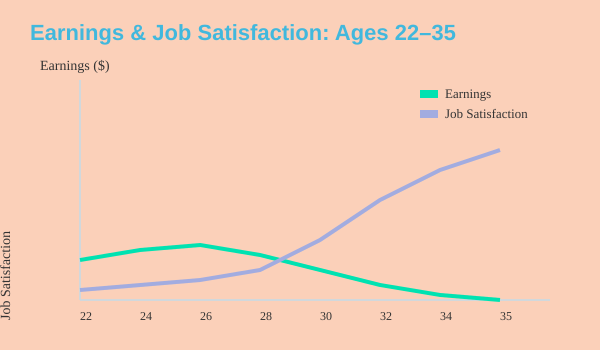

Picture this: You're 24, stuck in a job you barely tolerate, sipping bad coffee before sunrise and wondering—seriously—if anyone ever gets rich just working for a salary. Codie Sanchez would probably smirk and tell you, 'Absolutely—but not if you’re looking for shortcuts or avoiding hard work.' This isn't another hustle-culture sermon. It’s a real talk on why delayed gratification, embracing crappy years, and chasing not Lambos but learning will put you miles ahead. As someone who spent their own 20s collecting headaches on Wall Street, only to find freedom in buying "boring" businesses, Sanchez’s unconventional path might be exactly what you need to hear—imperfections and all.

When Your 20s Suck (And Why That’s Perfect for Wealth Creation)

Let’s get real: nobody warns you that your 20s are supposed to be hard. The glossy Instagram feeds and TikTok success stories rarely show the ramen dinners, the cramped apartments, or the 12-hour days grinding away at jobs you barely tolerate. But as Codie Sanchez—former Wall Street investor and author of Main Street Millionaire—points out, this struggle is not only normal, it’s essential for wealth creation and long-term financial freedom (9.21–9.25).

Sanchez is blunt: “

'The best advice for a 20-year-old is to realize that your 20s do suck.'” (9.47–9.50). You’re likely working a $65,000-a-year job (if you’re lucky), answering to tough bosses, and feeling like you have no time for yourself. Maybe you’re living with roommates in Brooklyn, eating cheap takeout, and wondering if this is what adulthood is supposed to feel like. It is. And that’s actually a good thing.

Why? Because, as Sanchez’s own Wall Street grind shows, real growth comes from pain, not play. The discomfort you feel in your 20s—whether it’s from low pay, long hours, or a job you don’t love—isn’t a sign you’re failing. It’s a sign you’re building the stamina and skills that will pay off later (9.34–9.40). Research shows that enduring these tough years is a universal experience, and it’s healthy. This is the phase where you acquire the skills and experience that set the foundation for future wealth.

There’s a trap, though, and it’s easy to fall into: chasing big money too early. Sanchez admits that focusing on earning instead of learning is a huge mistake (11.01–11.09). “The only thing you should focus on is learning—how can I think about my salary like putting pieces of cash into my brain?” she says. The real value in your 20s is mentorship and experiential learning, not a fat paycheck. Studies indicate that those who prioritize mentorship and skill-building in their early careers see higher long-term earnings and greater financial freedom.

It’s normal to endure tough bosses, low pay, and relentless work schedules. In fact, your physical and mental stamina peaks now. As Sanchez jokes, you can’t deadlift your financial future at 50 like you can at 23 (11.41–12.07). So, if you’re working 12-hour days, know that this is the season for it. You’re building a work ethic that will serve you for decades.

Sanchez’s own journey is proof. She admits that the party scene and hanging out with the wrong crowd didn’t help. What made the difference? Finding mentors, asking questions, and soaking up every lesson—even when it hurt (9.52–9.58). That’s where the seeds of wealth creation are planted.

So, if you’re in your 20s and life feels like a never-ending grind, remember: this is exactly where you’re supposed to be. Embrace the struggle, focus on learning over earning, and seek out mentors. These years are the foundation for the financial freedom you’ll enjoy later.

