Let me level with you: getting rich isn’t glamorous, and it certainly isn’t about flashy secrets or hustling 20 hours a day. I realized this one night, bored out of my skull, reviewing my bank statement and thinking, ‘Is this all wealth is?’ Spoiler: that boring stuff—budgeting, investing, even talking awkwardly about your salary—actually works. But how does a regular person go from paycheck-to-paycheck anxiety to real economic security? That’s the odd path we’ll explore today, blending awkward truths, wild personal stories, and the occasional data-driven detour.

Section 1: The Not-So-Secret Sauce — Why Boring Money Habits Work

Let’s be honest: when it comes to wealth building, it’s not the flashy moves or chasing the latest trends that make people rich. As Scott Galloway puts it,

“Let’s be honest: it’s the boring that makes you rich.”(0:00–0:02). The real secret? Consistent, steady habits—like budget creation, disciplined saving, and regular investing—are what drive investment growth and long-term wealth maximization.

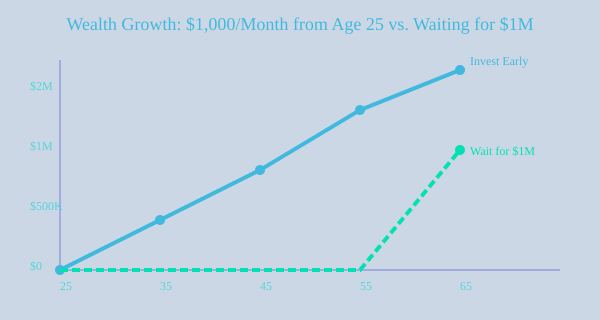

Research shows that the most effective savings plan is often the simplest one. Start early, invest regularly, and let compounding do its magic. If you begin investing $1,000 a month at age 25 and keep at it until you’re 65, you’ll have invested $480,000 in total. But thanks to the power of compounding, your actual wealth at retirement could be several times that amount (1:04–1:14). This is the invisible engine of investment growth—it works quietly in the background, but its impact is massive.

The Power of Compounding: Your Best Invisible Friend

Compounding is often misunderstood or underestimated, especially when you’re young. Galloway’s team uses a bucket of sand to illustrate how small, regular investments pile up over time (1:00–1:06). The earlier you start, the more time your money has to grow. Even if you can’t invest much at first, the habit is what matters. Waiting until you have a “big sum” to invest is a trap—most people never reach that point. The way to get to a million isn’t by waiting for it to appear; it’s by investing what you have, right now (1:16–1:23).

Financial Discipline in a Consumption-Driven World

Here’s the hard truth:

“98% of us will spend everything we get our hands on. It’s very hard to have the discipline to take money that is within your grasp and invest it.”(0:47–0:54). Social pressure to consume is relentless. Everywhere you look, you’re encouraged to spend, not save. That’s why financial discipline—the ability to stick to a budget and prioritize your savings plan—is what separates those who build real wealth from those who don’t.

- The ‘boring’ path of budgeting, saving, and steady investing beats chasing trends every time.

- Compounding rewards consistency, not perfection.

- Most people spend nearly everything—only a disciplined few build real wealth.

- Investing $1,000/month from age 25 to 65 beats waiting for the ‘big break.’

- It’s never ‘too late’ to act; incremental changes always beat all-or-nothing plans.

Why Acting Now Matters More Than Waiting

Studies indicate that investing early and often is crucial for wealth growth. Even if you’re not in your 20s, there’s always something you can control—your spending. Small, incremental changes to your habits can have a big impact over time. Waiting for the perfect moment or a large windfall rarely pays off. Instead, start with what you have, refine your financial goals, and stick to your plan.

Chart: Wealth Growth — Investing Early vs. Waiting for a Big Sum

Section 2: The Uncomfortable Truth About Talking Money

If you want to master financial literacy and truly understand wealth building strategies, you have to do something that feels uncomfortable: talk about money. It’s a lesson that’s rarely taught, but it’s one that separates those who build wealth from those who don’t. As highlighted in the transcript (3.30-3.39), “Rich people talk about money, and it’s considered taboo for employees, the middle class, and women to talk about money.” This taboo isn’t just social awkwardness—it’s a barrier that keeps financial knowledge, and therefore power, in the hands of a few.

