Back in high school, I remember saving up three months’ worth of allowance just to grab the latest console. These days, the same console might cost more than my first used car—and now, with $80 games, microtransactions everywhere, and economic hurdles at every turn, it’s no wonder Gen Z is checking out. Instead of the escapism games used to offer, today’s landscape sometimes feels more like a rigged claw machine than a playground. So what’s really going on, and is there a way out for the gaming world (and the people who love it)? Let's dig in.

Sticker Shock: Game Prices and Gen Z’s Spending Freeze

In 2025, the gaming industry is facing a crisis that few saw coming: a dramatic drop in spending among its youngest and most crucial audience. Rising video game prices, combined with mounting economic pressures, have led to what can only be described as a spending freeze among Gen Z gamers. Once shocked by $70 price tags, players now see $80 as the “new normal” for major releases. But as prices soar, wallets are closing—especially for those aged 18 to 24.

Game Prices Soar, Gen Z Steps Back

The sticker shock is real. According to a June study by Circonana, first reported by the Wall Street Journal, total spending among 18-24 year-olds dropped by 13% from January to April 2025 compared to the previous year. Video game purchases were hit even harder, falling nearly 25% in just a few months. “Young people are so strapped for cash right now that even video games are too expensive for them,” wrote Stevie Bonofield for PC Gamer. This sharp decline is especially surprising given that video games have historically catered to younger audiences.

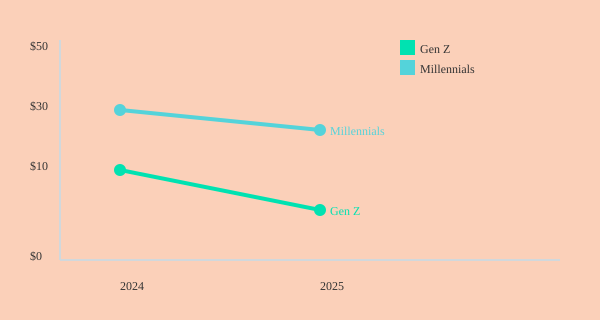

Microtransactions: No Longer a Solution

As full game prices climb, publishers have leaned even harder into microtransactions. But the data shows that microtransactions and gamers are not the solution many hoped for. Less than 35% of Gen Z spends more than $10 per month on microtransactions, compared to 50% of Millennials. In fact, more than 36% of Gen Z gamers reported spending nothing at all on games—double the rate of Millennials, according to Matt Piscatella’s analysis shared on Blue Sky. Microtransactions have become all but mandatory across genres, but they are failing to make up for the decline in full game purchases among young gamers.

Socioeconomic Pressures Squeeze Gen Z

The decline in Gen Z gaming spending is not just about rising video game prices. Socioeconomic factors are playing a major role:

- Student loan payments have restarted for millions, eating into disposable income.

- High living costs and inflation make even small luxuries, like new games, harder to justify.

- Job scarcity means many young grads are struggling to find stable employment.

- Major console prices north of $500 put new hardware out of reach for many newcomers.

Credit card delinquency rates among young adults have also spiked to their highest levels since before the pandemic, compounding the problem.

Gen Z’s Spending Freeze in Context

Gen Z and Gen Alpha now make up 28% of all gamers, with Millennials close behind at 26%. Yet, the difference in spending is stark: while only 18% of Millennials reported spending nothing on games, more than double that number of Gen Z gamers spent nothing at all. When Gen Z does spend, it’s less across the board—less than half per month on microtransactions compared to Millennials. As older generations age out of the hobby and stick to older titles, the industry faces a generational spending collapse.

“Young people are so strapped for cash right now that even video games are too expensive for them.” – Stevie Bonofield, PC Gamer

Monthly Gaming Spend by Age Group (2024-2025)

Chart: Monthly gaming spend (including microtransactions and full game purchases) for Gen Z and Millennials, 2024-2025. Source: Circonana, Matt Piscatella/Blue Sky.