The Truth About Getting Rich on a Salary (and Where Side Hustles Come In)

Can you really achieve financial freedom by relying on your salary alone? According to Codie Sanchez, the answer is a resounding yes—if you use your salary as a tool, not an endgame (0:00-0:06). The myth that you need to be born wealthy or stumble upon a get-rich-quick scheme is just that—a myth. Instead, Sanchez emphasizes discipline, strategic investment, and the willingness to start small as the real keys to Salary Wealth Building and long-term cash flow.

Why Your Salary Is More Powerful Than You Think

Many people underestimate the power of their paycheck. Sanchez points out that millions have achieved financial freedom by steadily investing their salary income into businesses or assets (Data). Your salary is the starting capital that can fund your first steps into side hustles or even business acquisition. As she puts it, “Money is just a tool—it’s a tool in your toolbox for you to be able to have more freedom to do more things and to say no more often” (6:29-6:34).

Debunking the Get-Rich-Quick Myth

If you’re looking for shortcuts, Sanchez is blunt: “It’s only not accessible to you if you’re a lazy piece of [__] that wants to do nothing” (0:08-0:12, 7:03-7:07). Her approach is rooted in reality, not hype. She stresses that none of this is rocket science, but it does require work, learning, and a willingness to endure some discomfort—especially in your 20s (0:37-0:42). The upfront pain of hard work and learning pays off in the long run.

How to Turn Your Salary Into Cash Flow

Sanchez recommends maximizing your salary and investing in what she calls “gateway drug” businesses—simple, cash-flowing side hustles that are manageable even for beginners (1:11-1:15). These small businesses are the perfect entry point for anyone looking to escape the paycheck-to-paycheck cycle. The key is to start small, learn the ropes, and reinvest your side earnings to accelerate your journey toward asset ownership and greater cash flow.

You Don’t Need to Be Rich to Buy a Business

One of the biggest misconceptions is that business acquisition is only for the already wealthy. Sanchez argues there are far more opportunities than most people realize, and you don’t need a fortune to get started (1:19-1:23). Creative deal-making, leveraging partnerships, and even sweat equity are all viable paths. Research shows that transitioning from employee to business owner is possible for anyone willing to work and learn.

Three Main Ways to Buy a Business

- Leverage: Using borrowed funds or seller financing to acquire a business.

- Investing Savings: Putting aside a portion of your salary to build up capital for acquisition.

- Sweat Equity: Trading your time, skills, or management for ownership stakes.

| Strategy | Description | Impact on Wealth Building |

|---|---|---|

| Steady Salary Investment | Investing salary into businesses or assets | Millions have achieved financial freedom this way |

| Business Acquisition | Leverage, savings, or sweat equity | Accelerates cash flow and asset ownership |

| Combining Salary & Side Hustles | Using salary to fund side businesses | Multiplies growth trajectory |

Ultimately, Sanchez’s message is clear: anyone—regardless of starting wealth—can become wealthy by combining their salary with smart investment strategies and business ownership. The path is open to those who are willing to put in the work, learn, and take calculated risks.

Business Acquisition: Boring Is the New Sexy (Especially for Financial Freedom)

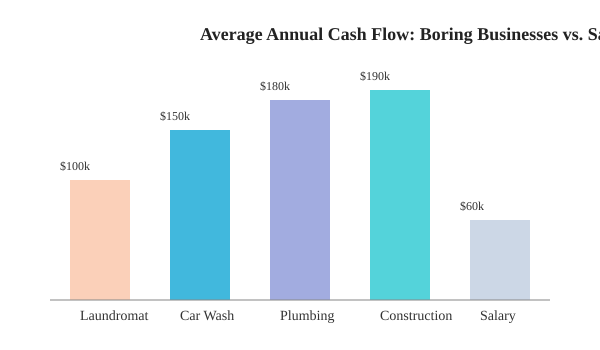

When you think about Business Acquisition, your mind might jump to flashy startups or the next tech unicorn. But what if the real path to becoming a Main Street Millionaire is hiding in plain sight—inside overlooked businesses like laundromats, car washes, or local plumbing companies? Codie Sanchez, through her journey and teachings, proves that financial freedom isn’t rocket science. In fact, it’s often found in the “boring” corners of Main Street, where most people aren’t even looking (8.20-8.27).

