

Real-Life Proof: Wait for Traction Before the Leap

Here’s the reality: the smartest founders don’t quit until they have measurable success. Whether it’s a big client, a profit milestone, or a major order, they wait for proof of concept. This approach isn’t just about money—it’s about confidence and clarity. You’ll know when your side hustle is ready to support you, and you’ll avoid the trap of resenting your job for “holding you back.” Instead, you’ll see it as the golden goose funding your freedom.

"Your job isn’t your enemy. It is your funding source."

Extract Every Last Benefit (and Avoid Resentment)

Don’t fall into the trap of resenting your job. Instead, extract every benefit you can: health insurance, retirement contributions, networking opportunities, and skill-building. Use your salary to budget and save, building an emergency fund and investing in your business. This is the logic behind stable income in an unstable market. If you lost your job tomorrow, you’d have a cushion and a plan—because you used your job as a tool, not a cage.

Stability doesn’t limit your risk—it enables it. Treat your job as your business’s first investor, and you’ll build a foundation for side hustles success and long-term wealth. Smart budgeting and saving now means freedom later.

3. Do Less, Achieve More: Why Limited Time Can Be Your Competitive Edge

It might sound counterintuitive, but having less free time can actually make you more productive. This is one of the most surprising Productivity Principles you’ll ever encounter. If you’ve ever waited until the last minute to finish a school assignment, you’ve already experienced this phenomenon firsthand. You had three weeks, but somehow, all the real work happened in the final three days. This isn’t just procrastination—it’s a well-documented effect known as Parkinson’s Law: “Work expands to fill the time available for its completion.”

When you’re working a full-time job and building a side business in the evenings or on weekends, your hours are limited. At first, this might feel like a disadvantage. But research shows that this scarcity of time actually forces you to focus on what matters most. You become ruthless about priorities and naturally avoid distractions. In fact, studies indicate that people who keep their day jobs while working on side hustles often produce sharper, more effective output than those who quit too soon.

The Paradox of Productivity: Less Time, More Focus

Let’s look at what happens when you suddenly have all day to work on your business. Many people imagine that quitting their 9-to-5 will unlock endless productivity. The reality? It often leads to the opposite. Without the pressure of limited hours, it’s easy to fall into the trap of procrastination and lower output. As one entrepreneur put it:

"When I dropped out of school, my productivity went down, not up."

Why does this happen? When you have 12 hours to get something done, you tend to fill those hours—often with busywork or distractions. But when you only have 2-3 hours after work or school, every minute counts. You become hyper-focused, and your Consistent Work Effort is naturally higher in quality.

Mini-Case: Side-Hustlers vs. Full-Timers

Consider the difference between side-hustlers and those who go full-time on their business. Side-hustlers, working just a few hours each evening or on weekends, often report sharper decision-making and improved productivity. The time constraint creates a sense of urgency and clarity. In contrast, full-timers with open schedules can struggle to maintain momentum, leading to a 30-50% drop in self-reported productivity after quitting their structured jobs.

| Scenario | Hours Worked per Week | Productivity Outcome |

|---|---|---|

| Side Business (while working 9-to-5) | 5-10 | Significant progress, sharper focus |

| Full-Time (after quitting job) | 40+ | 30-50% decrease in self-reported output |

Scarcity of Hours: Your Hidden Advantage

When your time is scarce, you’re forced to get clear on your priorities. You can’t afford to waste hours on tasks that don’t move the needle. This is where Budgeting and Saving your time becomes just as important as budgeting your money. By setting boundaries and working within them, you avoid burnout and maintain steady progress. In fact, balancing your efforts is a key way to avoid burnout while still making meaningful strides toward your goals.

Remember, you don’t need 40 extra hours a week to build something great. Even 5 to 10 hours of focused, consistent work can create massive results over time. Constraints aren’t your enemy—they’re your secret weapon for achieving more with less.

4. Consistent, Small Actions: The Real Growth Engine

When it comes to escaping the rat race, most people imagine they need to hustle nonstop, sacrificing every spare minute to their side business. But research shows that consistent work effort—not frantic, all-in sprints—actually drives the most sustainable results. Let’s break down why small, steady actions are the true engine for financial freedom, and how you can use this to your advantage in 2025 without quitting your 9-to-5.

Why 1 Hour a Day Beats Weekend Marathons

It’s tempting to think you’ll make massive progress by dedicating your entire Saturday to your side hustle. But as the saying goes:

'It is much better to consistently put in one hour a day than it is to burn yourself out with occasional weekend marathons.'

Why? Because consistency compounds. When you work on your goals every day—even for just an hour—you build momentum. You avoid burnout. And you make your new financial habits stick.