Layoffs, AI Ambitions, and a Shrinking Talent Pool: Industry Crisis Signals

Between 2022 and May 2025, the video game industry has faced an unprecedented wave of layoffs, studio closures, and job market upheaval. Over 35,000 jobs have been lost globally, with some of the most significant cuts coming from major players like Microsoft Xbox, which alone laid off 9,000 employees to prioritize building new AI infrastructure. These mass layoffs are not isolated incidents—they are part of a larger pattern reshaping the entire landscape of AAA game development.

| Metric | Figure | Period |

|---|---|---|

| Video game industry layoffs | 35,000 | 2022-May 2025 |

| Microsoft Xbox layoffs (AI integration) | 9,000 | 2022-May 2025 |

| Digital game sales (share of total) | 95% | 2025 |

AI Integration Levels and the Impact on Gaming Jobs

AI integration in the gaming industry is accelerating, with automation, data analysis, and content generation now central to many studios’ operations. Companies are betting on AI as a solution to rising costs and development bottlenecks. However, this shift comes at a steep price: the creative workforce is shrinking. As studios automate more roles, the number of available jobs drops, especially for entry-level positions.

The impact of AI on gaming jobs is double-edged. While it promises efficiency and faster production cycles, it also means fewer opportunities for human workers. For new graduates, the situation is especially dire. Entry-level roles are disappearing or now demand several years of experience, making it nearly impossible for fresh talent to break in. Many young people, saddled with student debt and promised that a degree would be their ticket into the industry, find themselves locked out of the job market.

Studio Closures and Game Cancellations

The wave of layoffs has led to a domino effect: more studio closures and game cancellations. This not only reduces the number of games being developed but also limits the creative risks studios are willing to take. The AAA development model is being reshaped, with fewer teams working on fewer, safer projects. The result is a less diverse and innovative gaming landscape.

AI Infrastructure: No Savings for Consumers

Despite the promises of AI-driven efficiency, the benefits have not trickled down to consumers. In 2025, 95% of game sales are digital, eliminating many traditional distribution costs. Yet, these savings are not reflected in game prices or product quality. Instead, the focus on AI and automation has primarily served to cut jobs, not costs for players.

"People need jobs to be able to buy things. So, if there’s less people with jobs, there’s less people buying products."

This shrinking talent pool and reduced consumer base create a feedback loop that threatens the industry’s long-term health. As more people lose jobs, fewer can afford to buy games, which in turn pressures studios to cut even more costs—often through further layoffs and automation. The gaming industry crisis is no longer just about technology or business models; it’s about the future of work, creativity, and the very people who make and play games.

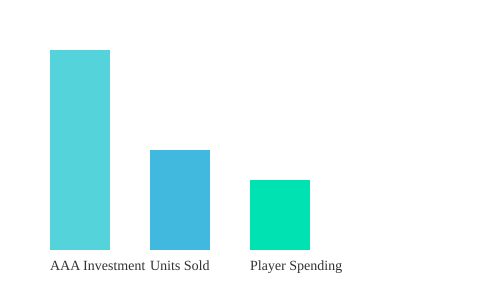

The AAA Paradox: Millions Invested, Fewer Players Interested

The gaming industry in 2025 is facing a unique dilemma: despite the massive size of the gaming industry and record-breaking investments in blockbuster titles, the AAA gaming market is struggling to keep players engaged. According to the latest gaming industry report, nearly 19,000 games were released in 2024, but only about 150 of these were classified as AAA or double A (AA) titles. This small group of high-profile releases accounted for a staggering $13.5 billion in development costs alone, highlighting the growing gap between investment and actual player interest.

AAA Gaming Market Challenges: Big Budgets, Small Returns

On average, a double A game now costs around $30 million to produce, while a single AAA title demands an eye-watering $150 million investment. Publishers are pouring more money than ever into these projects, hoping to capture a wide audience by packing games with every possible mechanic, identity, and message. However, this approach often results in products that feel generic and uninspired, failing to resonate with the core gaming community.

"The reason that their games aren’t selling right now is simple. It’s because they suck and they’re overpriced."

This blunt assessment from a prominent gaming analyst reflects a growing sentiment among players. The rising video game prices—with new AAA releases often launching at $70–$80—are making gamers question the value they receive. Many are turning to older games, mods, or emulation, where they find more enjoyment and better value for their money.

Quality vs. Price: The Value Perception Gap

The gap between the high price tags of new AAA games and the perceived value is wider than ever. Players are increasingly skeptical about paying premium prices for games that, in their view, offer little innovation or replayability. This disconnect is evident in sales numbers and engagement statistics, with many high-budget releases underperforming despite massive marketing campaigns.

Comparing Investment, Engagement, and Spending

| Category | Number of Releases (2024) | Avg. Investment per Title | Player Engagement (Est.) |

|---|---|---|---|

| AAA | 75 | $150 million | Low to Moderate |

| Double A | 75 | $30 million | Moderate |

| Indie/Other | 18,850 | Varies (Low) | High (Niche/Long-tail) |

Key Takeaways from the Gaming Industry Report

- Only 150 out of 19,000 games released in 2024 were AAA or double A, yet they absorbed over $13.5 billion in investment.