During the pandemic, a cultural shift took place. People left big cities, traded corporate commutes for fresh air, and started noticing the value of small, community-focused businesses (8.27-8.56). Codie was ahead of this curve—she’d been investing in these types of businesses for years. What seemed unglamorous to most became her secret weapon for building serious cash flow and, ultimately, financial freedom.

Let’s break down why these “boring” businesses are so powerful:

- Consistent Cash Flow: Research shows that laundromats and car washes can generate over $100,000 in net profit per year for their owners. That’s not a side hustle—that’s a life-changing income stream.

- Overlooked Opportunities: While everyone else chases the next big thing, overlooked businesses quietly deliver reliable wealth. Codie Sanchez’s portfolio is proof: she’s built a holding company worth nine figures by focusing on what others ignore.

- Creative Acquisition: You don’t need to be rich to start. There are three main ways to buy a business: using leverage (like loans), forming partnerships, or offering sweat equity. These strategies open the door for everyday people to step into business ownership (1.23-1.34).

- Scalable Freedom: Owning multiple small businesses multiplies your options. It’s not just about money—it’s about lifestyle, flexibility, and generational wealth.

Codie’s message resonates with millions. Her online audience now tops 7 million subscribers, all eager to learn how to spot and seize these overlooked opportunities (1.30-1.49). She’s created a movement, showing that Main Street is bursting with potential for those willing to look beyond the obvious.

"The only way to have freedom is through ownership and the world doesn’t want to give it to you." – Codie Sanchez

It’s not just about buying any business—it’s about finding the right ones. Key industries like plumbing, construction, and laundromats are often recession-resistant and essential to their communities. Studies indicate that managing several of these businesses at once can lead to exponential cash flow growth, far outpacing the average traditional salary.

Below, you’ll find a visual comparison of the average annual cash flow from select “boring” businesses versus a typical salary. The numbers speak for themselves: overlooked businesses are reliable wealth creators, and with the right approach, anyone can leverage creative deal-making to change their financial trajectory.

With the market primed for generational wealth creation, the Main Street Millionaire mindset is more relevant than ever. Codie Sanchez’s story is living proof that you don’t need to invent the next big thing—you just need to see value where others see boredom.

Why Nobody Trusts the Old Gatekeepers—And What That Means for Your Wealth

Take a look at the media landscape today, and you’ll notice something that would have seemed unthinkable just a decade ago: Media Trust is at an all-time low, especially among younger generations. If you’re in your 20s or 30s, chances are you trust a social media influencer more than a news anchor on CNN or Fox. This isn’t just a hunch—it’s backed by hard numbers and recent trends. In May, CNN’s prime-time viewership hit a record low, drawing just 83,000 viewers for a full week of three-hour segments (4.58-5.28). Even Fox, historically the ratings leader, only managed 186,000 viewers in the same period. These figures are a clear signal: the old gatekeepers are losing their grip.

| Network/Source | Weekly Prime-Time Viewers (May) |

|---|---|

| CNN | 83,000 |

| Fox | 186,000 |

| 30-year-olds' Trust | Social media influencers > Mainstream media (historical first) |

So, what’s behind this shift? Research shows that skepticism toward big corporations and traditional institutions is at an all-time high. For the first time ever, as Codie Sanchez points out, “30-year-olds right now for the first time ever have more trust in social media influencers than the mainstream media” (5.39-5.47). This isn’t just about news; it’s about Authenticity and Personal Branding. People crave real conversations, not scripted teleprompter moments. They want advice from someone who’s walked the walk, not just talked the talk.