Why Money Talk Is Taboo—And Who Benefits

You’ve probably heard that discussing your salary or investments is “vulgar” or “inappropriate.” But have you ever wondered who benefits from this silence? In most workplaces, your boss knows exactly what everyone earns, while you know almost nothing about your coworkers’ pay. This is called information asymmetry, and it’s no accident. As the transcript points out (3.42-3.45), “Asymmetry of information will always benefit the person that has symmetry.” In other words, the people with the most information—often those at the top—are the ones who profit from your silence.

| Group | Knowledge of Salaries | Money Talk Taboo? |

|---|---|---|

| Boss/Management | 100% | No |

| Employees | 0% | Yes |

| Social Circles | Minimal | Yes |

Caption: This table illustrates the stark information gap between management and employees, and the pervasiveness of money talk taboos in most environments.

Financial Literacy Comes from Conversation, Not Silence

You don’t learn about money by keeping quiet. In fact, research shows that financial literacy grows through open dialogue and shared experiences. If you want to set and refine your financial goals, you need real-world information—what people are earning, how they’re investing, where they’ve made mistakes. The transcript (4.07-4.19) makes a compelling analogy: “Roger Federer talks about tennis; if you want to be good at money, you have to talk about money.” The more you talk, the more you learn, and the better your financial planning becomes.

Breaking Taboos: Start Early, Stay Transparent

So, how do you break the cycle? Start young. Be uncomfortably transparent. Ask your friends about their mortgage rates, their salaries, their investment blunders (4.24-4.30). Yes, it might feel awkward at first. But that discomfort is where real learning happens. Studies indicate that refining your financial goals early and revisiting them often is key to wealth maximization. High-income earners, for example, often focus on tax efficiency and strategic planning—knowledge they gain from open conversations, not secrecy.

Who Gets Hurt by Silence?

It’s not just about you. Taboos around money talk hurt everyone but the privileged. Gender, class, and workplace norms keep financial information hidden, making it harder for most people to get ahead. If you want to build wealth, you have to break these taboos. Don’t just accept the status quo—challenge it. Ask questions. Share your experiences. The more transparent you are, the more empowered you become.

Rich people talk about money, and it’s considered taboo for employees, the middle class, and women to talk about money.

Asymmetry of information will always benefit the person that has symmetry.

When you’re open about money, you’re not just helping yourself—you’re helping everyone around you move closer to their financial goals. That’s the real art of wealth building.

Section 3: Luck, Privilege, and Being in the Right (or Weird) Room

When you think about wealth maximization and the journey to financial success, it’s easy to focus on hard work, smart investments, or starting an ecommerce business. But if you look closer, you’ll notice that sometimes, the biggest factor is simply being in the right place at the right time—or, as some would say, being in the right (or weird) room. As you reflect on your own financial path, it’s worth considering how much of it was shaped by luck, privilege, and unexpected opportunities (4.47-4.51).

Luck: The Unseen Hand in Wealth Building

Let’s be honest: luck plays a bigger role than most people admit. Maybe you had a generous mentor who taught you about stocks early on, or a sibling who supported your investments. Sometimes, you’re simply born in the right era. One story that stands out is learning about money from a mentor at a young age, leading to a $200 investment in stocks at just 13. That small start created lifelong lessons about markets and risk (4.47-4.58).

These “sliding doors” moments—being invited into a room, meeting a key person, or stumbling onto a new idea—can change your entire financial trajectory. As research shows, starting early and staying invested is crucial for wealth growth, but the opportunity to start often comes down to luck and timing.

Privilege: The Invisible Advantage

Privilege is often invisible until you look back and see its impact. For example, being born a white male in 1960s California meant access to free education and a much higher chance of getting into top universities. As one person put it,

"The smartest thing I ever did was being born a white heterosexual male in California in the 60s."