- Player engagement and spending are not keeping pace with rising development costs and prices.

- Gamers are increasingly seeking value in older titles, mods, and emulation, bypassing new AAA releases.

The AAA paradox is clear: as publishers invest more in hopes of mass appeal, they risk alienating the very audience they seek to attract, making the challenges in the AAA gaming market more pronounced than ever.

Indie Games, Subscriptions, and the Great Gaming Pivot

The gaming landscape in 2025 is undergoing a dramatic shift, as players and developers alike respond to the turbulence shaking the industry’s foundations. With nearly 150 major releases in the past year, only a fraction—about half—were classified as AAA or double-A titles, each averaging a staggering $30 million in development costs. This high-stakes environment has left many players priced out or disillusioned, fueling a surge in indie games success stories and a renewed focus on affordability and creativity.

Affordable Indie Games: 2025’s Unexpected Heroes

As AAA studios double down on blockbuster formulas, indie developers are seizing the moment. Their games, often priced well below the industry average, offer fresh ideas and unique experiences that resonate with both budget-conscious gamers and those weary of repetitive big-budget releases. In 2025, affordable indie games have become a lifeline for players seeking value and innovation. As one industry observer notes:

"Indie games are gaining success in 2025, with affordable titles attracting players amid financial pressures on AAA game markets."

This trend is visible across digital storefronts and social media, where indie titles regularly top charts and spark viral conversations. The success of these games is not just about price, but about offering something different—whether it’s a new art style, experimental gameplay, or stories that big publishers overlook.

The Game Pass Subscription Model: Redefining Value

The Game Pass subscription model and similar services are fundamentally changing how players access and value games. Instead of paying full price for individual titles, gamers now pay a monthly fee for access to a vast library, including both AAA and indie releases. This shift from ownership to access is particularly appealing in a year marked by economic uncertainty and rising game prices.

Subscription models have also become a powerful platform for indie games, giving them unprecedented visibility and reach. As usage rates climb, more players are discovering hidden gems and taking risks on games they might otherwise overlook. This democratization of access is helping indie developers thrive, even as the traditional market faces instability.

Piracy Trends and the Pushback Against Digital-Only Tactics

Not all players are satisfied with the current direction of the industry. As publishers experiment with digital-only releases and restrictive anti-ownership measures, interest in piracy trends video games and emulation is on the rise—especially among Gen Z. While exact figures are elusive, industry watchers report a growing number of players turning to alternative markets to reclaim control over their libraries and avoid high costs.

This renewed interest in piracy and emulation reflects a broader backlash against perceived anti-consumer practices. For many, indie games and subscription services offer a legitimate alternative, but the temptation to bypass restrictions remains strong as long as publishers continue to limit player choice.

Subscription Model Usage and Indie Hits: 2025 Snapshot

| Metric | 2025 Estimate |

|---|---|

| Game Pass/Xbox Subscription Usage Rates | Rising |

| Notable Indie Hits | [user to insert leading 2025 indie titles] |

| % Gen Z Turning to Indie/Piracy/Emulation | Growing (exact figures not cited) |

Players are flocking to indie games, subscriptions, and alternative markets as big publishers risk alienating their core audience. The great gaming pivot of 2025 is well underway, with affordability, creativity, and access driving the next chapter of gaming culture.

Tough Times, Tough Choices: Economic Pressures and Alternative Paths

The gaming industry in 2025 faces a crisis that goes beyond declining sales or shifting trends. For many young people, especially those in their 20s or younger, the dream of a gaming career—or even the simple joy of gaming as a hobby—has become harder to reach. The cost of entry into gaming is at an all-time high, with hardware, software, and microtransactions putting pressure on already tight budgets. At the same time, socioeconomic factors like unemployment, student debt, and a competitive job market are forcing Gen Z to rethink their paths, both as consumers and as future professionals.

Gaming Industry Crisis: Barriers to Entry and Career Uncertainty

In 2025, the average price of a new gaming console or high-end PC can easily exceed $500, not including the cost of games, subscriptions, and in-game purchases. For many, these expenses are simply out of reach. The gaming industry crisis is not just about companies struggling—it's about the players and aspiring developers who are being priced out.