This climate of distrust creates a unique opportunity for you. You’re no longer bound to the advice of faceless institutions or corporate talking heads. You can be your own boss—and your own news source. The rise of creators like Codie Sanchez is no accident. Her unfiltered, honest approach resonates with those who are tired of being sold a narrative. She’s built a loyal following by showing exactly how she creates Financial Freedom and Wealth Creation through acquiring cash-flowing businesses, not just talking about it.

In fact, research indicates that declining institutional trust is fueling the demand for honest, relatable financial advice. Leaders who embrace transparency and authenticity are building stronger, more loyal audiences. Codie’s messaging taps directly into the “show me what’s real” demand, offering practical strategies for wealth that anyone can follow. Her story proves that you don’t need to be born into money or have an Ivy League degree to achieve financial freedom. You just need to be willing to look beyond the old gatekeepers and trust in new, more authentic voices.

For anyone interested in building a personal brand or seeking new paths to wealth, the lesson is clear: Authenticity is your greatest asset. In a world where trust is scarce, being real isn’t just refreshing—it’s a competitive edge.

“30-year-olds right now for the first time ever have more trust in social media influencers than the mainstream media.” – Codie Sanchez

You’re Not Lazy, You’re Just Undirected: Hustle Culture Revisited

Let’s get straight to it: according to Codie Sanchez, the only people truly excluded from building financial freedom through entrepreneurship are those who simply refuse to act (7.03-7.05). If you’re looking for a shortcut, a magic formula, or a way to get rich without putting in the work, Sanchez is clear—this isn’t for you. She says bluntly, “If you really want only to be given things, you want to ask permission all the time, and you aren’t willing to work a little bit earlier in the morning and work a little bit later in the evening, then you should turn this off” (7.07-7.18). Her message? Work ethic is non-negotiable.

There’s no “get-rich-quick” scheme here. Instead, Sanchez’s approach is about showing up early, staying late, and doing the hard things most people avoid. The reality is, wealth creation isn’t rocket science (7.39-7.41). It’s about consistent action, learning from mistakes, and adapting as you go. Research shows that the biggest barrier for most people isn’t their circumstances—it’s their unwillingness to take action and stick with it. Hard work, not luck or timing, is what separates those who achieve financial freedom from those who don’t.

Sanchez often says, “Choose your hard: it sucks being broke just as much as it sucks working hard” (3.54-3.58). This tough-love wisdom has struck a chord with millions. Her audience spans across social media, proving that her message resonates deeply in today’s culture (4.01-4.06). People are hungry for real talk about entrepreneurship and wealth creation—not empty promises, but practical advice that acknowledges the grind.

One of Sanchez’s core beliefs is that if you opt out of ownership, you’re playing a rigged game. When you don’t own your path—whether that’s a business, your time, or your decisions—you’re letting someone else set the rules (4.30-4.34). Ownership is about choosing hard work over hard times. It’s about taking control, even when the path is uncertain.

But here’s the kicker: you don’t need a perfect plan. Sanchez emphasizes that action, paired with relentless learning, always beats waiting for the “right” moment or the “perfect” strategy. Paralysis by analysis is just another form of inaction. The most successful business owners aren’t the ones who never make mistakes—they’re the ones who learn, adapt, and keep moving forward.

Of course, Sanchez is no stranger to burnout. She’s candid about her own struggles—sometimes powering through with sheer stubbornness, other times relying on caffeine and grit. Her journey is a reminder that imperfection is reality. Everyone stumbles. What matters is getting back up, learning, and pressing on.

In the end, Sanchez’s tough-love approach isn’t for the faint of heart. If you want easy, look elsewhere. But if you’re ready to put in the work, the path to financial freedom and wealth creation is open—even if it’s bumpy. Her message is simple:

“Choose your hard: it sucks being broke just as much as it sucks working hard.” – Codie Sanchez

Lessons in Deal Making and Networking: The 'Apprenticeship Advantage'

When you think about wealth creation in your 20s, it’s tempting to chase flashy trends—crypto, fast cars, or instant entrepreneurship. But as Codie Sanchez makes clear in Main Street Millionaire, the real shortcut to financial freedom isn’t about skipping steps. It’s about finding the right mentor and learning the art of deal making and networking strategies from the ground up (0.27-0.35).