Back then, UCLA’s acceptance rate was 76%. Today, it’s just 9%. That’s a massive shift in access—and a reminder that the doors you walk through are sometimes held open by factors outside your control (4.45-5.51).

| Year | UCLA Acceptance Rate |

|---|---|

| 1960s-1970s | 76% |

| Today | 9% |

Environmental Factors and Support Systems

Your environment—supportive parents, lucky friendships, or even a sibling’s career—shapes your economic options. One entrepreneur shared how his brother, after a long stint in investment banking, offered to manage his money and join his business full-time after a successful exit. He described it as,

"Life gave me the greatest gift anyone could ever have been given."

These support systems can be the difference between struggling and thriving, especially in entrepreneurship and financial planning.

Entrepreneurial Advantage: Entering the Unexpected Room

Entrepreneurship is often about taking chances—sometimes entering rooms you weren’t “meant” to be in. Research indicates that starting an ecommerce business is one of the top wealth building strategies for 2025. But even here, luck and access play a role. You might meet a future business partner at a random event, or discover a new market just by being curious. Still, careful planning and execution are essential for success in ecommerce, as studies suggest.

In the end, while you can maximize your wealth through smart strategies and discipline, it’s important to recognize the outsized impact of luck, timing, privilege, and the rooms you find yourself in—or fight to get into. Sometimes, the oddest opportunities are the ones that change everything.

Section 4: Building Financial Muscle — Learning Money the Hard and Messy Way

When you think about Financial Education, you might imagine textbooks, online courses, or maybe a parent sitting you down for “the talk” about money. But in reality, your first lessons in wealth building strategies are often awkward, unpredictable, and—let’s be honest—a little messy. Sometimes, they come from the most unexpected places. For example, imagine being 13 years old, standing in the lobby of a fancy brokerage, feeling completely out of place. That’s how real financial confidence begins: not from grand plans, but from small, repeated risks and a willingness to ask questions, even if you feel out of your depth.

Let’s rewind to a story that captures this perfectly (7.05-8.50). Picture yourself as a teenager, living with your mom, who happens to be in a relationship that’s not exactly conventional. Her boyfriend, Terry, is a kind and generous man. He’s not your father, but he becomes a mentor in ways you never expected. One weekend, you ask him, “What is a stock?” Instead of giving a lecture, he hands you two crisp $100 bills and says:

“Here’s $200. Walk down to one of those fancy brokerages and buy some stock.”

He adds a challenge: if you don’t invest it by the time he’s back next weekend, he’s taking the money back. That’s the kind of push most people never get. It’s not just about the money—it’s about learning to take initiative, to step into intimidating environments, and to make decisions with real consequences.

So, you march down to Merrill Lynch in Westwood Village. The lobby is intimidating. You’re ignored, maybe even dismissed. But you don’t give up. You cross the street to Dean Witter Reynolds, where a young broker named Ciero greets you. He doesn’t just help you buy 14 shares of Columbia Pictures—he gives you your first real lesson in the stock market. This is mentorship in action, and it’s a hidden lever in true financial education.

For the next three years, you call Ciero every weekday from a junior high payphone, dropping in two dimes to get your daily market update. Sometimes, you swing by the office for another impromptu lesson. These moments, messy and imperfect as they are, lay the foundation for lifelong investment strategies and habits. Research shows that early exposure to financial concepts, even in small doses, sparks curiosity and builds the confidence needed to make bigger moves later on.

What’s striking is how much of this comes down to audacity. If you don’t ask, you don’t get. If you don’t take the risk, you don’t learn. Generosity and mentorship—sometimes from the most unlikely sources—can steer your financial learning in formative years. And it’s these small, repeated risks that build your financial muscle, not just reading about grand strategies.

Modern wealth building strategies still echo these lessons. Starting early, investing consistently, and seeking advice—these are the foundations of financial planning. Whether you’re launching an ecommerce business or calling your broker from a payphone, the path is rarely smooth. But it’s the messy beginnings that stick, shaping your approach to money for life.