At the same time, entry-level jobs in the gaming sector are fiercely competitive and often offer modest starting salaries. According to recent data, entry-level positions in game development may start around $45,000 per year, while the average student debt for 2025 graduates is projected to surpass $40,000. This financial burden, combined with rising living costs, means that even those passionate about gaming are reconsidering their options.

Vocational Trades: A Practical Alternative

As traditional college degrees and creative tech fields struggle to deliver secure employment and financial stability, interest in vocational trades is on the rise. Careers such as electricians, pipe fitters, and HVAC technicians are increasingly seen as viable alternatives. These roles often offer higher starting wages—sometimes $50,000 or more—and a clearer path to financial independence, without the heavy burden of student loans.

"I try to do my best to be able to promote the trades … because it helped me when I was in the lowest point of my life."

This personal testimony highlights a growing sentiment among young people: when college and creative industries fail to deliver, the trades can provide not just stability, but a sense of purpose and community. While breaking into these fields can be challenging—often requiring connections or starting in smaller towns—the demand for skilled workers remains high. Many trade unions and local employers are actively seeking young talent, sometimes even more so than tech companies or game studios.

Societal Pressures and the Need for Change

Despite the practical benefits, societal attitudes toward vocational trades can be slow to change. Many young people still face criticism or shame for choosing a "less glamorous" path, especially when compared to high-profile tech or creative careers. However, as economic realities set in, more are realizing that financial literacy and vocational training should be a bigger part of high school education. The call for these skills is growing louder, as they offer a real solution to the challenges facing Gen Z in the current economy.

In a time when the gaming industry crisis and socioeconomic factors are shaping the future of work and play, alternative paths like the vocational trades are not just fallback options—they are becoming smart, strategic choices for a generation facing tough times and even tougher choices.

When Publishers Push Too Hard: Market Reactions and the Piracy Comeback

The gaming industry in 2025 is facing a turbulent shift, with publishers taking increasingly aggressive steps to control digital ownership of games. As more companies remove access to older titles and force consumers into digital-only purchases, the market is experiencing a strong backlash. This hardline stance on digital control is not only frustrating loyal fans but is also fueling a dramatic rise in piracy trends in video games and a resurgence in secondhand sales.

Access Restrictions and the Vanishing Game Library

One of the most controversial gaming industry trends is the removal of access to previously purchased games. As publishers transition to digital-only models, many older titles are being delisted or locked behind new paywalls. Gamers who once believed they owned their digital libraries are now discovering that access can be revoked at any time. This erosion of digital ownership in games has left many feeling betrayed and priced out of their favorite hobby.

High Prices and Anti-Consumer Policies

Alongside access restrictions, rising prices and aggressive monetization strategies have put further strain on consumer spending trends. Season passes, microtransactions, and deluxe editions have become the norm, often pushing the cost of a single game well above previous generations. For many, these anti-consumer policies are the final straw. As one frustrated gamer put it,

"When people feel pushed, they push back."

Piracy and Emulation: The Consumer Response

Faced with limited access and soaring prices, gamers are increasingly seeking alternative ways to play. The demand for emulators and ROMs is rising, with online communities sharing tips on how to crack newly released titles. While publishers continue to clamp down on piracy, their efforts have had limited effect. As history shows, when motivated enough, people will always find a way. The genie of piracy is out of the bottle, and attempts to suppress it have only made consumers more determined.

- Emulation: Retro gaming and emulation communities are thriving, allowing players to revisit classics that are no longer available legally.

- Secondhand Sales: The used game market is experiencing a resurgence, as players seek physical copies that cannot be remotely disabled.

- Piracy: Anecdotal reports and rising emulator downloads suggest a significant uptick in game piracy, even if exact numbers remain elusive.

The Wild Card: A Pirate-Led Revolution?

As publishers dig deeper into restrictive practices, some industry watchers speculate that the next big revolution in gaming could be sparked not by a major company, but by a pirate or hacker. The tools and knowledge to bypass digital locks are spreading rapidly, and with each new clampdown, the community grows more resourceful. In this climate, the balance of power is shifting, and the industry may soon be forced to reckon with the consequences of its own policies.

Ultimately, as publishers tighten the screws, gamers are showing that they will not simply accept the new normal. Whether through piracy, emulation, or secondhand markets, the pushback is real—and it is reshaping the future of gaming.