“Step one: you get with the biggest, baddest guy or gal you can find who’s already successful and you do everything possible to provide value to them.” – Codie Sanchez

That’s the first lesson: seek proximity to success. Instead of asking what someone can do for you, flip the script. Ask yourself, “How can I solve a problem for this person?” This is the core of value-based networking. It’s not about schmoozing or handing out business cards at every event. It’s about identifying someone who’s already where you want to be—and then making yourself indispensable to them (0.35-0.39).

Codie’s own turning point came when she found a mentor on Wall Street who, as she puts it, “had zero patience for excuses.” The lessons she learned there weren’t found in any textbook. Instead, she traded her free time, weekends, and comfort for real-world experience—learning how to spot opportunities, negotiate deals, and build relationships that would last a lifetime (0.39-0.54).

Research shows that early mentorship and strategic networking are strongly correlated with long-term financial success. In fact, Sanchez’s approach is built on the idea that providing value to successful people is the fastest shortcut to getting your foot in the door. This “apprenticeship model” outperforms traditional classroom learning when it comes to building actual wealth. Her early mentors didn’t just teach her about business—they shaped her entire investment and business acquisition philosophy.

But let’s be honest: your 20s will probably suck if you’re doing this right. You’ll sacrifice free time, social outings, and maybe even sleep. Codie is upfront about this: “Upfront pain always leads to long-term gain” (0.54-1.00). Instead of focusing on how much money you’re making right now, focus on how much you’re learning. The skills you gain by working closely with experienced business owners—watching how they negotiate, seeing how they solve problems—will pay off exponentially down the road.

It’s also important to remember that networking isn’t just about making friends or collecting contacts. It’s about problem-solving for someone above your pay grade. If you can figure out what keeps your mentor up at night and help them fix it, you’ll become invaluable. That’s how doors open in business—by adding value first, not by asking for favors.

As Sanchez’s own story shows, deal making and mentorship aren’t just buzzwords. They’re the foundation of sustainable entrepreneurship. Her audience and opportunities grew massively by applying these networking strategies, and her framework has helped build a nine-figure holding company. The lesson? Don’t try to go it alone. Find someone who’s already successful, add value, and let the apprenticeship advantage work its magic.

Quick Comparison: Salary-Only vs. Side-Business Ownership (Table)

When you start thinking about Wealth Creation, the first question that often comes up is: should you stick to a traditional salary, or should you branch out into Business Acquisition and side hustles? Codie Sanchez, in her book and interviews, makes it clear that while both paths can lead to financial security, the difference in long-term outcomes is dramatic—especially when you factor in the compounding power of Cash Flow from business ownership.

What’s the Real Difference Over a Lifetime?

Let’s break it down with real numbers. Imagine you start your career earning $65,000 a year. If you’re diligent, you might see 3% raises annually. Over 25 years, that adds up to about $2.5 million in gross income. Not bad, right? But here’s where things get interesting.

Suppose instead you take Codie’s advice and invest $20,000 a year from your salary into acquiring or building a cash-flowing business on the side. By year 10, that business could be generating $100,000 a year in net income. Over the next 15 years, that’s an extra $2 million (or more) in net income—on top of your salary. Research shows that the compounding returns from business investments can far outpace even generous annual raises from a regular job.

Why Do Salary-Only Careers Plateau?

A salary gives you predictability, but it also comes with a ceiling. Most jobs, even with steady promotions, eventually hit a plateau—your earning trajectory flattens out. Codie Sanchez points out that you can absolutely become a millionaire with just a salary, but it requires relentless discipline, smart investing, and a willingness to avoid lifestyle creep.