Section 5: Embracing Rejection: Why Risk is the Most Undervalued Wealth Tool

When it comes to wealth building strategies, most people focus on the obvious: budgeting, investing, and saving. But there’s a less talked-about ingredient that separates those who simply get by from those who achieve outsized rewards—risk taking. Not just any risk, but the kind that makes you uncomfortable, the kind that puts your ego on the line and exposes you to public failure (9.01-9.35).

Let’s be honest: most people avoid situations where they might be rejected or embarrassed. Whether it’s asking for a raise, pitching a business idea, or even starting a conversation with a stranger, the fear of public failure is real. But here’s the thing—the rewards go to those who are willing to risk that failure. As Scott puts it,

“Unless you’re willing to take an uncomfortable risk, nothing wonderful is ever going to happen to you.”(9.31-9.35).

Uncomfortable Risks: The Price of Outsized Rewards

Think about the moments that change your life. They rarely happen while you’re playing it safe. Scott shares a personal story: he promised himself he would approach a woman at a hotel pool, despite feeling awkward and exposed. He did it anyway, and 18 months later, their first son’s middle name became “Raleigh”—after the hotel where they met (9.01-9.30). This isn’t just about romance; it’s about the willingness to step into discomfort, to risk rejection, and to see what happens.

Public Failure: The Unspoken Teacher

Most people won’t risk public failure, so the rewards of entrepreneurship and bold action go to those who do. Scott ran for student government four times and lost every single election. Instead of quitting, he used each loss as a lesson in resilience (11.58-12.10). Research shows that taking risks and learning from failure increases your chances of wealth maximization. Every rejection, every failed campaign, is a step toward building the kind of confidence and grit that money alone can’t buy.

Salespeople: Masters of Enduring Rejection

In any organization, salespeople are often the most “overcompensated.” Why? Because they endure more rejection than anyone else. They pick up the phone, get told “no” a hundred times, and keep going (11.26-11.47). That willingness to eat rejection for breakfast is what makes them so valuable. It’s not just about working hard or being smart; it’s about being willing to fail in public, over and over again.

Small, Sustained Risks Unlock Big Doors

It’s not always about grand gestures. Sometimes, wealth building strategies are about small, sustained risks—expressing interest, seeking mentorship, starting a side business. These actions might seem minor, but over time, they open doors that staying safe never will. Studies indicate that financial discipline and a willingness to invest early and often are crucial, but so is the courage to step outside your comfort zone.

- Approaching strangers can lead to life-changing relationships.

- Pitching investors, even if you get rejected, builds resilience.

- Running for office and losing teaches you more than winning by default.

Ultimately, risk taking is the most undervalued tool in your wealth-building arsenal. If you want to maximize your financial and personal growth, you have to be willing to look foolish, to be rejected, and to keep going anyway. That’s where the real rewards are hiding.

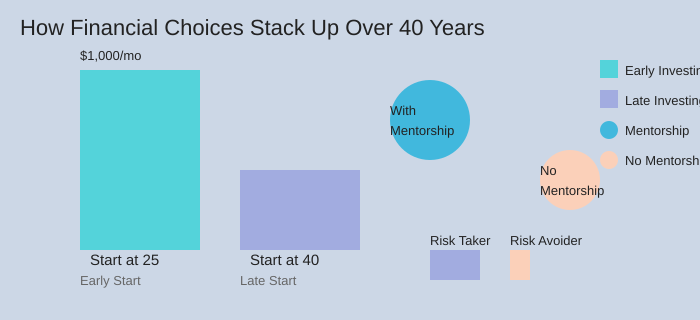

Section 6: Tables and Comparisons — How Financial Choices Stack Up

When it comes to wealth maximization, the numbers tell a story that’s often more powerful than any motivational speech. Let’s break down how your financial choices—when you start investing, who you learn from, and how you handle risk—can shape your long-term financial security. The data and stories here aren’t just abstract concepts. They’re real-life lessons that can help you refine your savings plan and make smarter moves for your future.