The Compounding Magic of Tiny, Repeated Efforts

This is where habit stacking comes in. By attaching your new financial habit (like working on your digital product or tracking expenses) to something you already do daily, you make progress automatic. Studies indicate that incremental progress, repeated over time, outperforms sporadic bursts of effort. It’s the same principle behind investing: small, regular contributions grow faster than occasional big deposits.

Realistic Commitment: How 5-10 Focused Hours a Week Add Up

You don’t need to grind 24/7 to build wealth or replace your 9-to-5 income. In fact, research shows that even 5-10 focused hours per week can create massive results over time. Let’s look at the math:

| Scenario | Time Invested | Potential Impact |

|---|---|---|

| 1 hour/day for 6 months | 180 hours | Significant progress on side gig |

| Habit tracking app usage (since 2020) | Up 30% | More people sticking to routines |

That’s 180 hours you can invest in building your side business, learning new skills, or developing digital products—without ever quitting your day job.

Anecdote: My Own 45-Minute Evening Chunks

When I started my own business, I didn’t have endless free time. Most nights, I carved out just 45 minutes after dinner. Some days, I barely made progress. But over six months, those small chunks added up. I launched my first digital product, grew my audience, and started earning real money—while still working my 9-to-5. That’s the power of financial goal setting paired with consistent effort.

Why You Don’t Need to ‘Grind’ 24/7

Burnout is real. If you push too hard, you’ll lose motivation and risk giving up altogether. Instead, focus on building financial habits that stick. Use budgeting apps to automate savings and track your progress. Remember, building wealth is a marathon, not a sprint.

SMART Framework for Realistic Goal-Setting

Set yourself up for success by using the SMART framework:

- Specific: Define exactly what you want to achieve (e.g., “Earn $500/month from my side gig”).

- Measurable: Track your progress with budgeting or habit tracking apps.

- Achievable: Set realistic targets based on your available time.

- Relevant: Align your goals with your broader financial vision.

- Time-bound: Give yourself a clear deadline (e.g., “by June 2025”).

With consistent, small actions and the right tools, you can steadily move toward financial independence—one hour at a time.

5. Why 2025 Is the Year of the Digital Product (and How to Jump In)

If you’re looking for a way to build real wealth and escape the rat race—without quitting your 9-to-5—2025 is shaping up to be the year of the digital product. The landscape has shifted. Digital products now offer a unique blend of low risk, high flexibility, and massive potential for income growth. Let’s break down why this is the perfect time to explore Digital Products Income, and how you can jump in, even if your schedule is packed.

Why Digital Products Are the Ultimate Low-Risk, High-Flexibility Wealth Builder

Here’s the secret: digital products require almost no upfront investment. According to Forbes, digital products need less than 5% of the startup cost compared to physical product businesses. That means you don’t have to drain your savings or take on risky debt. No inventory. No suppliers. No shipping headaches. Just your ideas, a laptop, and a connection to the world.

Research shows that digital products create massive leverage for people with limited time and resources. You can start small, test your ideas, and scale up without the usual business risks. In fact, a recent Upwork/Fiverr study found that 40% of side hustlers plan to launch digital products or services by 2025. The trend is clear: digital products are the side business strategy of choice for the modern entrepreneur.

Personal Experience: Physical Products vs. Digital Results

I’ve been on both sides of the fence. I’ve run software companies—some bootstrapped, some VC-funded. I’ve built digital product businesses, service-based companies, and even launched multiple physical product brands. In fact, I’m wearing one of my eyewear brands right now, a company that’s been running for four years. But honestly, nothing compares to what’s possible with digital products right now.

Nothing compares to what’s possible with digital products right now.

Physical products come with a mountain of logistics: manufacturing, inventory, shipping, returns, and supplier headaches. Digital products? You create once, and you can sell forever, to anyone, anywhere. That’s the power of Monetize Digital Platforms in 2025.

Unlimited Scaling: Sell to the World, Not Just the Neighborhood

One of the most exciting aspects of digital products is their unlimited scaling potential. Your costs stay the same whether you sell to 10 people or 10,000. Digital platforms enable global reach without the need for huge capital. You’re not limited by geography, shelf space, or shipping zones. With the right strategy, you can reach customers worldwide—often while you sleep.

Time Flexibility: Build on Your Terms

Another huge advantage? Flexibility. You can moonlight your digital business on your schedule—nights, weekends, lunch breaks, or whenever you find a spare moment. This is a game-changer for anyone who can’t (or doesn’t want to) quit their day job just yet. AI Digital Product Creation tools make it even easier, letting you automate everything from content creation to marketing and customer support.