However, business ownership introduces a different dynamic. Not only can your income scale much faster, but you also build equity in something that can be sold or passed on. As Codie says, “The only way to have freedom is through ownership and the world doesn't want to give it to you.” This ownership is what creates both wealth and the flexibility to design your own life.

Work/Life Balance and Cash Flow Security

It’s easy to assume that running a business means sacrificing your personal life. In reality, once your side business is established, it can provide more flexibility than a traditional job. You’re not just trading time for money—you’re building systems and teams that generate income, even when you’re not working. That’s the power of Cash Flow from business ownership.

On the other hand, a salary offers stability, but it’s tied to your continued employment. Lose your job, and the cash flow stops. With a business, you have multiple levers to pull: you can grow, sell, or even step back and let others run the day-to-day.

Sample Numbers: The Compounding Effect

- Salary Earner: $65,000/year starting salary, 3% annual raise, 25 years = ~$2.5M gross income

- Small Business Owner: $65,000/year salary, invests $20,000/year into a side business; business grows to $100,000/year net by year 10, compounded over 15 years = $2M+ additional net income

The numbers speak for themselves. The compounding effect of investing your income into business ownership leads to significantly greater wealth over time than relying on salary alone. As Codie Sanchez demonstrates, Salary vs. Business isn’t just about money—it’s about creating options, autonomy, and a life you control.

Media Trust Metrics and Shifting Influence (Table)

If you’ve ever wondered why it feels like fewer people trust the news these days, you’re not alone. The numbers tell a striking story. In May, CNN’s prime-time weekly viewership dropped to a historic low—just 83,000 viewers tuning in for their three-hour evening slot over an entire week (5.25-5.28). Even Fox, which led the pack, only managed 186,000 viewers in the same period (5.31-5.33). For context, that’s less than the population of many small towns. It’s a far cry from the days when millions gathered around their TVs for the nightly news.

So, what’s really happening here? The answer lies in a dramatic shift in media trust. According to the transcript (5.39-5.47), for the first time ever, 30-year-olds trust influencers—yes, people like you see on Instagram, YouTube, or TikTok—more than they trust traditional media outlets. This isn’t just a blip; it’s a generational turning point.

Why does this matter, especially if you’re thinking about personal branding or wealth creation? Because the gatekeepers of information and advice have changed. Where people once looked to anchors and journalists for guidance, now they’re turning to real conversations and peer-led advice. As Codie Sanchez points out, this shift is opening up new opportunities for authentic voices to break through—especially in areas like finance and entrepreneurship, where trust is everything.

The Decline of Mainstream Media Trust

Let’s break down what’s driving this change. First, there’s the sheer drop in viewership. When only 83,000 people are watching a major network like CNN during prime time, it’s clear that traditional media is losing its grip on the public’s attention. This isn’t just about numbers—it’s about credibility. Research shows that younger generations are skeptical of media gatekeepers, often perceiving them as out of touch or biased.

- CNN prime-time weekly viewers: 83,000 (May, all-time low)

- Fox prime-time weekly viewers: 186,000 (May)

- Trust metric: 30-year-olds now trust influencers more than traditional media (5.41-5.47)

The Rise of Influencers and Peer-Led Advice

At the same time, influencers are stepping in to fill the void. They’re not just entertainers—they’re educators, mentors, and trusted advisors. For many, following a favorite creator is more personal and relatable than listening to a distant news anchor. This is especially true in the world of finance, where people crave honest, actionable advice.

Codie Sanchez’s approach, as highlighted in Main Street Millionaire, taps directly into this trend. She’s built a brand around demystifying wealth creation—showing that you don’t need to be born into money or have a fancy degree to succeed. Her message resonates because it feels real, and because it’s delivered outside the traditional media machine.