Crisis or Transformation? Possible Futures for Gaming (and Who Stands to Win)

The gaming industry in 2025 stands at a crossroads, facing both crisis and the potential for transformation. Layoffs, the rise of artificial intelligence, financial instability, and a noticeable decline in Gen Z participation have all contributed to an atmosphere of uncertainty. Yet, with a projected global market size of $200 billion in 2025, the sector remains a heavyweight in entertainment. The question is: who will thrive as the industry evolves, and what catalysts will drive market recovery?

Industry in Flux: Layoffs, AI, and Shifting Demographics

Recent years have seen sweeping layoffs across major studios, with automation and AI tools replacing traditional roles in art, programming, and even narrative design. The shrinking participation of Gen Z—who increasingly turn to other forms of media or content creation—has further complicated the landscape. As companies tighten budgets, the average cost to develop a AAA game now hovers around $150 million, while double-A titles average $30 million. With nearly 19,000 games released last year, but only about 150 qualifying as AAA or double-A, the pressure on big studios is immense.

Market Recovery Catalysts: Big Releases and New Hardware

Despite the turbulence, several market recovery catalysts could reshape the gaming industry. Major releases like GTA VI and the anticipated launch of Nintendo’s new platform are seen as potential lifelines for AAA publishers. Mergers and acquisitions are also on the rise, as companies seek stability and new growth opportunities. As one analyst put it,

"The global video game market is projected to reach around $200 billion in 2025, continuing modest growth and surpassing other entertainment sectors."

These events could spark renewed interest and spending, but the outcome is far from certain. A market crash isn’t guaranteed, but neither is a smooth recovery—just a mix of risk and opportunity.

Industry Transformation: Who Stands to Win?

New development models driven by technology, economic shifts, and changing consumer tastes will dictate who thrives next. The AAA sector faces a critical test: can it pivot to more sustainable production and monetization models, or will it be outpaced by indie studios and alternative business models? Indie developers, often operating with smaller teams and budgets, are increasingly capturing audiences seeking unique, “handmade” experiences. Meanwhile, alternative business models—such as subscriptions, user-generated content, and live service games—are gaining traction.

Jobs, Trades, and the Rise of AI

One of the most pressing questions is whether jobs lost to AI will ever return. As automation takes over routine tasks, there’s a growing sense that creative trades—like game design, community management, and narrative writing—may become the default for young creators entering the industry. However, the rise of AI-generated games also raises concerns about authenticity and player connection.

Creative Scenario: Gaming in 2030

Imagine a future where most games are made and played by robots, and player communities rally behind indie “handmade” titles for real connection. In this scenario, the industry becomes a blend of high-tech automation and grassroots creativity. Some sectors may shrink drastically, while others—especially indie and new trades—blossom. The only constant is change, and those companies and creators savvy enough to adapt will be the ones to watch.

Conclusion: Gaming’s Make-or-Break Moment—And What Comes Next

The state of the game industry in 2025 is more uncertain than ever before. For perhaps the first time in decades, even industry veterans admit they cannot see a clear path forward. The turbulence is not just about sales numbers or the latest blockbuster flop—it’s about deeper, systemic problems that threaten the very foundation of gaming as we know it.

Gen Z’s Retreat: A Symptom of Deeper Issues

Gen Z’s declining spending on games is not the core problem; it’s a warning sign. Young players are turning away because games are more expensive, less appealing, and less accessible than ever before. This shift points to financial and structural failings within the industry. High prices, aggressive monetization, and a lack of fresh ideas have made it harder for new generations to fall in love with gaming.

AAA Publishers: Burning the Candle at Both Ends

Major studios and publishers are facing a crisis of their own making. The cost of developing AAA games has skyrocketed, while returns are shrinking. In a rush to cut costs, many are turning to AI and automation. While these tools promise efficiency, they risk deepening the disconnect between creators and players. The result? Games that feel soulless, formulaic, and out of touch with what players actually want.

"Unless the industry pivots fast, we might be watching a slow-motion collision."

Indie Games Success Stories: Bright Spots in a Dark Forecast

Amid the gloom, indie developers are providing hope. These small teams are not afraid to take risks, experiment with new ideas, and connect directly with their communities. Indie games success stories like Dave the Diver and Baldur’s Gate 3 have shown that players crave innovation and authenticity. Subscription services and alternative business models are also helping to make games more accessible, while offering developers a more sustainable path forward.

Alternative Paths: Subscription Services and New Careers

Subscription platforms are making it easier for players to try new games without a huge upfront cost. At the same time, some would-be developers are leaving the industry altogether, seeking stability in trades or other creative fields. This talent drain is both a challenge and an opportunity: it forces the industry to rethink how it attracts and retains the people who make games possible.