Risks and Reality Checks: Staying Focused and Avoiding Overwhelm

Of course, it’s not all sunshine and instant success. The low barrier to entry means competition is fierce, and it’s easy to get overwhelmed by options. The key is to focus on traction-building activities—creating value, understanding your audience, and iterating quickly. Don’t get lost in endless planning or perfectionism. Start small, learn fast, and use side business strategies that fit your lifestyle and goals.

In 2025, digital products are more than a trend—they’re the superhack for anyone serious about building wealth and freedom on their own terms.

6. Seize the Moment: Grabbing Opportunities Before They Pass

In your journey toward Financial Freedom 2025, one principle stands out above the rest: you must learn to spot and seize opportunities as they arise. The ancient Greeks had a fascinating way of illustrating this idea. They personified opportunity as a god named Chyros. He was depicted with wings on his feet, a long lock of hair at the front, and—curiously—bald at the back. The symbolism is striking: opportunity comes swiftly, and you can only grab it by the forelock as it approaches. Once it passes, there’s nothing left to hold onto. As the old saying goes:

"When opportunities fly past you, you must grab them by the forelock because once it’s passed, you can never catch it again."

Why Timing and Boldness Matter in Wealth Strategies for 2025

In the world of Strategic Side Ventures and digital entrepreneurship, timing is everything. Research shows that awareness and bold action are just as important as careful planning when it comes to building long-term wealth. In fact, studies indicate that opportunity windows in digital markets last, on average, only 6-12 months before they become saturated (source: entrepreneur.com). That means the best ideas—whether it’s a new AI tool, a trending digital product, or a niche side hustle—don’t stay fresh for long.

Successful entrepreneurs know this. They act quickly, often before the rest of the world even notices the chance. If you want to join their ranks, you need to develop a keen sense for spotting these “golden windows.”

Tactics for Spotting Golden Opportunities in 2025

- Stay Curious: Regularly scan industry news, forums, and social media for emerging trends.

- Network: Join communities of like-minded people—sometimes, the best tips come from casual conversations.

- Test Early: Don’t wait for perfection. Launch a minimum viable product or side hustle quickly to gauge real interest.

- Leverage AI: Use AI tools to analyze market data and spot patterns others might miss.

Personal Tangent: The Opportunity I Missed

I’ll be honest—there was a time I hesitated. Years ago, I spotted a gap in the digital education market. I had the skills, the resources, and even the audience. But I waited, wanting everything to be “just right.” By the time I was ready, the market was flooded. That regret taught me more than any success ever could: opportunities don’t knock forever. If you wait too long, you risk missing out entirely.

Checklist: Is This Opportunity Worth the Leap?

- Does it align with your long-term goals?

- Is there clear demand? (Look for rising search trends or unmet needs.)

- Can you act quickly? Speed matters more than perfection.

- What’s the downside? Assess the risks, but don’t let fear paralyze you.

- Do you have a backup plan? Smart risk-taking means knowing your limits.

Balancing Risk: When to Play It Safe, When to Jump

Not every opportunity is worth the leap. Sometimes, the best move is to observe and learn. Other times, you need to act boldly, even if you’re not 100% ready. Research shows that Successful Entrepreneurs Examples often come from those who balance calculated risks with decisive action. The trick is to recognize when the window is open—and to trust yourself enough to leap through it.

In the fast-paced world of Wealth Strategies for 2025, remember: fortune favors the bold, but only if you’re paying attention.

Conclusion: The Long Game (Plus a Tangent on ‘Second Chances’)

When it comes to building Long-Term Wealth and achieving Financial Freedom, the truth is simple: slow and steady really does win the race. It’s tempting to believe the loudest voices online—the ones promising overnight riches if you just quit your job and “go all in.” But research shows that sustained, strategic action over time is what actually leads to lasting wealth. The highlight reels you see on Instagram? They rarely show the late nights, the failed experiments, and the quiet, consistent effort that makes real success possible.

Let’s be honest: your wealth journey isn’t meant to be a series of viral moments. It’s the behind-the-scenes grind, the hours you put in after work, and the small wins that add up. Most people don’t see the spreadsheets, the budgeting, or the times you choose to save instead of splurge. But these are the building blocks of Building Financial Habits that last. If you’re feeling impatient, remember—those who stick to a plan, rather than chasing the latest hype, are the ones who eventually escape the rat race for good.

Why Slow and Steady Wins—Every Single Time

Think about the stories of Jeff Bezos and Phil Knight. Both built their empires while holding onto their day jobs. They didn’t leap without a net; they used their jobs as a foundation, a safety net that allowed them to take smart risks. It’s a reminder that you don’t need to follow the motivational herd mentality to achieve real financial freedom. In fact, the most successful stories are filled with pivots, mistakes, and second attempts. That’s not failure—it’s part of the process.