Early Investing vs. Late Investing: The Power of Time

If you’ve ever wondered whether it’s too late to start investing, consider this: investing $1,000 a month starting at age 25, and continuing for 40 years, can lead to dramatically different results compared to waiting until you’re 40 to begin (1:04-1:13). Research shows that the earlier you start, the more you benefit from compound interest. The difference isn’t just incremental—it’s exponential.

Why? Because compound interest rewards consistency and time. Even if you think you need to wait until you have a “million” to start, the reality is, you build that million by starting with what you have—whether it’s $500 or $1,000 (1:16-1:23). This is why a disciplined savings plan is at the heart of effective financial planning.

Transparency and Mentorship: The Hidden Edge

Another often-overlooked factor in wealth maximization is transparency. Rich people talk about money, while most others are taught to keep it private (3:30-4:07). When you’re open about your finances, you gain access to information and opportunities—like learning about investment costs or new savings strategies—that others miss. Mentorship, too, can be a game-changer. Imagine being 13 and having someone hand you $200 to buy your first stock, then guiding you through the process (7:37-8:43). That early exposure and support can set you on a path to financial literacy and confidence.

Risk Tolerance: Persistence Pays Off

Finally, let’s talk about risk. Most people avoid it, fearing public failure or rejection. But as the stories show, those who persist—whether running for student office and losing repeatedly (11:58-12:10), or starting a business and facing setbacks—are the ones who ultimately see outsized returns. The willingness to endure discomfort and keep going is a trait that separates the financially secure from the rest.

In sum, your financial planning decisions—when you start, how open you are, who you learn from, and your risk appetite—stack up over decades. And remember, research indicates that keeping investment costs low is vital to maximizing your returns. The earlier you start, the more you talk, and the more you risk (wisely), the better your odds of building lasting wealth.

Section 7: Wild Card Wisdom — Uncomfortable Advice That Works

When it comes to Wealth Growth, most people stick to the safe, familiar advice: save more, spend less, invest wisely. But what if the real unlock to building wealth is something far more uncomfortable? Let’s talk about radical Transparency—the kind that makes people squirm. Almost no one practices it, especially when it comes to personal finances. Yet, this odd habit might be the secret ingredient to meaningful Financial Discipline and long-term success.

What If Everyone Talked Openly About Money?

Imagine a world where your social group discussed money as openly as they talk about weekend plans. What would change? For one, peer learning would skyrocket. People would swap strategies, warn each other about pitfalls, and celebrate wins together. Research shows that open conversations about finances can increase Financial Education and discipline, helping everyone make smarter decisions. In fact, if openness increased peer learning and financial discipline by even a modest percentage, the ripple effect on Wealth Growth could be massive.

Squeeze Every Drop: The Lemon Analogy

There’s a quote that sums up this approach:

'Why wouldn’t you live out loud? Why wouldn’t you squeeze so much juice from this lemon called life?'(10.41-10.44). The idea is simple—don’t just settle for what’s comfortable. Squeeze every last drop out of life, including its financial lessons. That means taking risks, asking uncomfortable questions, and learning from every awkward moment.

Risk Taking: The Uncomfortable Path to Wealth

Here’s the reality: most people aren’t willing to take uncomfortable risks that might result in public embarrassment (10.49-10.55). Whether it’s pitching a new business, asking for a raise, or admitting you don’t understand a financial concept, the fear of rejection holds many back. But as the transcript points out, the reason entrepreneurs and top salespeople often see outsized returns is because they’re willing to endure rejection and public failure (10.15-10.39). They’re not just risk-takers—they’re risk-endurers.

- It’s embarrassing to get rejected by a potential investor.

- It’s awkward to admit you lost money on an investment.

- It’s tough to start a business and watch it fail.

But these are the very experiences that teach the most valuable lessons in Financial Education and discipline. The people who are willing to face these moments head-on are often the ones who unlock the greatest opportunities (10.49-11.26).

Turning Embarrassment and Rejection Into Assets

What if you saw embarrassment and rejection not as threats, but as assets? The most overcompensated people in organizations are often the salespeople—those who are willing to hear “no” again and again, and still show up the next day (11.26-11.47). They’re compensated not just for their skill, but for their resilience. This is the ultimate trio for achieving meaningful financial returns: Money talk, risk, and resilience.