“The media is no longer actually reaching the masses because they’ve lost complete trust with them. In fact, 30-year-olds right now, for the first time ever, have more trust in social media influencers than they do the mainstream.” (5.35-5.47)

This shift in media trust isn’t just a trend—it’s a new reality. For anyone interested in building a personal brand or pursuing financial freedom, understanding this landscape is crucial. The old rules don’t apply anymore, and the opportunities for authentic, peer-led influence have never been greater.

FAQ: Your Main Street Millionaire & Codie Sanchez Questions Answered

Curious about building wealth through small business ownership or what it really takes to become a Main Street Millionaire? Codie Sanchez’s approach, rooted in real experience and practical advice, has helped thousands demystify the process of business acquisition and wealth creation. Here are answers to the most common questions, drawing directly from Codie’s strategies and philosophy.

Can anyone really buy a business without being rich?

Absolutely. Codie Sanchez is living proof that you don’t need to be born wealthy to acquire a business. She emphasizes that resourcefulness is more important than resources. Through seller financing—a method where you pay the seller from future profits instead of upfront cash—over 60% of small business deals in the U.S. are closed without massive capital. Codie recommends starting with accessible, cash-flowing businesses like laundromats or window cleaning services, which often require little money down and can be acquired through sweat equity or creative deal-making.

What’s the hardest part of becoming a Main Street Millionaire?

It’s not rocket science, but it is hard work. Codie says, “Choose your hard.” Being an owner means facing tough moments, like making payroll or managing crises. But the alternative—remaining broke or stuck in a job you dislike—has its own challenges. The key is resilience and a willingness to learn from every setback. As Codie puts it, “The only way to have freedom is through ownership and the world doesn't want to give it to you.”

How do I avoid get-rich-quick scams while pursuing wealth?

Codie is clear: there are no shortcuts. If someone promises easy money, run the other way. Instead, focus on building real skills, understanding the mechanics of business acquisition, and investing in “boring” businesses that generate steady cash flow. Research shows that transparent, experience-driven advice—like Codie’s—helps you avoid costly mistakes and spot red flags early.

Why do most people fail at side businesses?

Many fail because they chase trends or viral ideas instead of solving real problems. Codie recommends looking for a 20-30% referral or review rate in your business. If customers aren’t recommending you, it’s likely a product problem, not a marketing one. Start small, iterate quickly, and focus on value creation over hype.

How do I know if business ownership is for me?

If you crave autonomy, are willing to work hard, and want to control your financial destiny, business ownership could be your path. Codie suggests starting by working for entrepreneurs to learn the ropes, then gradually taking on more responsibility. Ownership isn’t for everyone, but if you’re willing to “front-load pain” in your 20s for greater rewards later, you’re already thinking like a Main Street Millionaire.

What’s one thing Codie Sanchez wishes she’d known at 22?

She wishes she’d understood the power of proximity and “economic interconnectedness.” Surrounding yourself with ambitious, successful people can raise your own standards and opportunities. Codie’s advice: seek out mentors, add value, and never underestimate the impact of your network on your long-term wealth.

Is now the right time to invest in ‘boring’ businesses?

There’s never been a better time. With millions of baby boomer-owned small businesses up for grabs and a massive generational wealth transfer underway, the opportunity is huge. Codie’s research and experience show that these overlooked businesses are the backbone of wealth creation—and they’re accessible to anyone willing to learn and act.

In summary, Codie Sanchez’s Main Street Millionaire philosophy proves that financial freedom isn’t reserved for the elite. With the right mindset, actionable strategies, and a commitment to learning, you can build real wealth through business acquisition and ownership—no rocket science required.

TL;DR: Yes, you can get rich from a salary, but only if you play the long game: work like mad (especially in your 20s), learn obsessively, seek great mentors, invest wisely, and embrace business ownership—especially the overlooked, unsexy kind. Freedom is worth the upfront pain, and Codie Sanchez proves it’s possible for anyone willing to choose their 'hard.'

A big shoutout to The Diary Of A CEO for the insightful content! Be sure to check it out here: https://youtu.be/IYu_PDPqKFc?si=dltupuXrPvvledpF.

Post a Comment