The Next Five Years: Adapt or Get Left Behind

The gaming industry crisis is not just about surviving the present—it’s about shaping the future. The next five years will be defined by who adapts, who listens, and who is willing to change. Long-term success will require bold shifts in how games are made, marketed, and sold. Survival and innovation will rest on humility, a willingness to return to smaller, weirder, riskier projects, and a renewed focus on what makes gaming special in the first place.

If the industry doesn’t adapt—creatively and economically—its next era may be shaped more by its failures than its triumphs. The choices made now will determine whether gaming’s best days are still ahead, or if we are witnessing the start of a slow-motion decline.

FAQ: Burning Questions About the Gaming Industry’s Rollercoaster

Why are video game prices rising so fast?

The rapid increase in video game prices is driven by several factors. Publishers cite higher development costs, especially for AAA titles, as justification for raising prices from $60 to $70, and now eyeing $80 as the new standard. However, this price hike coincides with aggressive monetization—microtransactions, season passes, and deluxe editions—making gaming less accessible, especially for Gen Z. Economic pressures like inflation, stagnant wages, and high living costs further compound the issue, leading to a sharp drop in Gen Z gaming spending. Ultimately, while publishers chase short-term profits, they risk alienating the very audience they depend on.

Is AI helping or hurting gaming jobs (and gamers)?

AI’s impact on the industry is double-edged. On one hand, AI can streamline development and create new gameplay experiences. On the other, it’s fueling video game industry layoffs, as seen with Microsoft’s recent cuts at Xbox to prioritize AI infrastructure. Entry-level jobs are vanishing, and automation threatens creative roles. For gamers, this could mean fewer unique titles and more formulaic releases, as AI-driven tools are often used to cut costs rather than foster innovation.

Can indie games really challenge AAA blockbusters?

Absolutely. The past year has seen a surge in indie games success stories like Lethal Company, Repo, and Peak. These games offer focused, cooperative fun at a fraction of AAA prices, often under $10. Their viral popularity proves that players crave affordability, creativity, and genuine enjoyment over bloated, expensive blockbusters. While indie titles may not match AAA budgets, they’re increasingly winning the hearts—and wallets—of gamers disillusioned with mainstream trends.

What’s the safest career path for young creators right now?

Given the instability in gaming and tech, the safest path may lie outside traditional game development. The transcript suggests vocational trades—plumbing, electrical, or other skilled work—offer more stability and financial security than chasing risky creative jobs in a shrinking industry. For those passionate about games, indie development or related fields like digital art or streaming may offer alternative entry points, but adaptability is key.

Will subscription models like Game Pass change the industry for good?

The Game Pass subscription model and similar services have changed how people access games, lowering upfront costs and offering variety. However, rising subscription fees, tiered access, and filler content threaten long-term value. Developers increasingly use these platforms to offload struggling titles, while premium releases are withheld for direct sales. Unless these models adapt to deliver consistent quality and affordability, they may not provide the sustainable solution the industry needs.

How can Gen Z break into the industry—if at all?

Breaking into gaming is tougher than ever for Gen Z. With fewer entry-level jobs and rising barriers, traditional routes are closing. However, opportunities exist in indie development, content creation, and community management. Building skills through modding, game jams, or small-scale projects can help, but success requires resilience and a willingness to pivot as the industry evolves.

Is piracy really coming back, and will it hurt or help?

With high prices and revoked digital ownership, piracy is resurging, especially among younger gamers. While piracy can undermine sales, it also signals a market failure—when legal access is too expensive or unreliable, players seek alternatives. This trend may force publishers to rethink pricing and ownership models, but it also risks further eroding trust and revenue.

Any silver linings in this storm?

Despite the turmoil, there are reasons for hope. Indie games are thriving, offering affordable, memorable experiences. Community-driven projects and creative collaborations are on the rise. The industry’s crisis is forcing a long-overdue conversation about value, accessibility, and sustainability. As the transcript suggests, there’s no single fix—adaptability is the only constant. If publishers, creators, and players can learn from current challenges, the gaming world may yet emerge stronger, more diverse, and more inclusive.

TL;DR: In 2025, the video game industry is flashing warning lights everywhere: Gen Z is being priced out, AAA games are less appealing and more expensive, and even tech fixes like AI might be digging the hole deeper. Indie games and alternate careers (like the trades) offer a flicker of hope, but unless the industry pivots fast, we might be watching a slow-motion collision. Keep reading to see why.

Post a Comment