Strange but true: embracing public awkwardness is often the secret ingredient to wealth. If you can learn to live out loud, to squeeze every lesson from life’s lemons, and to see rejection as a stepping stone, you’re already ahead of the game. Financial Discipline isn’t just about budgets and spreadsheets—it’s about staying open and resilient, even when it feels uncomfortable. And that’s a lesson almost no one teaches, but everyone can benefit from.

Frequently Asked Questions (FAQ)

When it comes to Wealth Building, there’s no shortage of questions—especially about what actually works, what’s just noise, and how to handle the awkward parts of talking about money. Let’s dive into some of the most common questions people have about Financial Planning, Risk Taking, and setting Financial Goals, drawing from both research and real-world lessons (see transcript references 0:00-12:10).

What’s the single best investment someone in their 20s can make?

It’s tempting to look for a magic stock or a hot new crypto, but the truth is much simpler—and, honestly, a bit boring. According to Scott Galloway (0:02-0:09), the most powerful way to build wealth early is to take advantage of your flexibility and time. That means investing early and often, letting compound interest work its magic. Research shows that starting an ecommerce business is also a top wealth-building strategy for 2025, but the real secret is to start investing whatever you can—even if it’s just a small amount. Over decades, that discipline pays off exponentially.

How do I overcome the fear of talking about money with friends or at work?

Money talk is taboo for many, especially outside wealthy circles (3:30-4:44). But the reality is, transparency is a huge advantage. Rich people talk about money; everyone else is told not to. If you want to get better at Financial Planning, start having honest conversations about salary, investments, and mistakes. The more you talk, the more you learn—and the less intimidating it becomes. As Galloway puts it, “To be good at something, you need to understand it, and to understand it, you need to talk about it.”

Is it too late to start building wealth if I’m over 40?

Absolutely not. The idea that you’ve missed your shot is a myth (1:23-1:26). While starting young gives you more time for compounding, focusing on what you can control—like spending, saving, and investing consistently—still leads to meaningful results. Research indicates that prioritizing retirement savings and building an emergency fund are key steps at any age. It’s never too late to set new Financial Goals and pursue Wealth Building.

How does privilege affect my financial options, and what can I do about it?

Privilege is real and often invisible to those who have it (6:00-6:12). Access to education, networks, and even timing can create unfair advantages. But recognizing this isn’t about guilt—it’s about awareness. If you have privilege, use it to help others and make smart choices. If you don’t, focus on what you can control: building skills, seeking mentors, and staying persistent. As Galloway notes, sheer luck and environment play a role, but commitment and discipline matter, too.

What’s a practical way to get better at accepting rejection or failure in my financial life?

Rejection is part of the process, whether you’re pitching a business, asking for a raise, or making investments (9:31-11:54). The most successful people are often those willing to take uncomfortable risks and endure public failure. Remember: most people aren’t willing to put themselves out there, and that’s why outsized rewards go to those who do. The more you practice, the less it stings—and the more you grow.

Why is discipline more important than income when it comes to wealth building?

It’s easy to think that making more money is the answer, but discipline is what really moves the needle (0:47-0:56). Most people spend everything they earn. The difference between those who build wealth and those who don’t often comes down to the ability to save and invest consistently, regardless of income. Creating a realistic budget, sticking to it, and keeping investment costs low are proven strategies for Wealth Maximization.

In the end, Wealth Building isn’t about luck or secrets—it’s about habits, transparency, and the willingness to take risks. Start where you are, talk openly about money, and keep moving forward. The art (and oddity) of getting rich is that it’s often simpler, and more uncomfortable, than anyone ever tells you.

TL;DR: Building wealth isn’t just about what you earn; it’s about discipline, transparency, risk, and a pinch of luck. Talk about money, embrace uncomfortable risks, and stick to what works—even if it’s boring.

A big shoutout to The Diary Of A CEO for the enlightening content! Take a look here: https://youtu.be/rKOx5qlLyaA?si=jqc10z-OtxuOhZNT.

Post a Comment