A Tangent on ‘Second Chances’

Here’s a quick story from my own journey. Years ago, I tried launching a side hustle selling custom phone cases. I poured in weeks of effort, only to realize I’d misjudged the market and my margins were razor-thin. It flopped. But that “failure” taught me more about product research, customer feedback, and digital marketing than any course ever could. The lesson? Every misstep is a second chance in disguise. Most entrepreneurs don’t get it right the first time. What matters is how you adapt and keep moving forward.

Stick With the Plan—Not the Hype

Whatever your starting point, don’t let flashy success stories or pressure from social media push you into reckless decisions. Your 9-to-5 isn’t your enemy—it’s your launchpad. Use it to fund your side ventures, test ideas, and build a safety net. Smart risks are about timing and preparation, not blind leaps. Studies indicate that automating your savings, setting clear financial goals, and focusing on consistent progress are the real Wealth Building Tips that pay off.

Your Safety Net Is a Feature, Not a Flaw

It’s easy to feel like you’re “playing it safe” by not quitting your job right away. But in reality, that safety net is what gives you the freedom to experiment, fail, and try again—without risking everything. Long-term, strategic side-hustling and digital product ventures create the most sustainable path to independence. Trust the unglamorous grind. Your future self will thank you for every hour you invested, every mistake you learned from, and every smart risk you took along the way.

FAQ: Burning Questions on Building Wealth Without Quitting Your Job

When you’re trying to achieve financial freedom in 2025, it’s easy to get lost in a sea of conflicting advice. You’ve probably heard that to escape the “rat race,” you need to quit your job and go all-in. But research shows that building wealth without quitting is not only possible—it’s becoming the smarter, more common path. Let’s address the most pressing questions side-hustlers like you are asking right now.

How long should I keep my 9-to-5 while working on my side business? The honest answer: as long as it takes for your side income to consistently match or exceed your salary. Real-life examples, like Jeff Bezos and Phil Knight, show that keeping your job provides stability and reduces risk. Your job isn’t your enemy—it’s your funding source. Use it to buy time and peace of mind while you validate your business idea.

What’s the minimum savings I need before considering a leap? There’s no magic number, but most experts recommend having at least 6-12 months of living expenses saved. This emergency fund acts as a safety net, giving you breathing room if your side business hits a rough patch. Remember, financial freedom 2025 is about security, not gambling your future.

How do I avoid burnout juggling a job and a side hustle? Consistency beats intensity. Instead of working 40 extra hours a week, commit to 5-10 focused hours. Use frameworks like SMART goals to keep your efforts targeted. Studies indicate that small, steady progress compounds over time and helps prevent burnout.

What digital products work best for beginners in 2025? Digital products are the top “vehicle” for building wealth without quitting your job. E-books, online courses, templates, and AI-powered tools are all low-cost, scalable options. With platforms and AI tools more accessible than ever, you don’t need to be an expert to start.

Is it really possible to replace my job income part-time? Yes, but it takes strategy and patience. Many creators on digital platforms now earn $100 a day or more, and some make thousands. The key is to validate your idea, build consistently, and reinvest early profits wisely.

How do I track real progress, not just busywork? Focus on outcomes, not hours. Set clear, measurable goals—like sales, subscribers, or product launches. Review your progress weekly and adjust your plan as needed. Busywork feels productive but doesn’t move the needle.

What’s the worst financial advice you see online? “Burn all the boats.” It sounds inspiring, but for most people, it’s reckless. The best path to achieve financial freedom is gradual, strategic, and grounded in reality.

How should I use my first $500 side-hustle profit? Reinvest in your business—upgrade tools, improve your product, or invest in marketing. Avoid the temptation to splurge; let your profits fuel your growth.

How do I know when an opportunity is legit, not a scam? Look for transparency, real testimonials, and a clear value proposition. If something promises overnight riches or asks for large upfront payments, be skeptical. Trust your instincts and do your research.

What if I fail my first attempt—should I try again? Absolutely. Failure is part of the process. Learn from what didn’t work, adjust your approach, and keep moving forward. Most successful entrepreneurs failed before they found their winning formula.

In 2025, building wealth without quitting your job is not only possible—it’s practical. Stay grounded, use your job as a launchpad, and take consistent, rational steps toward financial freedom. The opportunities are real, and the time to start is now.

TL;DR: You can escape the rat race—without quitting your day job or risking total burnout. By embracing strategic planning, consistent side hustles, and the digital product wave, you can build wealth and freedom with far less drama. Real-world examples, proven principles, and some myth-busting will get you on the right path—step by step, not all at once.

Post a Comment